Royal Mail: UBS Claims CWU Dispute 'Major Risk Factor' to Offer Share Price

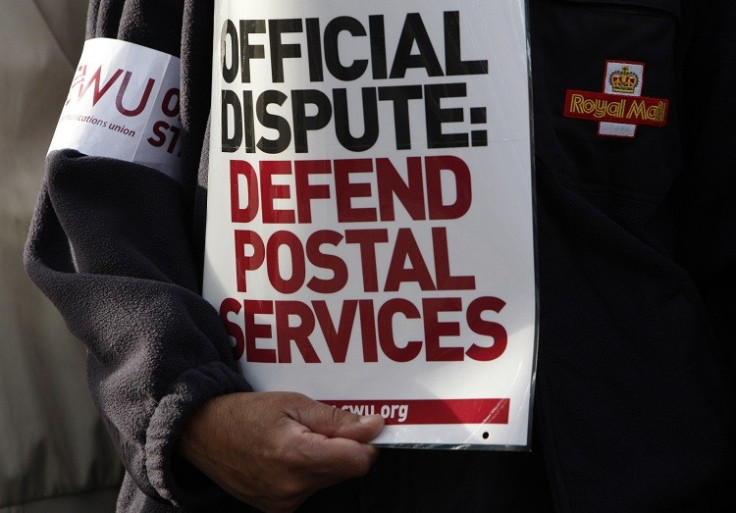

Royal Mail's industrial dispute with the Communication Workers Union was "the major risk factor" weighing down on the historic firm's offer price in its flotation onto the London Stock Exchange, according to one of the senior bankers advising the government on its privatisation.

James Robertson, managing director at UBS, said Royal Mail bosses had privately warned the Swiss investment bank in September during its pricing work ahead of the flotation that a pay deal with the CWU was unlikely and that industrial action would probably take place.

"Up until September we were hoping to get a pay deal and hoping to do the IPO on the backdraft of a positive industrial relations scenario," Robertson told MPs on the business select committee at a hearing on the Royal Mail privatisation.

"From September onwards, [industrial relations] was the major risk factor."

He was pressed by MPs on how much the threat of strike action had dented the Royal Mail's valuation range by, but he said he could not give an exact number. Robertson was also asked why UBS did not advise that the flotation be delayed until the dispute was resolved.

"There was no evidence with the feedback from the company that [the dispute] would have been resolved before an IPO took place," he said, adding that much of the dispute was centred around the firm's privatisation anyway.

The dispute has since been resolved and the threat of industrial action no longer hangs over the company.

330p 'Right Price'

Alongside Robertson was Richard Cormack, a managing director at Goldman Sachs, the other of the government's two "Global Co-ordinators" advising on the valuation of Royal Mail.

Both men defended the research process which led to the heavily criticised offer price of 330p, which some argue seriously undervalued the Royal Mail and cost taxpayers hundreds of millions of pounds in potential revenue. The price has risen as high as 587p, but has since fallen back to around 542p.

Cormack said the offer price was based on discussions with the target long-term investor base the government sought to lure. He said there were a number of competing tensions to balance in setting the price.

These included ensuring all 600 million shares were placed; that the price was not too high and produced a disappointing initial performance which damages the firm's future potential to access capital markets; and ensuring a decent market performance because the government retains a significant stake.

"I don't think that today's price is indicative of where we could have placed 600 million shares," Cormack told MPs.

"Based on all of the information we had at the time, based on all the analysis we had at the time, 330 was the right price for the transaction.

"This was a large complicated deal against an uncertain backdrop - in the markets with the US debt ceiling and at a company level with the strike ballot - in that context this was a well-executed transaction."

UBS's Robertson added: "I think the investors we placed the stock with are exactly the sort of long-term blue chip investors the company should be very pleased to have on their shareholder register."

Cormack confirmed Business Secretary Vince Cable's comments that big investors said they would not buy Royal Mail shares at a higher price than top end of range.

He would not confirm exactly who these institutions were for commercial confidentiality reasons. When pressed on if those institutions went on and bought Royal Mail shares at a higher price later on, Cormack said he did not have access to that information.

Ahead of the committee appearance by Robertson, UBS set a target price for Royal Mail shares of 450p and placed a sell rating on them.

Cable Letter

Cable is due to face a grilling by the business select committee on 27 November. He has already written to the group of MPs to defend the offer price.

He said the process of valuation ahead of the flotation "comprised a combination of rigorous market testing and extensive analysis of comparable companies in the sector."

This process included meeting with the institutional investors likely to buy Royal Mail shares.

"Given final demand indications from the GloCos, it was agreed that 330p was an appropriate valuation of our shareholding," wrote Cable.

"This was endorsed by Lazard," the government's independent adviser.

He also admitted that he had, late on, considered a higher offer price - but decided against it.

"Revising the price range upwards late in the bookbuild was considered given the demand generated," Cable wrote.

"However this was not pursued based on an assessment of the composition of demand in the order book and an assessment of where demand would taper off, especially from informed potential long-term investors."

© Copyright IBTimes 2025. All rights reserved.