Oil plunges to 7-month low on US rig data and Libyan crude uptick

Brent, WTI futures register heavy losses as American rig count rises for 22nd consecutive week.

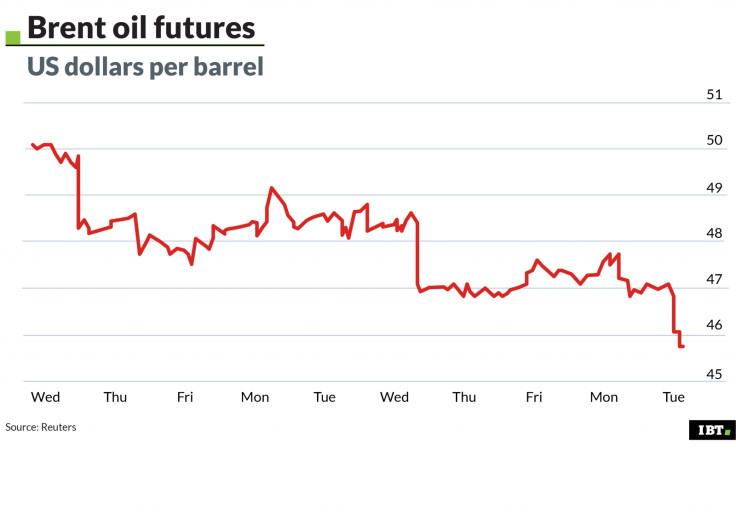

Oil benchmarks sustained heavy losses on Tuesday (20 June) following reports of higher crude production in Libya, and the ever rising number of US drilling rigs.

At one point, the Brent and West Texas Intermediate (WTI) futures contracts plunged by over 3% to their lowest level in nearly seven months, before mounting a marginal recovery. At 5:01pm BST, the Brent front month contract for August delivery was down 2.39% or $1.12 at $45.79 per barrel, while WTI July contract – due to close at the end of US business hours – was down 2.79% or $1.29 to $42.79 per barrel.

The WTI, as it currently stands, is inching closer to a technically bearish market, i.e. a drop of over 20% from a price peak, which in the US benchmark contract's case was $54.45 per barrel as noted on 23 February.

The price drop comes, as the number US oil and gas drilling rigs rose for the 22<sup>nd consecutive week, pointing to rising American production.

As measured by Baker Hughes, the number of US rigs came in at 933 last week, up 509 on the same week in 2016. Additionally, reports of an uptick in Libyan production also knocked the stuffing out of the market.

Newswire Bloomberg reported that Libya, which is excluded from Opec cuts, is pumping around 900,000 barrels per day, according to "a person with direct knowledge of the matter." If officially confirmed, the figure would put the country's production at its highest level in almost four years.

Fawad Razaqzada, market analyst at Forex.com, said: "The lack of a positive response in oil prices clearly suggests market participants are not convinced that Opec's efforts will help shore up prices in a meaningful way in the short-term as shale supply continues to rise in the US.

"Last week's news of an unexpected build in US gasoline stocks only helped to exacerbate those fears. We will have to see how the supply situation evolves over time. However, as the global disparity between demand for and supply of oil reduces in the coming months, prices should begin to recover."

Analysts at JBC Energy said from the importers' standpoint, things appear to be very different. "Crude prices have reversed most of the gains made since Friday, so China wants to keep the crude coming. While new Chinese crude import quotas and a rebound in refining margins at least signal that crude demand has a good chance of ramping up further over the coming weeks, supply news remains quite bearish with rising Libyan production now also in the mix."

© Copyright IBTimes 2025. All rights reserved.