Budget 2017 as it happened: Hammond pledges £2bn to social care but warns against reckless spending

The chancellor warns against expecting major surprises on taxes and spending plans.

Chancellor Philip Hammond has stuck to his script while delivering the Spring Budget against a backdrop of heightened uncertainty as the government prepares to leave the European Union.

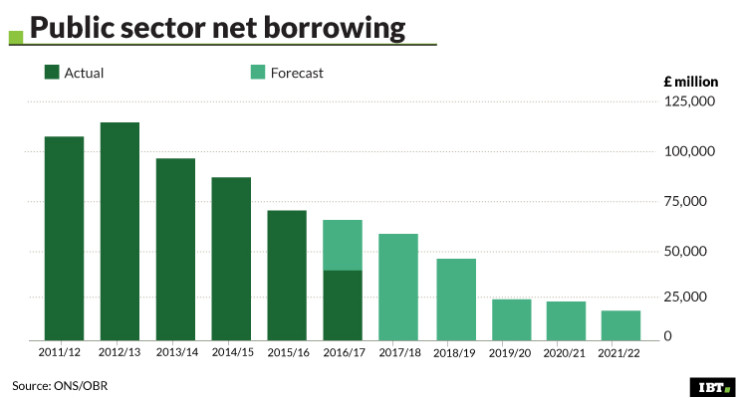

Britain's economy will grow more than forecast this year, before slowing down next year, while public sector borrowing is expected to peak in 2018, while an extra £2bn will spent in social care over the next three years. Here are the key points from the Chancellor's Spring Budget:

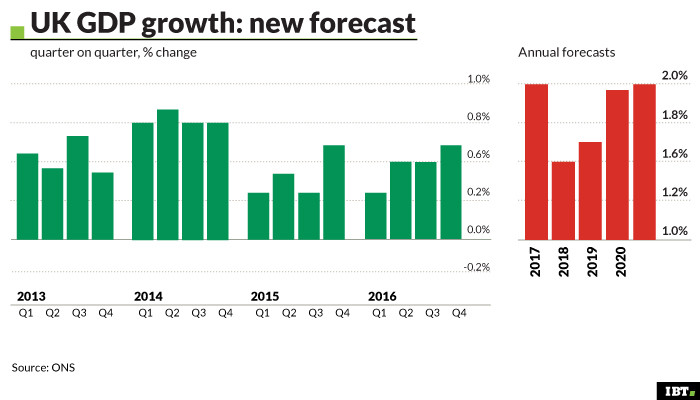

- The OBR now expects the UK economy to grow 2% this year, compared with a previous forecast of 1.4%. However, growth will slow to 1.6% in 2018, before picking up to 1.7% in 2019, 1.9% in 2020, and 2% in 2021.

- An extra £2bn will go into social care in England over the next three years, with £1bn available in 2017-18.

- Debt is forecast to be 86.8% of GDP this year, before reaching an 88.8% next year which, however, is 1.4% lower than initially forecast.

- There are no changes to the previously planned charges on tobacco and alcohol products, while vehicle excise duty will be frozen for hauliers, and HGV road user levy will also be frozen.

- The national living wage will rise to £7.50 in April, while the personal allowance will increase for the seventh year in a row, and the higher rate threshold will rise to.

That concludes our live coverage of the Spring Budget for today. Thanks very much for following and remember you can find more in-depth analysis of today's events and of the key points of the Spring Budget here.

Meanwhile, Hammond could be facing a self-employment related backlash after announcing a hike in National Insurance Contributions (NICs) in his Spring Budget.

Hammond will scrap class two NICs for self-employed workers from April 2018 and increase the main rate (class four) NICs by 9% to 10%, with an additional 1% hike in April 2019. The take rise will cost more than 2.4 million self-employed workers £240 a year.

On the subject of growth forecast, analysts say that the OBR's caution on both the economy and the fiscal outlook deprived the Chancellor Phillip Hammond of the additional Brexit "war chest" that some had predicted.

The OBR expects the UK economy to grow 2% this year, compared with a previous forecast of 1.4%. However, growth will slow to 1.6% in 2018, before picking up to 1.7% in 2019, 1.9% in 2020, and 2% in 2021.

"If we are right in expecting the economy to remain rather more resilient than the OBR expects, then public borrowing will clearly fall rather faster and give the Chancellor more elbow room," said Jonathan Loynes, chief economist at Capital Economics.

"For now though, the big picture is still one of a substantial further tightening of fiscal policy over the coming years."

