Opec Preview: Tough Talks Ahead on High Oil Prices and Supply

The Organisation of the Petroleum Exporting Countries (Opec) has a tough meeting ahead, as talks over how to tackle soaring oil prices, police over-supply and which members will bear the brunt of longer-term output cuts are expected to dominate the Vienna agenda.

While market consensus expects the 30m barrels per day output target to remain unchanged for the first six months of 2013, there are still many fundamental medium and long-term issues that need to be wrestled with now.

"The world economy is weak and supply will be running ahead of demand, which could justify a cut of around 500,000 barrels per day, but political factors will prevent Opec from taking any formal action," said a senior Opec delegate from a Gulf producer, referring to Middle East unrest and sanctions on Iran when speaking to Reuters.

Syria and Iran also pose a topic of contention, as although Syria does not supply a major share of Opec supply, delegates will still have address that geopolitical events like these put pressure on them to spend more to head off dissent.

"I am not expecting much in the way of a change in policy, although stormy weather lies ahead for the organisation. Indeed this may be the last meeting at which there is no strictly identifiable hazard for them to come to terms with, as the supply side of the equation comes into play," says Malcolm Graham-Wood, analyst at VSA Capital.

Oil Price Correction?

Oil prices have stabilised at a high level this year, but analysts say that a correction is on the horizon.

Brent Crude, the forward contract that is used to price international varieties of oil, has averaged at $112 per barrel this year and is currently trading around the $107 per barrel mark.

Analysts at Deutsche Bank warn that oil prices are at risk of a major correction next year and oil price forecasts from various institutions range at "extreme levels".

According to data collated by IBTimes UK, the lowest 2013 forecast for Brent Crude currently stands at $102 per barrel from Morgan Stanley and the highest average forecast stands at $125 per barrel from Barclays and JP Morgan.

Rampant Demand

Opec delegates also have the issue of tackling rampant demand.

While high oil prices provide some relief to demand, the International Energy Agency (IEA) has already warned that global demand for oil is set to rise by 670,000 barrels a day this year.

According to the IEA's benchmark report World Energy Outlook 2012, Opec delegate and world swing producer, which has the ability to change the price of oil on global markets by varying its supply, Saudi Arabia will have address its role in paring back demand.

"Saudi Arabia, in common with many countries in the Middle East, faces a growing need to rein in rampant oil demand. Between 2000 and 2011, Saudi oil consumption almost doubled, to 2.8m barrels per day, partly because of surging use of oil for power generation. Annual per capita consumption of oil was 4.7 tonnes (35 barrels) in 2011 - the highest in the world," says the report.

Supply Dynamics

The other quandary that Opec will have to face is the control of supply.

Opec's current share of world oil production is set to increase from 42 percent in 2011 to 48 percent in 2035, according to the IEA and as remarked by the group, this is still below the historical 53 percent market share from the 1970s as existing reserves wane.

Elsewhere, the rise in non-Opec supply is also putting pressure on Opec's existence and its control over the oil price, which it has deftly done in the past.

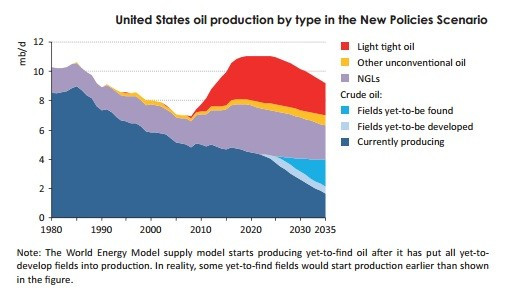

In September this year, US oil production hit the highest level in almost 15 years [Fig 1.], after notching up 6.5m barrels per day. Unconventional resources, such as the Bakken Shale have boosted output. North Dakota now pumps almost as much oil as OPEC-member Qatar.

"The rise in light tight oil production in the US in the last few years has been nothing short of spectacular," says the IEA.

It also said that the US will overtake Saudi Arabia as the world's largest oil producer within the next decade, as an oil and gas boom moves the world's biggest economy closer to energy self-sufficiency.

"I have talked about the increase in US domestic oil production which together with increasing supplies from Canada will lessen import requirements for that continent and of course shale gas is increasing the supply of cheap fuel for power generation," says Graham-Wood.

Question of Supply Control

In the past, Opec would easily be able to control oil prices, by increasing or decreasing output.

Back in 2001 and 2002, Opec had a spare capacity that was the equivalent of around 6 percent of global demand but by 2005 this spare capacity slipped to 1 percent of global demand.

In 2008, it was able to cut output to rebalance the market and fuelled a rebound in oil prices.

However, its tight control could be loosening with the growth in non-Opec production and therefore delegates will have to seriously debate about deeper output cuts in order to offset sluggish demand and rising competing supply.

Longview Economics predicts that supply growth will outstrip demand by 800,000 barrels a day in 2012, with another year of surplus to follow. It also believes that Brent could drop as low as $70 per barrel, which is around a $50 price differential from a number of upper end forecasts from the investment banks.

Will Saudi Arabia Bear the Brunt?

With competing supply, Opec has also address a 'problem' closer to home.

Iraq accounts for a bulk of the group's supply, has surpassed Iran output and now pumps more than 3.1m barrels per day. It is now Opec's second largest producer behind Saudi Arabia.

The IEA predicts that by 2015, Iraq could be producing 4.2m barrels per day and 6.1m by 2020.

While the rise in output is certainly a good sign for oil revenues for the country that had taken years to recoup production to pre-war levels, Saudi Arabia will need to discuss whether it will give up its market share by cutting output in order to support growth from Iraq.

However, according to US Energy Information Administration (EIA) Saudi Arabia's economy remains heavily dependent on crude oil and oil export revenues have accounted for 80-90 percent of total Saudi revenues and above 40 percent of the country's GDP.

It will be a surprise if Saudi Arabia doesn't put up a fight.

© Copyright IBTimes 2025. All rights reserved.