Jefferies Assigns 'Buy' Rating for Hammerson Plc

Hammerson, the real estate investment trust is scheduled to release its full year 2011 results next week amid reports that Jefferies has assigned 'Buy' rating on the stock with a target price of 447 pence per share.

The Group aims to be the best owner-manager and developer of retail and office properties in the U.K. and France. Hammerson regionally dominant shopping centres and convenient retail parks are trading ahead of national benchmarks and continue to attract successful retailers.

The investors of shopping centers, retail parks and offices strategies to outperform through two areas of focus: Maximising income growth; and creating a high quality property portfolios through acquisitions, development and asset management. Both areas are underpinned by prudent financial management. It has made good progress in all areas.

Despite a challenging retail backdrop in shopping centre's and retail park markets, it has seen little impact from the recent rise in U.K. retail administrations, and will benefit from positive indexation in France.

The Group will capitalise on the upturn in the London office market through both existing assets and developments.Recently the Group submitted a detailed planning application for the redevelopment of Centrale Shopping Centre to the London Borough of Croydon. Hammerson purchased the centre in March 2011 and the proposal, designed by Leslie Jones Architecture and submitted by the Group is its long-term vision for retail in Croydon.

The redevelopment plan submitted by the Group enhances the visibility of shop frontages within the centre, and improve connectivity with neighbouring parts of the town through a new glazed roof link over Drummond Road. Wider public realm improvement works also form part of future plans.

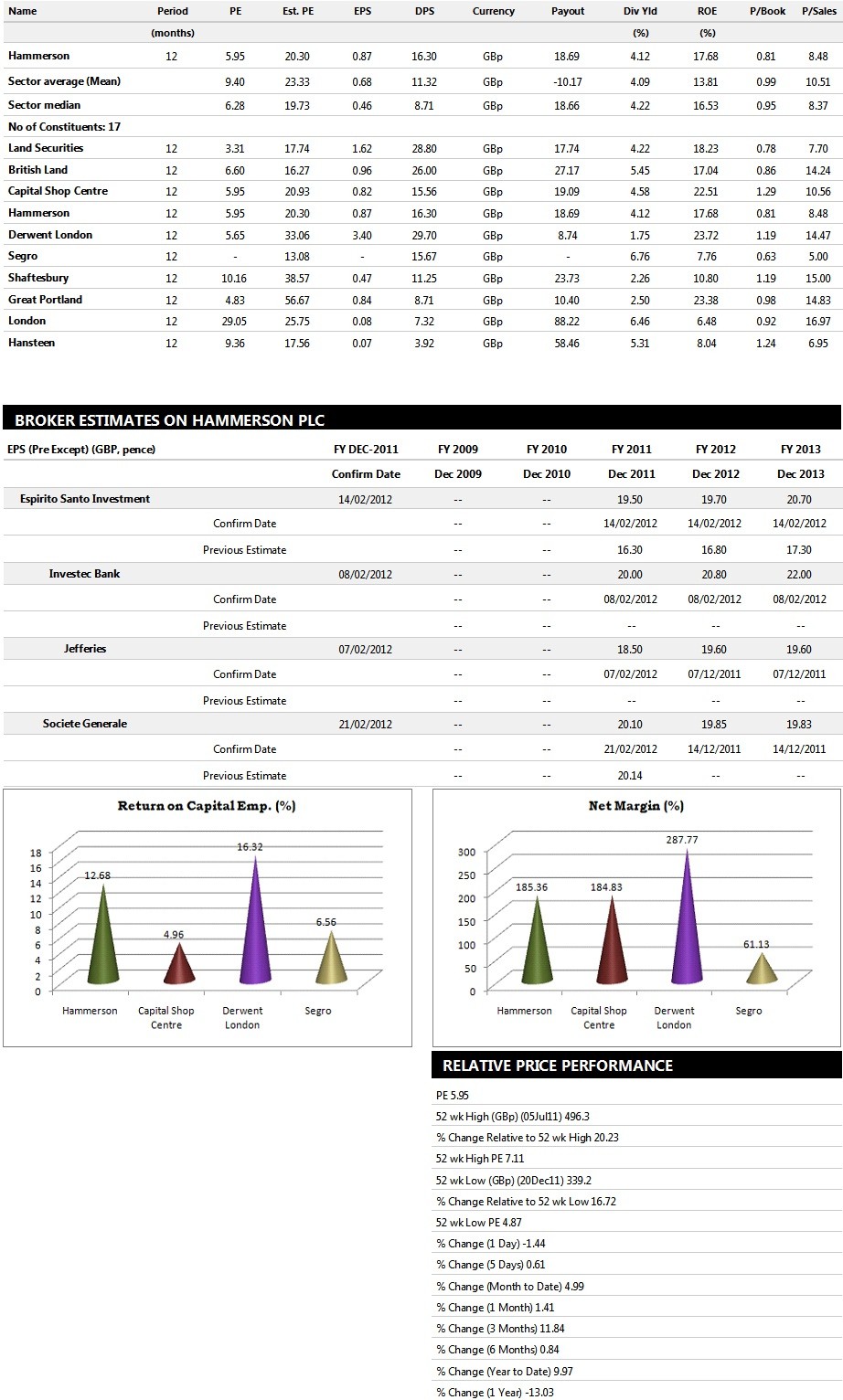

Brokers' Views:

-- Jefferies assigns 'Buy' rating on the stock with a target price of 447 pence per share

-- Investec Bank gives 'Hold' rating on the stock with a target price of 400 pence per share

-- Liberum Capital recommends 'Buy' rating on the stock with a target price of 424 pence per share

-- Credit Suisse recommends 'Out Perform' rating on the stock with a target price of 450 pence per share

-- Espirito Santo Investment recommends 'Out perform' rating on the stock with a target price of 470 pence per share.

Earnings Outlook:

-- Societe Generale estimates the company to report revenues of £340 million and £334 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £147 million and £145 million. Profit per share is projected at 20.10 pence for FY 2011 and 19.85 pence for FY 2012.

-- Espirito Santo Investment estimates the company to post revenues of £287.90 million and £291.50 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £146.20 million and £149.10 million. Earnings per share is estimated at 19.50 pence for FY 2011 and 19.70 pence for FY 2012.

-- Jefferies expects the company to earn record revenues of £294.60 million for the FY 2011 and £310.60 million for the FY 2012 with pre-tax profits of £138.60 million and £144.90 million respectively. EPS is estimated at 18.50 pence for the FY 2011 and 19.60 pence for the FY 2012.

Below is the summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents eight companies based on market capitalization.

© Copyright IBTimes 2025. All rights reserved.