Cult Wines' Tom Gearing: My Top Ten Tips for Investing in Fine Wine [BLOG]

With investors increasingly looking away from the traditional investment classes for diversification and to generate low volatile, stable long term gains, fine wine has come into the spotlight.

For most investors however the world of fine wine is a daunting place. Whilst the benefits and returns are clear, harnessing them is trickier.

So in order to help the intrepid investor, I have put together a list of my top tips in order to get the most out of the market.

1. Focus on buying from best estates from the old world regions of Bordeaux, Burgundy, Italian, Rhone and Champagne for the best returns.

Bordeaux Grand Cru Classés account for the largest part of the investment grade market for fine wine (c 75%) and is traditionally where most collectors and investors should focus.

The top Bordeaux estates such as the first growth wines; Mouton Rothschild, Lafite Rothschild, Latour, Haut Brion and Margaux, have long been the most tradable and in-demand wines on the secondary market. With production levels of c. 15,000 cases per annum they offer the investment market the right balance between sufficient availability and limited supply.

Away from Bordeaux there has been increasing demand from the emerging markets for the top wines from Burgundy, Italy, Rhone and Champagne, which has seen strong price appreciation.

As with any investment portfolio, the emphasis on building a profitable wine portfolio for long term capital appreciation should be to focus primarily on the best wines and vintages from Bordeaux, but to diversify holdings with allocations of capital to the other top wine making regions from the Old World.

2. Invest in wines with a medium-long term view

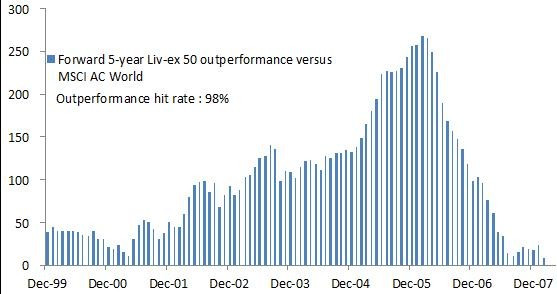

The most convincing factor of the viability of fine wine investment (FWI) to absolute return investors is that FWI has produced positive absolute return in every single 5-year holding period since the first period in record ('dec-99 to dec-04') except until the last two data points ('mar-08 to feb-13' and 'april-08 to mar-13').

When compared with global equities, FWI outperformed 98% of the time over any 5-year investment horizon since 'dec-99 to dec-04' until our last data point at 'dec-07 to dec-12'.

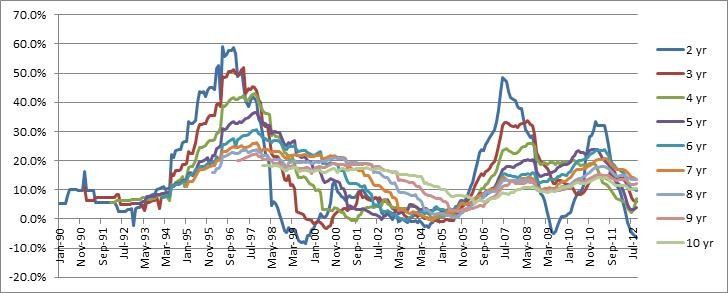

Further evidence for the validity of wine as a long term tool for capital appreciation is shown when you analyse wine market performance using the Liv-ex 100 - which is the industry benchmark index for fine wine prices - on the Compound Annual Growth Rate (CAGR) over a 2 year to 10 year period.

As the graph below shows, the longer wine is held the less volatile and more consistent the returns become.

The historical performance of fine wine has shown that it's capable of providing investors capital protection, low volatility and solid returns.

3. Provenance and storing your wines in bond are key

When buying a precious asset such as fine wine it is of paramount importance to make sure it is stored professionally and correctly in the right conditions. Doing so will help guarantee the future value of the wine when you come to sell.

The easiest way to prove unquestionable provenance is to store fine wine in wooden cases in bond (IB) in a bonded warehouse such as London City Bond or Octavian Vaults.

Such bonded warehouses provide the optimum environment for fine wine storage, by carefully regulating temperature, humidity and other microclimatic factors. In addition wines stored IB are not liable for VAT as they are considered 'in transit'.

