FCA Puts 'Flesh on the Bones' for Britain's Financial Market Overhaul

Britain's new market watchdog set out its plans to overhaul the financial services industry by promoting greater competition and a more stable and transparent and market in the hope of eventually rebuilding trust.

The Financial Conduct Authority (FCA) released a 32-page "Journey to the FCA" report which chairman designate John Griffith-Jones declared the start of "putting flesh on the bones of strategic and operational objectives" for the newly-formed regulator.

"There will be undoubtedly a few inevitable challenges to when the Financial Services Authority splits but as a very new boy on the block, I see great opportunities for the FCA, which will have a major and beneficial impact to the outcome of the wider economy," he added in a speech made a Reuters event in London.

Martin Wheatley, currenty the Financial Service Authority's (FSA) managing director but also the FCA's chief executive designate, added that there were several main aims for the new regulatory group to implement, including protecting consumers purchasing financial products and reforming markets and financial systems so that they're sound, stable, resilient and transparent.

The FCA also said it plans to use the Payment Protection Insurance (PPI) mis-selling scandal to better bolster its monitoring of the market, by learning from past mistakes.

"Scandals have plagued our financial services industry and society can no longer accept the significant amount taxpayers pay to rescue failing banks. Society needs a financial services industry that provides a better environment for the long term aims of investors, homeowners and those in need of access to credit and the change to the architecture to the industry will help meet the users' needs," said Wheatley.

While the FCA will start work in 2013, the Financial Services Bill which determines the level of power the FCA will have, is currently going through parliament. The final decision will be made by the end of this year.

Within the number of the FCA's published objectives, it also has a mandate under the Financial Services and Markets Act in 2000, for promoting better competition within the financial services industry, after the credit crisis caused a downsize to the industry.

"The FCA offers a huge opportunity for the regulator and firms to start afresh, and work in partnership to reset how we deal with conduct in financial services. The financial services industry is essential to the health of the economy and a provider of 2 million jobs. We see it as the role of the regulator to not only make the relevant markets work well but also to help firms get back to putting their customers at the heart of how they do business," said Wheatley.

Future FCA Cracks Down on Consumer Issues

The UK's new 'dual' regulatory regime is due to start in early-to-mid 2013 with the FSA splitting into the Prudential Regulation Authority (PRA) and the FCA.

The FCA will have responsibility for consumer issues and conduct of business regulation, and will supervise all financial services institutions meaning that some firms will be dual regulated.

The PRA will be an operationally independent subsidiary of the Bank of England and will focus on prudential supervision of financial institutions that manage significant risks on their balance sheets.

Wheatley has already made a number of large strides towards reforming supervision and rules over market structure for consumers and SMEs, as well as larger recommendations to overhaul the London Interbank Offered Rate (Libor).

At the end of September this year, Wheatley published a document of his recommendations for improving the way Libor is set and supervised, as well as giving more power to the regulator.

He also said that the FSA is looking to cut the number of currencies and maturities that make up the benchmark rate.

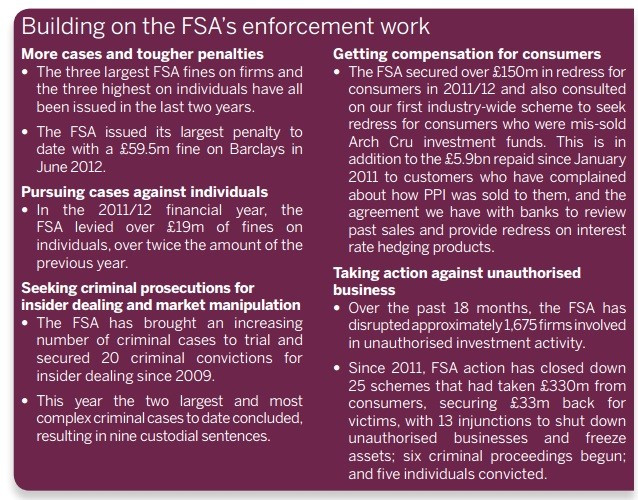

According to the new FCA report, the watchdog is looking to install tougher penalties on banks and companies engaging in market manipulation, as well as heightened sense of individual responsibility for fraud, through clearer routes for criminal prosecution.

Mis-Selling Derivatives and Sales Incentives

Meanwhile, one of the ticking time bombs for SMEs and the banking industry has been the case of Barclays, HSBC, Lloyds and RBS mis-selling derivatives.

Wheatley and his team issued their findings on 29 June and subsequently banned the UK's four largest banks of selling interest rate swap agreements (IRSA) to SMEs and said they found "serious failings" in the way the products were sold.

Initially the report stated that 28,000 products could have been mis-sold but that number has since been revised to 40,000.

Within the same report, Wheatley said that the banks agreed to look into every product sold, to determine if mis-selling had occurred and if this was the case, then the bank would be in charge of issuing compensation as part of the redress scheme.

While the FSA scheme with the banks have mostly been met by criticism from politicians, companies and lawyers, the agreement was the step in the right direction into highlighting the damaging situation many UK businesses and therefore the wider economy faces.

In tandem, Wheatley issued a statement and a report at the beginning of September about wanting to clamp down on banks sales rewards in order to prevent future cases of mis-selling of derivatives to consumers.

"What we found is not pretty. Most of the incentive schemes we looked at were likely to drive people to mis-sell in order to meet targets and receive a bonus, and these risks were not being properly managed," said Wheatley referring to the FSA's investigation.

For example, the PPI scandal will cost UK banks more than £6bn in compensation payments, after it was found that banks' sales incentive schemes too often resulted in customers being sold products they do not need or cannot use, while boosting the earnings of the sales person.

Now, according to the new FCA report, the regulator is considering how previous conduct issues can help it evaluate its overall success.

"This evaluation will help us decide when we need to provide a formal report to the Treasury. It is widely agreed that a problem the size of PPI should not be allowed to recur. Consequently, the FSA Board decided that it would have zero tolerance of absolute loss to retail consumers in excess of £250m and that smaller but still significant total losses should not occur more frequently than once every five years," said the report.

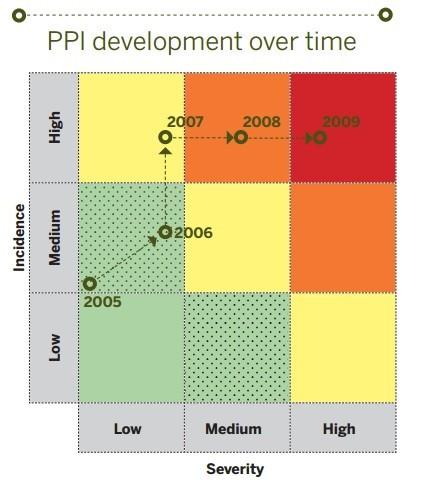

The FCA said that the following diagram sets out how the PPI issue developed over a number of years, in terms of the number of customers affected (incidence) and the amount of harm suffered (severity).

"We will aim to prevent any issue ending up inthe red zone, which represents many customers and high amounts of harm. We will also want issues in the yellow or orange zones to be exceptional (so no more than once every two years in the yellow zone and no more than once every five years in the orange zone)," said the report.

© Copyright IBTimes 2025. All rights reserved.