We have revised up GDP growth in 2017 from 1.4 to 2.0% following greater momentum at the end of 2016 #Budget2017 pic.twitter.com/sFWq8u4em7

— OBR (@OBR_UK) March 8, 2017

The Budget has so far not had a major impact on the markets, with both equities and FX meandering along, much as they did before Hammond's speech.

"Markets took a drab Budget in their stride [...] as you would expect, there was plenty of pro-business stuff in there and growth for 2017 was revised higher, in line with other forecasts," said Neil Wilson, Market Analyst at ETX Capital.

"Spreadsheet Phil cracked a few jokes but this was a Budget pretty low on content as far as investors are concerned – the reduction in the tax free dividend allowance aside.

"This was a dry run for the new autumn set piece when he will know a lot more about what the Brexit landscape looks like."

The Chancellor's plans to raise National Insurance tax for self-employed workers have not been met with universal approval.

Maike Currie, investment director for personal investing at Fidelity International, said it was "disappointing" that a Chancellor who once worked for himself could launch such a tax blitz on the incomes of the self-employed.

"A key driver behind the surge in self-employment was the 2008 financial crisis and the tough labour market left in its wake. Indeed, self-employment has accounted for one-third of all jobs created since 2010," she said.

"Other factors driving the so-called 'gig economy' has been technological change and an aging population - the rise of the 'silver entrepreneur' has accounted for half of the increase in self-employment since 2004, according to the Bank of England.

"Working for yourself by definition means greater insecurity and the risk of falling incomes [...] If you are part of the self-employed cohort, now more than you ever you need to have a firm grip on your personal finances."

Ben Handley, director at PwC, said the Budget felt like a bit of a mixed bag for start-up and small entrepreneurial businesses.

"Measures to relieve the cost of business rates, reduction in administration for R&D claims and confirmation of lower corporation tax rates will be welcomed," he explained.

"But the reduction in dividend exemption from £5,000 to £2,000 could increase the cost of withdrawing profits from a business by over £1,000 from 6 April 2018.

"We are also expecting a review of the taxation of partnership and company structures in the summer which may provide a backdrop of uncertainty for those setting out now on a new business venture."

In case you have missed all the excitement, you can read Hammond's speech in full here.

The Confederation of British Industry (CBI) described the Budget as a "major breakthrough" for the business sector.

"This is a breakthrough Budget for skills," said CBI Director General Carolyn Fairbairn.

"There has never been a more important time for the UK to sit at the global top table of technical education for young people.

"Firms will be looking for ongoing partnership with the Government as they try to make the Apprenticeship Levy work.

"However, with inflation rising and the cumulative burden weighing on businesses' shoulders, limited relief for firms hit hard by business rates falls short.

"Firms are wholly committed to the health and wellbeing of their people, and are pleased to see an increase in spending on social care."

Hammond delivers "safety first Budget"

Analysts suggest Hammond delivered a 'safety first' Budget with some well targeted giveaways on social care, vocational training and business rates relief that were broadly offset by tax rises for the self-employed and other measures.

"The Chancellor's caution is understandable given that, despite better than expected short term numbers, the OBR made little change to its medium-term projections for either economic growth or public borrowing," said PwC chief economist John Hawksworth.

"The timing of the adverse economic and fiscal impact of Brexit has been pushed back a bit, but the eventual impact in 2021 remains more or less the same as in the Autumn Statement in November."

Hawksworth added that the many economic and political uncertainties around Brexit and other geopolitical events, it was prudent for the Chancellor to protect the £26bn headroom he left himself in meeting the new fiscal target he set out in the Autumn Statement.

"But, given the OBR's view that the underlying economic position has not changed materially since November, the Chancellor was not able to add to this headroom despite his cautious overall Budget judgement," he said.

The Federation of Small Business has welcomed the Chancellor's decision to listen to the small business-led campaign on business rates.

"The £435m of new money is a direct and much-needed response to those facing astronomical hikes in their business rates," said Mike Cherry, the FSB National Chairman.

"This immediate relief is vital in the short-term, and action on more frequent revaluations will also help. But this tax remains out-of-date, so today we call for a cross-party Commission to create a simple, fair tax system for a modern economy."

Great to see @PHammondMP announcing a £300m discretionary relief fund for local councils to ease business rates burden #Budget2017 pic.twitter.com/PxRsmFMh1R

— FSB (@fsb_policy) March 8, 2017

Petra Wilton, director of Strategy and External Affairs at the Chartered Management Institute, has welcomed Hammond's decision to spend £500m a year to support 16-19-year olds in technical education.

