Money at Risk from Fraud, Complexity and High-Speed Trading [BLOG]

There was a time, not so long ago, when you could be reasonably relaxed about your money.

You could place it safely on deposit in a major bank or building society for a rate of interest which would provide some protection against inflation. If you wanted a modestly higher rate of return you might trust your bank, or a well established financial advisor, to recommend a sound collective investment vehicle based on blue chip stocks, government bonds and property. Such an investment might be expected to return 2-3 percent above building society rates with minimal risk of a large loss of capital.

For those prepared to accept higher risk, trust could be placed in an established wealth management organisation to provide an accurate assessment of risk/return criteria. Overall, it was expected that a suitable regulatory framework was in place to provide careful investors with adequate protection against fraud and malpractice.

What happy days they were!

Probably most of this was never true but, in any case, the rose-tinted glasses had to be cast aside in 2008 when it became apparent that the financial industry contained somewhat more than its fair share of fools, incompetents and fraudsters. No matter what the benefits of deregulation, it became obvious that greed in the financial community was definitely not good for the large mass of honest, hard working people.

How, then, can investors now judge the degree of risk involved in investments and financial transactions and acquire enough knowledge to reduce that risk. Consider the variety of organisations that may be involved in handling and transferring investors' money and how they will all expect to profit from the processes. They will include banks, managers of collective investment vehicles (funds), brokers and exchanges.

Major banks, it may be thought, are too big to fail. Governments would be forced to intervene, to prevent a financial, and political, disaster for large sections of the community. And so far this has proved to be so and would appear to be the reason for the extreme recklessness with which many of the major banks have operated, and continue to operate.

If you have concerns about a major bank, and you believe you have sufficient expertise you may try to conduct your own investigation of the likely condition of that bank's balance sheet. If you came anywhere near a sane conclusion then you would, apparently, be a few steps ahead of the bank's CEO, its auditors and the regulatory authority.

Fools, Incompetents and Fraudsters

One of the excuses used by bank executives for the 2008 events was that "we didn't really understand the derivatives on our books".

Nor, apparently, did the ratings agencies that awarded triple A ratings to securities that were obviously based on high risk (sub-prime) mortgages.

Apparently it was believed that the continuing rise in property values would solve any future problem - by this time the belief that property values must always rise had been transformed into a law of nature. Let us be absolutely clear about this: with the complete knowledge of the authorities, millions of loans were made to people and organisations who had virtually no chance of repaying them.

These loans were securitised as bonds, rated triple A and sold to banks and, apparently, no one in authority was concerned as the merry-go-round continued with bank mergers and acquisitions. Sooner or later, probably sooner, a government will not have the resources to support this sort of nonsense and banks, worldwide, will collapse like a pack of cards. Unfortunately, there is virtually no current alternative to the financial industry's reliance on the major banks.

Collective investments (funds) are obliged to use the major banks as custodians and the alternative use of the smaller "boutique" banks may require extensive, and expert, due diligence thereby placing onus on the fund's management and administrators.

Traditional funds based on long-only equity, bond and property investment have struggled in recent years, without the previously dependable economic growth, and there seems to be little chance of any improvement. Measuring performance against the benchmark of an equity index is far less reassuring to investors when the index goes sideways or down. Investors are, therefore, increasingly attracted to absolute return funds which aim to produce positive results under all market conditions. The so-called hedge fund industry is, however, highly diverse and includes funds with vastly different approaches to risk management.

Investment Complexity Can Mask Industry Ailments

The problem for investors is that the real risk of major capital loss in a fund may be extremely difficult to determine and many investors are fooled by widely used industry risk assessment standards, which have largely proved to be useless.

Most involve mathematical formulas, based on available 40-50 year data, which will indicate that certain potentially catastrophic events are only likely every 100,000 years or so. The fact that such events appear to occur every 5 - 10 years does not seem to embarrass those responsible. Consider this: choose a random 50-year period from the last two thousand years of history - would an analysis of this necessarily provide an accurate forecast of events in the following 50 years? Of course not, but that doesn't discourage the probability theory addicts.

