How War Impacts Markets: Geopolitical Risk Can Be Measured By Energy Prices

"There are causes worth dying for, but none worth killing for" – Albert Camus

The world is increasingly becoming engaged in civil wars and general turmoil where Camus' words could and should play a central role but never will.

This article is extremely difficult to write as war is never about right or wrong. They are by definition always wrong and extremely personal and emotional.

The fact is, however, that we need to put 'the risk of wars' into our macro outlook as they are increasing not only in intensity but also in casualties. I will not condone anyone or any party involved in the conflicts presently – I learned this lesson the hard way, having advocated the removal of Saddam Hussein, only to learn that his successors are just as bad, hence going forward Camus' words are my mantra.

Measuring Geopolitical Risk

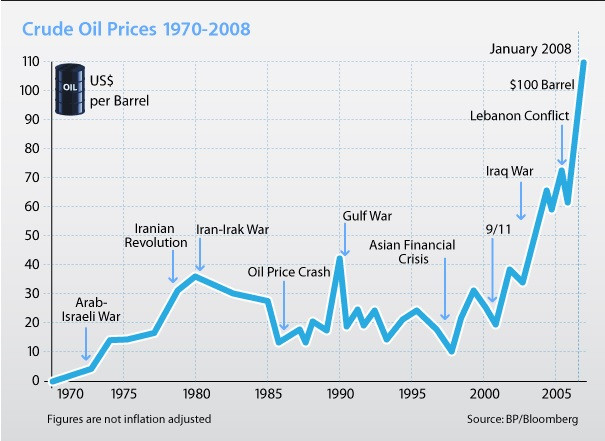

The simplest way to "measure" geopolitical risk is to look at the price of energy.

Energy is everything for a macro economist as it is a tax on the economy when high, and a discount when low. The high energy consumption makes it a critical part of any projection done, yet despite this energy assumptions are often exogenous (given!).

Think about this: Everything you did this morning had energy consumption in it; Waking up to your smart phone (charging overnight), putting on the coffee, pouring the cold milk from the fridge, taking a shower, driving the car to work and walking into your air-conditioned office.

Likewise the rest of your day will be one big consumption of energy. World energy resources are primarily extracted from "volatile" or underdeveloped regions creating a real risk of disruption of supply. Herein lies a clear and quantifiable risk.

The way I measure this geopolitical risk is through measuring the spread between the 5<sup>th contract of the WTI crude oil and the first contract. Of course, there are other factor workings, but lacking a better alternative, it is what I use.

As can be seen since 15 July the "war premium" or more neutral "disruption premium" have increased by $2 - world consumers are now paying $2 more per barrel of WTI Crude.

Overall there are many factors influencing the crude market but the price of energy remains the one component we need to know is stable and preferably falling.

The overall impact from war is negative despite the glorified analysis of how World War II stopped the recession – think of the 1970s – probably a better and more relevant analogy to today's trouble in Gaza, Iraq, Russia/Ukraine, Libya, and Syria.

Many will argue it is different this time, and back then we were too dependent on the Middle East.

Sure, but prices were only between $10 and $25!

Now we have lived with an oil rise in excess of $100 more or less since 2007.

Crude is now four times higher in price than during the "inflationist" 1970s – The time where we ended The Bretton Woods and the emergence of inflation targeting from central banks.

No, the signal from the energy market about the demand of energy and the risk of getting enough of it is clear: prepare for less growth, less certainty and more geopolitical risk.

What's Next?

The market however maintains a steady hand: Israel will be contained inside a couple of weeks; Russia vs. Ukraine will find a solution, the denial of tail-risk (Black Swans) is clear for everyone to see.

A market is "perfect" in its information, zero interest rates will save us and we have all been duped into believing that the real world no longer matters.

Unemployment, social inequality, wars, innocents being killed, and tv images of people fighting to live another day is not relevant- except for the fact that for world growth to keep growing, we need to continue to see growth in Africa, the Middle East and Eastern Europe.

We need to accept the world is now truly global – we smiled while globalisation reduced prices and made our companies more profit; now the escalation of wars reflect a world where growth is short, energy is expensive and increasingly hard to get and that we have gone full circle with macro and interventionist policies.

The escalation of turmoil in the world is yet to play a role for the market, but be warned: everything economic has a delayed reaction of nine to twelve month – where there is an action there will be a reaction – if the present state of alertness continues through the summer you can bet on higher energy prices having a serious impact not only on world growth but also on markets.

The real losers, however - let's remind ourselves - are the individual families losing loved ones. No, Camus got it right. There is nothing worth killing for, but plenty to fight for.

Steen Jakobsen is the chief economist at Saxo Bank

© Copyright IBTimes 2025. All rights reserved.