Libor Scandal: Central Banks Planning to Scrap Benchmark as Global Probe Widens

Global central bankers will met in Switzerland next month to discuss the possibility of scrapping Libor, the controversial inter-bank lending rate that has been the epicentre of one of the year's biggest financial scandal.

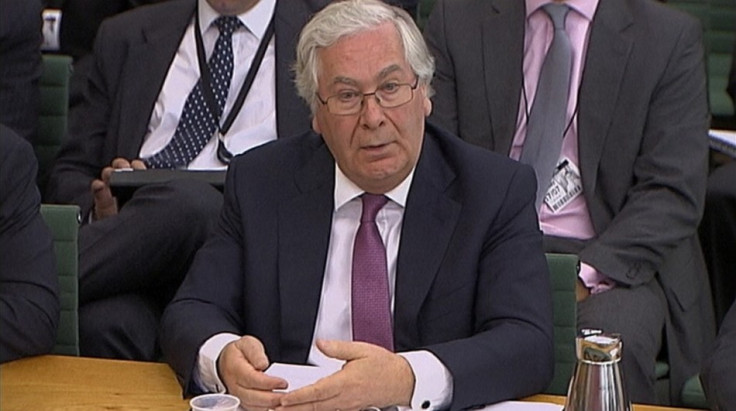

Bank of England Governor Meryvn King, one of the highest-ranking officials within the Economic Consultative Committee, an informal panel inside the Bank for International Settlement's bi-monthly Global Economy Meeting in Basel, is planning to table discussions that could lead to "radical reforms" of the benchmark rate, according to several media reports Thursday.

"When I meet with my central bank colleagues in September in Basel ... I will put on the agenda the discussion of the future arrangements of this sort of benchmark," King told members of the British Parliament's Treasury Select Committee Tuesday.

King and deputy Bank of England Governor Paul Tucker have been criticized for failing to heed warnings about potential fraud in the London rate that's managed by a British Bankers' Association unit know as Libor Limited. A memo published last week revealed the BoE governor was told of concerns related to inaccurate submissions as far back as 2008 by US Treasury Secretary Tim Geithner when he was President of the New York Federal Reserve. King told the TSC he only became aware of fraudulent activity in the benchmark two weeks ago.

The issue of the accuracy and honesty of Libor submissions has dominated headlines in and out of the global financial markets for weeks following the record $453m fine paid by Barclays for admitted attempts to rig the inter-bank lending rate that's tied to $550tn worth of securities around the world. Regulators and central bankers from Tokyo to Toronto have vowed to closely examine the method in which banks participate in so-called Libor panels and punish those found to have made false submissions or colluded with other banks to manipulate it.

"There are different alternatives if Libor cannot be fixed," said Bank of Canada governor Mark Carney, who will attend the BIS meeting, at a news conference in Ottawa Wednesday. "If it's structurally flawed and can't be fixed -- which is a possibility -- there may need to be different types of approaches, and we need to think that through."

Authorities in Hong Kong said Tuesday that they've found no evidence of any wrong doing in the market for local inter-bank rates, known as Hibor, but the Hong Kong Association of Banks, an effective central bank for the former British dependent territory, has initiated a review of both Hibor's fixing mechanism and its governance.

Meanwhile, multiple media outlets are reporting that traders in four of Europe's biggest banks - Deutsche Bank, Societe Generale, Credit Agricole and HSBC Holdings, are being investigated in what is now a global probe into allegations of Libor-related fraud.

The probe centres around the allegations that led to the Barclays admission that one of its traders conspired with his current and former colleagues and professional acquaintances to influence the daily rate set for Euribor, the euro-denominated benchmark which is established by a collection of 44 banks. Last month the US Commodity Futures Trading Commission (CFTC) said the trader "orchestrated an effort to align trading strategies among traders at multiple banks ... in order to profit from their futures trading positions". The active investigation is thought to include the dealers who were contacted by the former Barclays trader.

The enveloping scandal has once again shaken trust in an industry that has been under heavy criticism since the global financial crisis was revealed in five years ago - and those urging reform in Libor procedures, which date back to 1984, have found some unlikely allies.

"The biggest impact is once more undermining the integrity of a system that is already undermined substantially," said Goldman Sachs CEO Blankfein in a recent speech to the Economic Club of Washington. "There was this huge hole to dig out of in terms of getting the trust back, and now it's just that much deeper."

© Copyright IBTimes 2025. All rights reserved.