Assessing the level of risk in any fund requires considerable knowledge of the expertise (and ambitions) of the fund manager, the systems used and the fund manager's ability to operate them safely and consistently. In any event, funds that aim for above average return usually, but not always, involve a higher degree of risk of capital loss. Funds are, of course, subject to detailed regulation but, in reality, the rules may only be strictly applied to the smaller funds. Once a fund attains sufficient Assets Under Management (AUM) it may effectively become a law unto itself.

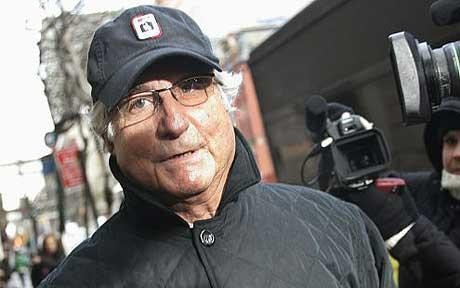

The Madoff scandal, for example, could have been prevented if the regulatory authorities had listened to a number of insiders and had had the courage to do their job. In fact, the passage of ever more detailed and irrelevant legislation is largely intended to appease lay critics of the financial industry.

The legislation is then translated into highly complex rulebooks that officials of the regulatory authorities, themselves, struggle to understand. Thus, smaller and more effective fund managers are shackled by regulation while the major players may have the financial resources and political clout to avoid regulatory obstacles.

MF Global: Rising Risk of Using Brokers

The management of money, personally or through investment in a fund, must involve the placement of money in the care of brokers and exchanges.

The level of risk involving brokers, in particular, has increased substantially in the last few years and there are a number of contributing factors.

Intense competition in attracting business has kept commission rates artificially low and most brokerage operations have had to find additional ways of generating income in order to survive. Client money held by brokers to cover margins has usually represented an opportunity for additional sources of income, even if the money is held in a "segregated" account - in order to understand what a "segregated " account really is it is necessary to read the small print of brokerage contracts with great care!

In fact, the great majority of brokers operate fairly and honestly in the protection of client money, within their terms and conditions, but for some the temptation of misusing funds has proved too great.

The last year has seen two major instances of misuse of client funds, and subsequent loss to investors. It is inappropriate to speculate on details of the MFGlobal and PFGBest collapses as legal issues may still be unresolved but, in both cases, client funds appear to have been used illegally for highly questionable objectives. Although substantial proportions of funds may be returned, following insolvency proceedings, access to these funds for investors may be delayed for periods of up to 10 years.

New Risk Evolves: Ultra-High-Speed Trading

A further major risk to investor's money has emerged, in recent years, with the introduction of ever more complex technology for ultra-high speed trading.

The rapid development of these technologies has coincided with the increasing reliance on scalping systems to generate returns, and the associated need to reduce trading costs on the greatly increased volume of trades. The major problem with these high-speed systems is that, at some stage, the human element is eliminated and risk management is only as good as the software written for it.

Knight Capital's recent loss of $440,000,000 in 45 minutes probably represents the tip of the iceberg.

How can investors be sure that they will not be exposed to losses associated with high-speed trading? Cost pressures will ensure that the technology will soon be used in a greater range of trading operations, with the growing risk of losses of sufficient proportion to wipe out major companies involved in the broad spectrum of trading activity. At the moment, therefore, there seems to be no solution to this problem other than severe restrictions on purely machine based systems. In the present climate no such action is expected. The fate of all investors' money, segregated or not, will depend on the ability of the regulatory authorities to ensure the protection of client funds. Recent history suggests that no investor should be reassured.

Unless major financial institutions and regulators can make major progress in correcting the mistakes of the past, and in re-asserting proper control over financial markets, investors will have to accept that their money is now at much greater risk than it has ever been in the past.

Christopher Clarke, is a former Goldman Sachs executive director, a hedge fund manager at Lawrence Clarke Investment Management and a senior lecturer in accounting and finance at Nottingham Business School. He has also launched a new blog to comment on the state of the global economy at www.economicperil.com

© Copyright IBTimes 2025. All rights reserved.