Russian rouble plunges again on falling oil prices

The gains made by the Russian rouble last Friday were short-lived, as the beleaguered currency opened 1.5% down against the dollar on Monday 8 December.

Weakening oil prices are once again being blamed for the devaluation, with Brent crude down more than 1% today – resting at $68.33 per barrel.

Central bank interventions late last week led to the rouble gaining 3% - its biggest rise in more than one month.

Capital flight, oil prices and western sanctions have all hammered the rouble, which has been in almost perpetual free-fall since June. It has lost some 40% of its value against the dollar since the beginning of 2014, with the majority of the loss coming since the start of October.

The Bank of Russia had previously opted to free-float the currency. In November it said there would be no more intervention and that the market would decide the currency's rate. Some suggested that the inevitable depreciation this ushered in would strengthen Russian exports, since they would cost less for overseas buyers.

However, with the rouble behind only the Ukrainian currency in the worst-performing in the world, the bank was required to step in to purchase foreign currency last week.

Russia's President Vladimir Putin warned last week that currency speculators would be punished by his government. In his annual state of the nation address at the Kremlin's St George Hall, he said: "You know the central bank has floated the rouble, but that doesn't mean the central bank no longer intervenes.

"We have asked the central bank to take measures to make sure that speculators can no longer take advantage. We know who those people are, and we have the means to rein them in. It's time to use these instruments.

"The rouble of course constitutes upward pressure on inflation. We should take measures to keep the situation with food prices under control. But the weak rouble also makes our companies more competitive, and we need to take advantage through import substitution.

Earlier in December, the Russian government admitted for the first time that it expects the economy to dip into recession in 2015.

The Economic Ministry expects a 0.8% contraction next year, a revision of its earlier prediction of 1.2% growth.

Oil sales account for 70% of Russia's exports and the plunge in prices has had a catastrophic impact on the country's economy. It's estimated that the drop in oil prices since July will slash $100bn from Russia's annual exports volume.

"I think that Russia's economy is vulnerable to three sorts of crisis — structural, conjectural and geopolitical," said Alexi Vedev, the deputy economic minister.

He added: "The basic assessment is that the exchange rate will stabilise at least at current levels... there's a feeling that oil prices will recover to $85-$95 by the middle of next year."

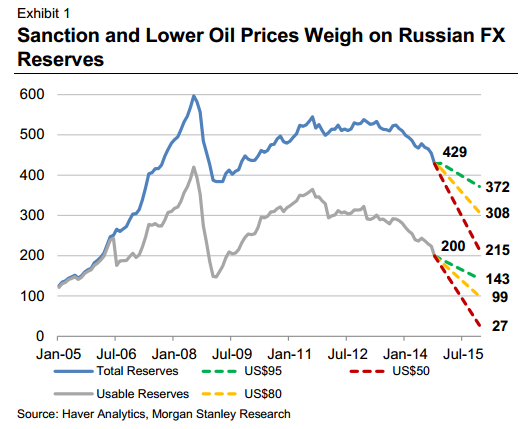

Meanwhile, the investment bank Morgan Stanley has warned that the falling oil price is weighing on Russia's cash reserves. While the central bank has reserves of $420bn, the bank claims that only $200bn of those are "usable".

© Copyright IBTimes 2025. All rights reserved.