"For the UK economy to punch above its weight post-Brexit we need to start ramping-up the number of young people entering the labour force with work-ready higher skills," she said.

"According to our research, one-third of 16-21-year olds in the UK aren't confident of finding a job in the next few years. Alongside championing the Government's apprenticeship agenda, we support this transformation of technical education that will lay clearer career paths for those leaving school. But to deliver the highly skilled workers we'll need to compete post-Brexit, these technical routes must be developed with employers and aligned with the new breed of apprenticeships."

Phil Vernon, head of rating at PwC, said the Chancellor's announcement to introduce new business rates transitional arrangements for businesses losing Small Business Rates Relief and a new £1,000 discount for many pubs is a welcome boost to small and medium sized business in London and the South East.

"However, at some point over the next five years many businesses will bear the full brunt of the large jump in their Rateable Values," he adds.

"Businesses in the north of England will also be breathing a sigh of relief as their expected decreases have not been further curtailed by this announcement."

You can find all the information you need to know about today's Spring Budget here and you here you can also read all of today's documents in their entirety.

Find all the #Budget2017 information in one place. https://t.co/vF2oWflFnq

— HM Treasury (@hmtreasury) March 8, 2017

Hammond reiterates the government remains committed to continue with its plan to improve the economy, adding it is determined to make Britain the best place in the world to do business.

"We have a remarkable history," he says. "But we look forward, confident our best days are ahead of us."

And, with that, the last ever Spring Budget is done and dusted.

Hammond adds £100m will be available to set up to fund triage projects in A&E departments, in time for next winter. As the result of the Copeland by-election showed, "we are the party of the NHS".

On site GP triage to be funded by £100m of capital spending to reduce pressure on A & E - pretty small potatoes #Budget2017

— Robert Peston (@Peston) March 8, 2017

As far as I can see - £500m extra for NHS - not what Simon Stevens was seeking but Chancellor says Copeland shows "we are the party of NHS"

— Faisal Islam (@faisalislam) March 8, 2017

Hammond says an extra £2bn will go into social care in England over the next three years, with £1bn available in 2017-18. Hammond says this will allow local authorities to act immediately and he adds the funds will help the NHS getting back on track.

This is how much the UK spends on healthcare as a proportion of GDP.

UK ranked 6/7 for healthcare expenditure as a proportion of GDP among G7 countries in 2014 https://t.co/c9EDfRy1Ri #Budget2017 pic.twitter.com/EBIShtfJpU

— ONS (@ONS) March 8, 2017

Some £200m will be allocated to projects to get private sector investment in full-fibre broadband networks, Hammond adds. Meanwhile, on the subject of education, the Chancellor says says 1.8 million more children are being taught in good or outstanding schools than seven years ago.

The government remains committed to create more selective free schools, to allow academically gifted students to thrive, he says, adding that new funding will be directed towards an extra 110 free schools, on top of the 500 already announced.

Free school transport to be extended to all pupils on free school meals at a selective school, while an additional £260m will be invested in improving school buildings.

Chancellor confirms maintenance loans for part time undergraduates and doctoral loans in all subjects for the first time #Budget2017 pic.twitter.com/LPjntewgfV

— HM Treasury (@hmtreasury) March 8, 2017

Hammond says rising living standards is crucial to deliver an economy that works for everyone. The Chancellor will allocate £300m to support the brightest research talent, including 1,000 PhD students in STEM subjects

£270 million to keep the UK at the forefront of disruptive technologies like biotech, robotic systems and driverless cars #Budget2017 pic.twitter.com/3Lne20UYDB

— HM Treasury (@hmtreasury) March 8, 2017

On the wage front, Hammond says the national living wage will rise to £7.50 in April, while the personal allowance will increase for the seventh year in a row, and the higher rate threshold will rise to.

The personal allowance will rise for the seventh year in a row to £11,500 #Budget2017 pic.twitter.com/NDUtqn0xtx

— HM Treasury (@hmtreasury) March 8, 2017

The Chancellor has now moved onto duties. There are no changes to the previously planned charges on tobacco and alcohol products, while vehicle excise duty will be frozen for hauliers, and HGV road user levy will also be frozen.

Hammond adds there will be a reduction in the revenue from the sugar tax, as producers have began reducing the amount of sugar in drinks, but schools will receive the £1bn revenue expected for this.

