Petrofac Upbeat on Growth, Secures Buy Rating

Petrofac Limited, the provider of facilities solutions to the oil and gas production and processing industry, with continued growth, high levels of backlog, exceptional revenue visibility is scheduled to report its preliminary results on March 5, 2012.

The group remains positive that it can continue the growth which it has achieved in the first half of the year, especially in engineering and construction. Petrofac is confident of acheiving strong full-year revenues and also anticipates net margins to be in line with its medium-term guidance at around 11%. With a healthy financial status, a differentiated and competitive offering and a confirmed track record in project implementation, the group is sure that it will continue to deliver better value for its customers and sector-leading returns for its shareholders.

Last month Petrofac won a $330 million engineering, procurement and construction (EPC) contract from Gazprom Neft Badra for the first phase of the Badra Oilfield Development Project in Iraq. The project will start shortly and be finished in three 18-month phases, with the final completion expected during the second half of 2015. The group has also acquired KW Limited which had gross assets of £2.7 million till March 31, 2011.

In the beginning of 2012, Petrofac's Integrated Energy Services (IES) and Schlumberger's Schlumberger Production Management (SPM) signed a Co-operation Agreement, according to which these divisions will set up a working relationship to deliver integrated and high-value production projects in the rising and developing production services and production development market.

In the second half of the financial year, the group's IES division signed a contract that will see the deployment of the floating production facility FPF1 on the Greater Stella Area development in the North Sea. Petrofac agreed to sell 80% stake in the company holding the FPF1 to Ithaca Energy, and Dyas BV.

In September 2011, Petrofac and China Petroleum Engineering & Construction Corporation (CPECC) established a new strategic JV, China Petroleum Petrofac Engineering Services (CPPES). The joint venture will offer project management and engineering services for selected oil and gas projects, focusing on projects for Chinese oil and gas companies. In addition, it declared in August 2011, that its Offshore Engineering & Operations (OE&O) business has won two North Sea contracts from GDF SUEZ E&P UK Ltd, which is valued at £30 million over three years with an additional two year option.

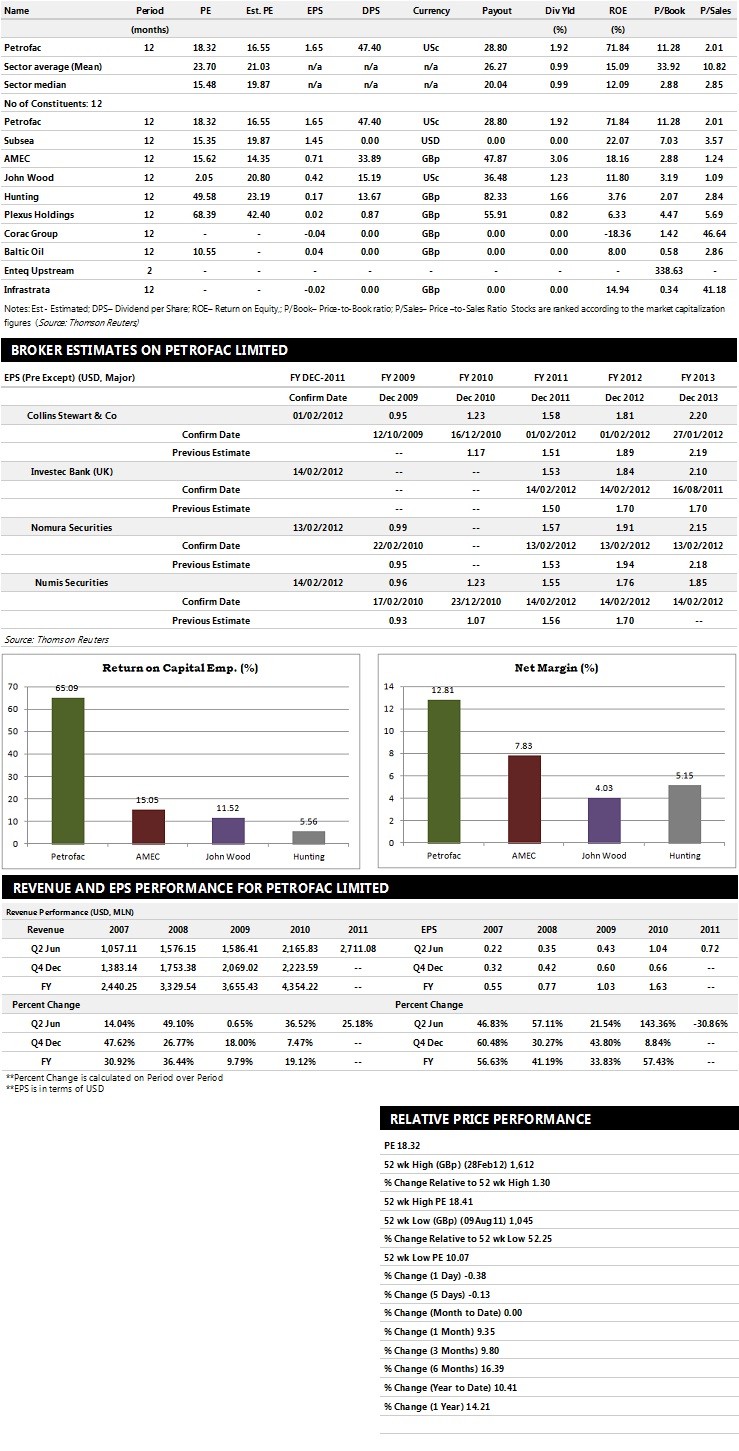

Brokers' Views:

- Numis Securities recommends 'Add' rating on the stock with a target price of $25.78 per share

- Nomura Securities assigns 'Buy ' rating on the stock with a target price of $25.78 per share

- Collins Stewart & Co gives 'Buy' rating on the stock with a target price of $30.67 pence

- Day by Day assigns 'Buy' rating - Charles Stanley recommends 'Accumulate' rating.

Earnings Outlook:

- Numis Securities estimates the company to report revenues of $5,771.50 million and $6,777.00 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of $677.00 million and $763.00 million. Profit per share is projected at $1.55 for FY 2011 and $1.76 for FY 2012.

- Nomura Securities expects the group to record revenues of $5,591.00 million and $6,392.00 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of $ 637.00 million and $848.00 million. EPS is estimated at $1.57 for FY 2011 and $1.91 for FY 2012.

- Collins Stewart & Co projects that Petrofac to record revenues of $5,863.00 million for the FY 2011 and $6,382.00 million for the FY 2012 respectively with pre-tax profits of $679.00 million and $776.00 million for the same periods. Profit earnings per share is projected at $1.58 for the FY 2011 and $1.81 for the FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector.The table below represents top ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.