MITIE Group Continues To Maintain Outstanding Profitable Growth For Coming Years

MITIE Group, the strategic outsourcing and energy services company, has had a positive financial year so far driven by the award and retention of a number of significant contracts, which strengthen its strategy to invest in its integrated facilities and energy management capabilities. This has resulted in the group's strong order book, the pipeline of sales opportunities and its organic growth.

MITIE sees uncertainties both in the global economy and in some of its more cyclical markets, though it is positive about the growth opportunities for the group. It is cautious of the challenging economic environment. However, the search for cost and energy efficiencies is a priority for governments and businesses across its markets, and delivering better quality services, innovation and efficiency are core to what the group does. According to the group, it is on track to continue its long record of sustainable profitable growth.

For the first half ended 30 September, 2011, MITIE reported an increase of 5.8 per cent in revenues at £971.7 million with profit before tax up 17.3 per cent to £43.3 million. Basic earnings per share rose by 22.1 per cent to 9.4 pence compared to 7.7 pence during the same period a year ago.

While commenting on the interim results, CEO Ruby McGregor-Smith, Chief Executive said: "The first half of this year has seen us deliver a strong set of financial results. We have been awarded a number of significant contracts which have enhanced our business. This demonstrates the success of our strategy to invest in our integrated facilities and energy management capability. With a record order book and a strong pipeline of sales opportunities, I am confident that the group will continue its outstanding track record of sustainable profitable growth."

Looking ahead, MITIE focuses on developing existing client relationships and maximising opportunities to deliver value in energy services. This will ensure that all of its clients receive great value, high quality services both in the UK and overseas.

In January, MITIE Group, the second largest energy services company in the UK, acquired Utilyx Holdings, the leading energy and carbon management specialist. The acquisition will help and improve the group's energy services capabilities, which contribute 35 per cent towards the group's revenues. Its energy services proposition supports all the key energy issues facing businesses and public sector organisations across the UK.

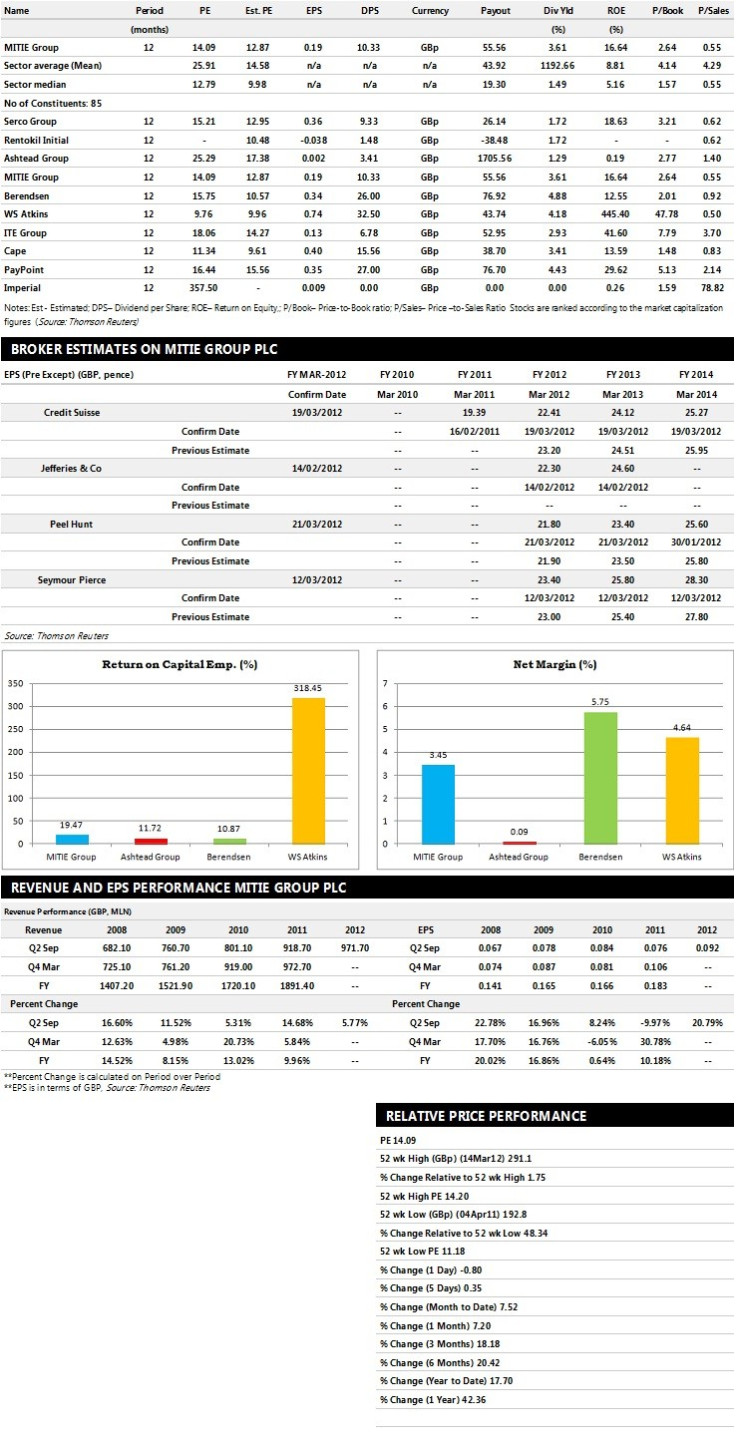

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top ten companies based on market capitalisation.

Brokers' Views:

- Peel Hunt recommends 'Sell' rating on the stock

- Credit Suisse assigns 'Outperform' rating with a target price of 290 pence per share

- Seymour Pierce gives 'Buy' rating with a target price of 300 pence per share

- Jefferies & Co assigns 'Buy' rating

Earnings Outlook:

- Peel Hunt estimates the company to report revenues of £2,014.60 million and £2,134.30 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £106.50 million and £114.30 million. Earnings per share are projected at 21.80 pence for FY 2012 and 23.40 pence for FY 2013.

- Credit Suisse projects the company to record revenues of £1,994 million for the FY 2012 and £2,099 million for the FY 2013 respectively with pre-tax profits (pre-except) of £104 million and £112 million. Profit per share is estimated at 22.41 pence and 24.12 pence for the same periods.

- Seymour Pierce expects MITIE to earn revenues of £2,118.40 million for the FY 2012 and £2,264.40 million for the FY 2013 respectively with pre-tax profits of £111.20 million and £122.70 million. EPS is projected at 23.40 pence for FY 2012 and 25.80 pence for FY 2013.

© Copyright IBTimes 2025. All rights reserved.