Metsera Stock Rockets After Pfizer's $7.3b — Should You Still Invest?

Pfizer's $7.3bn Metsera buyout sends shares soaring, raising the question: is it still a smart investment?

Metsera shares surged after Pfizer announced plans to buy the New York biotech in a deal worth up to $7.3 billion, reigniting the obesity drug race.

The Deal and Market Reaction

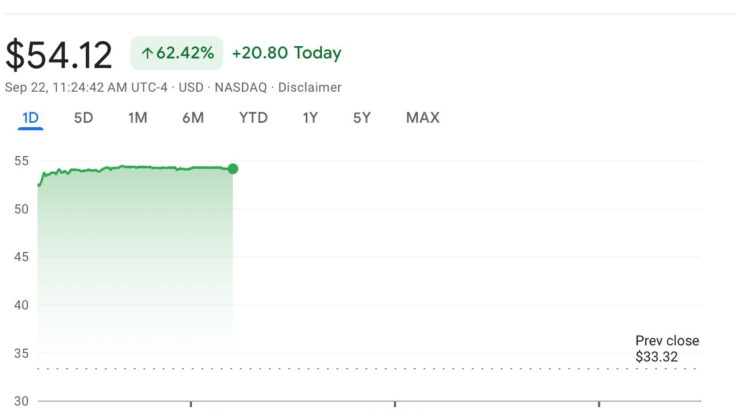

Pfizer Inc. confirmed on 22 September 2025 that it will acquire Metsera Inc., a biotechnology company developing obesity treatments, in a transaction valued at up to $7.3 billion. The agreement includes a cash offer of $47.50 per share and an additional $22.50 per share tied to clinical and regulatory milestones. Approved by the boards of both companies, the deal now awaits shareholder and regulatory clearance.

The news sent shockwaves through markets. Metsera shares jumped nearly 60% in pre-market trading, soaring from around $33.32 to reflect the deal premium. Pfizer's stock also rose modestly as investors welcomed the move. Analysts said the surge reflected not just the upfront cash value but the additional milestone payments, which leave room for long-term upside if Metsera's drugs prove successful.

Why It Matters

The acquisition places Pfizer back into the obesity race after it abandoned its own candidate, danuglipron, earlier in 2025 due to safety and tolerability concerns. The withdrawal left Pfizer at a disadvantage in a market increasingly dominated by Novo Nordisk's Wegovy and Eli Lilly's Zepbound. Buying Metsera gives Pfizer a second chance at competing in a space that has become one of the fastest-growing segments in healthcare.

Metsera's lead candidate, MET-097i, an injectable GLP-1 agonist, delivered an average 11.3% weight loss over 12 weeks in mid-stage clinical trials. Its pipeline also includes oral formulations and amylin-based therapies, which could help diversify Pfizer's obesity drug offerings beyond injectables. Analysts believe the combination of injectable and oral options could make Pfizer more competitive, especially among patients seeking alternatives to weekly injections. The global obesity drug market is projected to reach between $95 billion and $150 billion annually within the next decade. Pfizer's investment reflects not only the commercial potential but also the pressure to match rivals who are already generating billions in revenue from obesity treatments. For Metsera, the deal provides the funding and infrastructure needed to advance costly late-stage trials and regulatory submissions, though success remains uncertain.

What's Next

The transaction is expected to close in the fourth quarter of 2025, subject to shareholder approval and reviews by US regulators, including the Federal Trade Commission and the Food and Drug Administration. Once completed, Pfizer will integrate Metsera's programmes into its broader research portfolio and move MET-097i toward larger late-stage trials.

Investors will watch closely for updates on clinical progress, particularly whether the injectable maintains its efficacy in longer studies and whether oral versions can be delivered safely and conveniently. Analysts also highlight regulatory scrutiny of obesity drug pricing as a factor that could affect adoption and reimbursement. With healthcare costs under pressure, governments and insurers are likely to examine whether new treatments provide value relative to existing drugs.

Competition remains intense. Novo Nordisk and Eli Lilly continue to expand production capacity and launch new formulations, meaning Pfizer will need clear differentiators to capture market share. Integration risks are also real, as combining research teams and clinical strategies can be challenging. Still, if Pfizer succeeds, the $7.3 billion deal could give it a durable presence in one of the most lucrative markets in global pharmaceuticals.

© Copyright IBTimes 2025. All rights reserved.