Hammond now turns to the self-employed. The Chancellor outlines plans to raise National Insurance tax for self-employed workers, adding that the new state pension has removed the discrepancy between self-employed and other workers. As a result, the former no longer need to have different tax rates, as both categories use public services.

The lower NIC rates cost the taxpayer £5bn a year, but the new measure will reduce the gap.

However, that means the Chancellor will break a pledge the Tory party made in its manifesto before the 2015 General Election.

Hammond has broken key pledge in the Conservative 2015 GE manifesto with NIC rise #Budget2017 pic.twitter.com/JLxjPEZJMM

— Ian Silvera (@ianjsilvera) March 8, 2017

Hammond says business rates raise £25bn a year, which means they cannot be abolished. However, he admits the digital sector of the economy needs to be better taxed in the medium term. The Chancellor adds that the business rates system needs to be fairer and that the Government will outline plans and unveil its preferred approach before the next revaluation.

There are three main measures, which Hammond has set out.

Any business coming out of small business rate relief will benefit from an extra cap, which means rates will not raise by more than £50 a month and there will be a £1,000 discount on business rates bills for 90% of British pubs.

“I will provide a £1,000 discount on #businessrates bills in 2017 for all pubs with a Rateable Value of less than £100,000 #Budget2017 pic.twitter.com/lVL2YhMCEu

— HM Treasury (@hmtreasury) March 8, 2017

On the subject of debts, Hammond says debt forecast to be 86.8% of GDP this year, before reaching an 88.8% next year which, however, is 1.4% lower than initially forecast.

Hammond says lower borrowing does not justify unfunded spending, pointing out that Britain has a national debt of almost £1.7trn, which works out at roughly £62,000 per household.

Given the circumstances, he adds, remaining on course with the current plan is the only "responsible" thing to do.

“Public sector net borrowing as a percentage of GDP is predicted to fall from 3.8% last year to 2.6% this year.” #Budget2017 pic.twitter.com/WaOQWn084h

— HM Treasury (@hmtreasury) March 8, 2017

The Chancellor adds borrowing is forecast to be £16.4bn lower than forecast in the autumn.

Here’s a snapshot of economic data announced by the Chancellor #Budget2017 pic.twitter.com/m3Lq5e1VtQ

— HM Treasury (@hmtreasury) March 8, 2017

Employment is also expected to grow between now and 2021, Hammond adds.

No. of people in employment is set to grow in every year of the forecast period, with a further 2/3rds of a million people in work by 2021 pic.twitter.com/O4YNq3cawg

— HM Treasury (@hmtreasury) March 8, 2017

The OBR expects the UK economy to grow 2% this year, compared with a previous forecast of 1.4%. However, growth will slow to 1.6% in 2018, before picking up to 1.7% in 2019, 1.9% in 2020, and 2% in 2021.

Chancellor: In 2018 growth is forecast to slow to 1.6%, before picking up to 1.7% in 2019, 1.9% in 2020, and 2% in 2021. #Budget2017 pic.twitter.com/nJ8XNjqJND

— HM Treasury (@hmtreasury) March 8, 2017

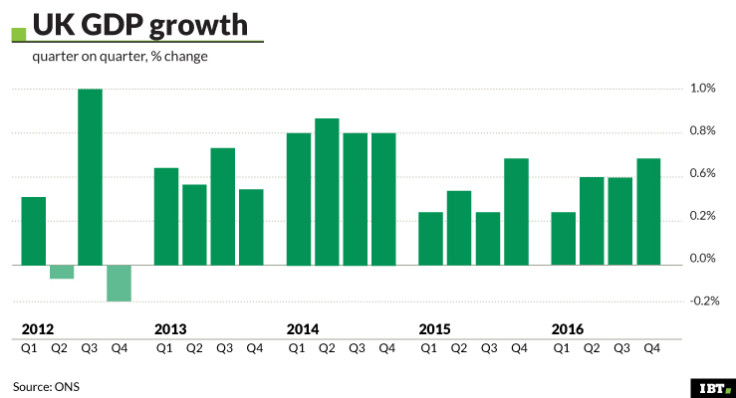

Hammond says the UK economy was the second-fastest growing among developed countries last year, while unemployment is at a record low which, he says, defies Labour's doom and gloom forecast.

However, there is no room for complacency, as debt is too high and too many families are feeling the squeeze. Hammond also warns that while employment is on the up, productivity remains "stubbornly low".

Hammond says the economy has continued to confound commentators, with economic remaining robust. The Budget, he continues, will provide a strong and stable platforms ahead of the Brexit negotiations and will get Britain "back to live within its means." He also confirms this will be the last Spring Budget.

