Mis-selling Derivatives Scandal: Consequential Loss Payments Average Only £1,800 Per Customer

The Financial Conduct Authority has revealed that businesses which claimed for consequential losses as a result of being mis-sold complex interest rate derivatives, are only receiving on average £1,800 each.

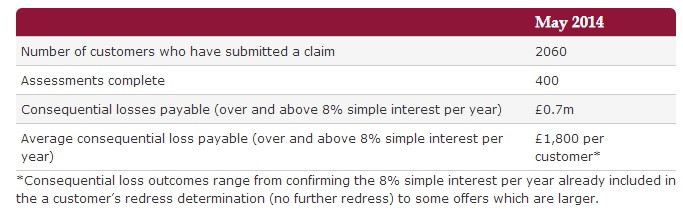

According to the FCA's latest set of data, 2060 customers submitted a consequential loss claim in May, relating to mis-sold interest rate swap agreements, and only 400 assessments have been completed.

The regulator showed in its data that consequential losses payable (over and above 8% simple interest per year) only reached £700,000 (€871,000, $1.1m). The statement confirmed that the average consequential loss payable was only £1,800 per customer.

The amount is tiny even when compared to redress from the payment protection insurance (PPI) mis-selling scandal.

"It must now be apparent to everyone that the FCA Redress Scheme is failing to deliver fair redress to thousands of small businesses," said Jeremy Roe, Chairman of the campaign group Bully-Banks.

"Banks mis-sold a financial product that brought thousands of small businesses to their knees. For the Redress Scheme to pay an average of only £1,800 to these businesses in respect of consequential loss is a scandal in its own right."

Consequential loss claims, which involve the party providing evidence that it incurred losses as a result of an interest rate swap, are filed separately.

What is an IRSA?

IRSAs are contracts between banks and customers where typically one side pays a floating or variable rate of interest and receives a fixed rate of interest payments in exchange.

Such contracts are used to hedge against extreme movements in market interest rates over a given period. Companies that saw the value of these products move against them as rates fell during the recession now owe banks inordinate sums of money in yearly interest payments.

This means that while a bank can make an initial redress offer - a product tear-up or switch and/or compensation - if a company is claiming for consequential losses on top, but it means waiting until after the banks have assessed the application for damages.

"The banks have conceded that they mis-sold these products and, in many cases, are repaying all the monies paid to them by the small businesses. But, because the banks are the ones with the power to decide the redress payable to the businesses mis-sold these products, the banks are rejecting the vast majority of consequential loss claims," said Roe.

"The amount of consequential loss being paid by the banks is so derisory that it is clear to every one that the banks have not changed their behavior at all. They are still riding roughshod over small businesses with the acquiescence of a the regulator. The know that the products have been mis-sold but they take every opportunity to leave the consequences of that mis-sale with the victims. It is a continuing disgrace."

Swaps Review Coming to An End?

Meanwhile, the FCA confirmed that all nine banks have now completed their sales reviews of customers claiming they were mis-sold swaps before March 2014.

AIB, Bank of Ireland, Co-op, HSBC, Lloyds, Santander, and Clydesdale and Yorkshire Banks have met their targets by delivering redress letters to all but a handful of customers by the end of May, within 12 months of starting the reviews.

"Barclays and RBS will send out redress letters to the remaining customers (around 500 customers between them relating to 700 sales) before the end of June," said the FCA.

"The banks have now sent 15,000 redress determinations to customers, 13,000 of which include a cash redress offer and 2,000 confirm that the IRHP sale complied with our rules or that the customer suffered no loss."

After close to 30,000 cases eligible for mis-selling review, only 7,000 customers have accepted a redress offer and only £1.1bn has been paid out.

In comparison, banks set aside £20bn to compensate PPI victims.

© Copyright IBTimes 2025. All rights reserved.