Diageo Bets on Fast Growing Emerging Markets, Cautious on Trends

Diageo Plc is expanding into fast-growing emerging markets with a cautious view on the consumer and economic trends in 2012, but the first half results of 2012 have positioned it well and demonstrated that group has brands, the routes to market and the people to deliver its medium-term guidance. The increase of 7 percent in the interim dividend signals its confidence that it is making a stronger business more robust.

The owner of the brands Johnnie Walker, Crown Royal, J&B, Windsor, Smirnoff, Ciroc etc is scheduled to report its third quarter 2011/2012 interim management statement on Thursday.

The premium drinks maker reported 3 percent volume growth at 84.1 million for H1 2012 with 7 percent organic net sales growth at £5,757 million. The group recommended half year dividend of 16.6 pence.

The results were "very good" said UBS analyst Melissa Earlam as the group beat forecasts for sales and profit growth."Management flags general caution regarding the consumer and economic trends they face in 2012, while there is certainly no sense of an underlying deterioration in trends from these results," she added.

The spirits group also saw 9 percent underlying profit growth at £1,866 million. The London-based group is expanding into fast-growing emerging markets with recent deals in China and Turkey, and expects half of its turnover to come from these markets by 2015.

"Diageo has delivered a solid and well balanced first half performance with 9 percent operating profit growth and 60 basis points of operating margin expansion. This is the result of the investments we have made to build our brands, deepen our routes to market in the faster growing markets of the world, enhance our leadership in US spirits and create an integrated organisation in Western Europe," said CEO Paul Walsh while commenting on the growth.

"Investors should be encouraged by strong trading in the U.S, as well as continuing momentum in developing and emerging markets, though Europe remains a mixed bag," said analyst Martin Deboo at Investec Securities.

While Shore Capital said "Our view was that upgrades to full-year expectations were already being built into interim expectations and underlying sales and profit have exceeded expectations so we anticipate the market now increasing full-year expectations even taking into account management's statement on its cautious view on the consumer in 2012."

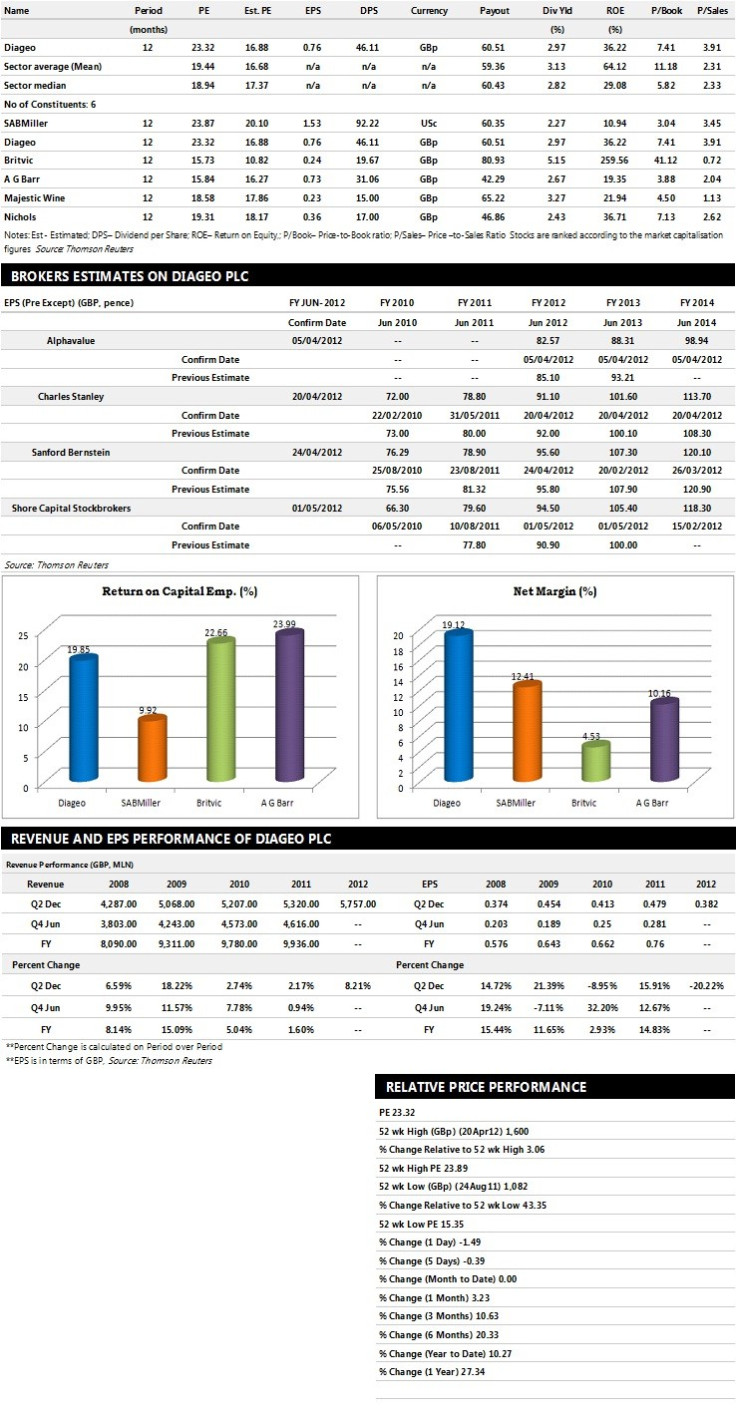

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents six companies based on market capitalisation.

Brokers' Views:

- Sanford Bernstein recommends 'Hold' rating on the stock with a target price of 1710 pence per share

- Liberum Capital recommends 'Buy' rating with a target price of 1750 pence per share

- Natixis gives 'Outperform' rating on the stock

- Jefferies assigns 'Buy' rating with a target price of 1760 pence per share

Earnings Outlook:

- Shore Capital Stockbroker estimates the company to report revenues of £10,791 million and £11,452 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £3,030 million and £3,426 million. Earnings per share are projected at 94.50 pence for FY 2012 and 105.40 pence for FY 2013.

- Sanford Bernstein projects the company to record revenues of £10,789 million for the FY 2012 and £11,568 million for the FY 2013 with pre-tax profits (pre-except) of £2,933 million and £3,342 million respectively. Profit per share is estimated at 95.60 pence and 107.30 pence for the same periods.

- Charles Stanley expects Diageo to earn revenues of £10,775 million for the FY 2012 and £11,452 million for the FY 2013 with pre-tax profits of £2,946 million and £3,282 million respectively. EPS is projected at 91.10 pence per share for FY 2012 and 101.60 pence per share for FY 2013.

© Copyright IBTimes 2025. All rights reserved.