While we wait for the Chancellor to start speaking, this is a very handy reminder of the challenges facing Hammond.

£58.7bn: The estimated 'cost' of Brexit that Philip Hammond will have to reckon with#Budget2017 pic.twitter.com/3mT6pG1E86

— Stephen Jones (@SteveJonesPA) March 8, 2017

Philip Hammond will start speaking in approximately 15 minutes. You can watch it live here.

Watch @PHammondMP give his #Budget2017 speech to the @HouseofCommons today at 12.30pm: https://t.co/ZuHw0bGE3j pic.twitter.com/0wDCRvLJy0

— HM Treasury (@hmtreasury) March 8, 2017

The Spring Budget is expected to contain tax increases for the self-employed.

"Whilst the Chancellor has to try to balance the books with such tax increases, a review of modern employment practices was already taking place so this move comes as little surprise, " said Vince McLoughlin, partner at Business, taxation and charity advisers firm Russell New.

"The goal for this government seems to be to remove any distinction between workers, the employed, and those who are self-employed. However, I can understand the frustrations of the self-employed who are a fundamental part of the wealth creating economy."

Today's Spring Budget could have a major impact on the course the pound will take in the short-term future. Sterling has lost ground for eight consecutive sessions and this morning fell to $1.2165, its weakest level against the dollar since 17 January.

"The general consensus going into today's Budget is that Chancellor Philip Hammond will disappoint and that the GBP/USD may extend its declines towards $1.20," said Fawad Razaqzada, market analyst at Forex.com.

"He is well aware of Brexit risks and may thus predict a more turbulent economic outlook. The risk therefore is if he expresses more optimism about the economy and delivers more fiscal spending plans than expected. If that's the case, the GBP/USD could easily rebound. There's some important US economic data coming up as well, so there is even more reason why the sellers may bank profit."

Budget Day formation, sterling. Bearish.

cc @MalcolmMoore https://t.co/wTQTlxgMuR pic.twitter.com/vb6hJqM5m2— Katie Martin (@katie_martin_fx) March 8, 2017

The Chancellor has just left 11 Downing Street carrying the famous red Budget box.

A Red Box Budget debut for @PHammondMP , with @HMTreasury team: Gauke, Ellison, Kirby, Neville-Rolfe pic.twitter.com/ksBnhopFwG

— Faisal Islam (@faisalislam) March 8, 2017

This would undoubtedly be welcome news for journalists on live-blogging duties today.

This could be a record breakingly short #Budget2017 statement

— Adam Boulton (@adamboultonSKY) March 8, 2017

According to William Hill, odds on Hammond speaking for 50 minutes stand at 8/11, meaning there is a 57% chance of it happening

Over in the City, the FTSE 100 is broadly flat as investors await the Chancellor's speech. Analysts expect Hammond to keep his powder dry, despite the likely improvement in borrowing forecast.

"The uncertainty associated with the forthcoming Brexit negotiations means that Hammond is unlikely to go all out for now, instead holding back capacity to boost the economy if things turn sour down the line," said Chris Beauchamp, market analyst at IG.

"While Mark Carney jumped the gun, implementing new stimulus immediately after the referendum result, it makes sense for Hammond to withhold his finite resources until they are unmistakably needed."

Neil Wilson, senior market analyst at EXT Capital, added: "The triggering of Article 50 is sure to weigh on the outlook for the UK economy and the Treasury is likely to keep a firm grip on the purse strings as it looks to bolster its war chest.

"Brexit is going to loom large and this is all about the chancellor setting out his stall as the most fiscally-responsible steward of the nation's finances at this precarious time."

Ahead of Hammond's speech, the bookmakers have had their say on what we can expect from the Chancellor.

According to William Hill, odds on Hammond speaking for 50 minutes stand at 8/11, meaning there is a 57% chance of it happening, while a shorter speech is priced at even money.

The bookmaker does not expect the Budget will contain a tax cut for 45% top rate payers, with incredibly short odds - 1/10 - for the rate to remain unchanged or be raised. Hammond is 1/12 to win mention the NHS and 1/4 and 2/1 to say "Brexit" and Donald Trump respectively.

As far as Hammond's sartorial choices go, the Chancellor is 1/4 to wear a blue tie, while red and yellow are quoted at 3/1 and 8/1 respectively.

As we await for the Budget, Prime Minister Theresa May has unveiled a £5m ($6.1m) fund to help mothers return to work.

PM: On #IWD2017 I'm announcing a £5m fund to help mothers returning to work after a long career break https://t.co/mjHf1syPqU @MumsnetTowers pic.twitter.com/MszTY3K4Co

— UK Prime Minister (@Number10gov) March 8, 2017

Staying with Labour, the shadow chancellor John McDonnell has had this to say ahead of the Budget.

In today’s #Budget2017, we’re demanding the Tories fix this rigged economy which favours a privileged few. @johnmcdonnellMP explains more ↓ pic.twitter.com/ruT1XnARSW

— The Labour Party (@UKLabour) March 8, 2017

Chancellor Philip Hammond must address the social care "crisis" in his spring Budget or face a mutiny from Conservative MPs, members of the Labour Party have said.

Shadow City Minister Jonathan Reynolds also told IBTimes UK that Hammond must provide more Brexit certainty with his major economic statement.

"We think Hammond must move to tackle the crisis in health and social care funding – he'll face a mutiny on his own side if he doesn't even acknowledge how difficult the social care situation is – and address the squeeze on living stands caused by the chronic level of low pay combined with rising inflation."

The Chancellor has posted a picture of the Spring Budget document on Twitter.

Here it is. My first (and last) Spring Budget #Budget2017 pic.twitter.com/BZCj8QK6PF

— Philip Hammond (@PHammondMP) March 8, 2017

Business rates expectations

Going back to expectations ahead of Hammond's speech for a second, the Chancellor is unlikely to announce any significant changes to the implementation of the 2017 Business Rates Revaluation.

"Any changes now would cause significant problems as the new Business Rates liabilities come into effect from 1st April 2017 and the bills are already being prepared and issued by the local authorities," explained Gerry Biddle, assistant director in Deloitte Real Estate.

"However, it's likely that the Chancellor will spend some extra money to help those businesses facing the steepest increases by making the transitional relief scheme more beneficial to those occupiers.

OECD upgrades growth forecast

Earlier today, the Organisation for Economic Cooperation and Development (OECD) said the UK economy will grow more than expected this year but the rate of expansion will still be slower than 2016.

The organisation predicted that UK's gross domestic product will increase by 1.6% this year, faster than the 1.2% growth predicted in November. However, it warned that rising inflation, weakening business investment and uncertainty over the UK's future trading relations with the rest of world as a result of Brexit will all act as drags on growth.

How has the UK economy done so far?

The economy has performed better than the OBR expected. At the end of last year the watchdog forecast growth of 1.4% for 2017. This is expected be upgraded by the OBR to close to 2%, in line with most other forecasts.

However, the OBR is likely to warn that household finances will be squeezed by higher inflation, currently at 1.8%. Some economists say this may jump as high as 4% in the second half of the year as high street prices rise, pushed by a weak pound. The Bank of England has said it does not expect wages to keep pace with inflation.

"The long grind of public sector austerity has much further to run," said Ian Stewart, chief economist at Deloitte.

"After seven years of deficit reduction, annual borrowing still accounts for 3.5% of UK GDP. The squeeze on public spending is stepping up, this Budget is unlikely to see any let up on that, and by the end of this decade the tax burden is likely to be at a 30 year high."

"As such, rebalancing the public finances after the global financial crisis is likely to be a three Parliament process and Hammond's first Budget could mark only the halfway point in the long journey to eliminating the deficit."

Sterling tumbles ahead of Hammond's speech

Sterling has fallen to $1.2165, its weakest level against the dollar since 17 January.

"We expect sterling to tread water with a bearish bias as we lead up to the Budget, after all, the contrasting fiscal stances between the UK and the US is decidedly pound negative," said Kathleen Brooks, research director at City Index.

"However, if the Chancellor manages to avoid terrifying the market with his continued push for austerity and instead focuses on a positive fiscal outlook for the UK – with borrowing down and tax take up – then the pound and gilt yields could stage a mini recovery on the back of Hammond's speech."

What to expect from the Budget

Few surprises are expected to day, but the day retains its own significance given that Hammond announced in the November Autumn Statement that the main Budget will take place in the autumn from 2018.

After that he said spring statements will no longer be major tax-raising events, but simply respond to economic forecasts by the independent government watchdog the Office for Budget Responsibility (OBR).

The move to one Budget a year has been welcomed by most tax experts. Bill Dodwell, president of the Chartered Institute of Taxation, said: "One budget allows more time to consult and reflect on policy."

Here is all you need to know ahead of today.

© Copyright IBTimes 2025. All rights reserved.