A case of IB wine may change hands multiple times without ever leaving the bonded warehouse which removes the risk of damage and disruption.

4. Understand the risks and benefits associated with buying en primeur

Commonly referred to as 'wine futures', en primeur refers to the process of buying wine whilst still in barrel, with bottling and physical delivery 2-3 years after the vintage release.

Traditionally this was believed to be the best way for investors and collectors to buy classified growth Bordeaux as it typically offers the chance for collectors to acquire stock at the lowest market offer price. By buying at en primeur release, the wines are at their youngest, with the maximum period for maturity and potential growth in value. It also offers the greatest security of provenance - as collectors have the added benefit of having wines delivered via the most direct route from the Château, ensuring absolute provenance.

However, buying en primeur carries a degree of risk as the wines are released before the final blend and oak aging is complete. Therefore the actual bottled product may turn out to be better or worse than the initial barrel samples suggested. If the former, then prices can increase significantly in the short term if the latter prices will soften.

Further to this in recent years due to increasing release prices by the Chateaux many feel the value and opportunity to make profit in the short term has been eradicated.

5. Use as a diversification tool

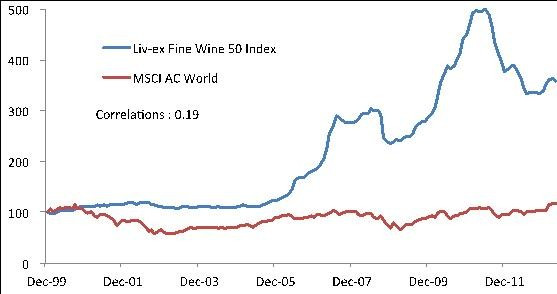

Fine Wine has many attractive features for investors none more so than as a diversification tool. Besides outperforming Global Equities in investment returns, FWI also gives diversifying benefits as the correlation of FWI to Global Equities is only 0.19.

FWI outperforms Global Equities with low correlation.

This low correlation to the wider financial markets makes wine a very attractive diversification tool for investors. It's relatively low volatility also adds to its appeal.

6. Buy Wines with a high Parker Score

Robert Parker Jr is the single most influential critic in the world of wine and the scores he awards wines have a direct effect on price and secondary market demand. When it comes to investing, it's important to follow Parker's scores.

For example the Liv-ex Fine Wine 100 (the wine market index) only includes wines scored 95+. And for the elusive few wines that receive the perfect 100 pt score, they can increase significantly in value as they become some of the most sought after and in demand wines in the market.

7. Speak to a tax advisor

Fine wine investment is often advertised as a 'tax-free investment' due to it being exempt from capital gains tax as it is deemed a wasting asset 'whose predictable life does not exceed more than 50 years' (Section 44(1) Taxation of Chargeable Gains Act 1992).

Whilst fine wine certainly can be considered more tax-efficient than other forms of investment, there a number of key considerations to make and it is crucial to observe that legislation in this area is not always black and white. I recommend you consult with your tax adviser to see how to make the most of fine wine as an asset.

8. Always check prices

Prices for investment grade wines can vary by as much as 20% when buying from one source or another and therefore when buying for investment it's crucial you shop around and buy at the best possible market price.

It is easier now more than ever to check prices online and make sure you're getting the best deal. Use websites such as wine-searcher.com to help do this.

9. Manage your portfolio online

As the wine market has moved into the 21<sup>st century so have the online tools available to wine investors to track prices and keep up to date with the market. Therefore anyone with an investment in wine should be signed up to one of the online data providers such as Liv-ex's Cellar Watch which allows private individuals to load in their portfolios and value their holdings against the most recent market activity and reliable price data.

Investment advisors such as Cult Wines also provide their client's online management tools in order to track their investment portfolios as well as have access to up-to-date market news, analysis and research

10. Invest in wines that offer value and growth potential

When assessing wines from a particular estate I recommend trying to find wines that offer both value and growth potential through qualitative and quantitative analysis.

For example by comparing prices across a range of vintages for a particular estate whilst cross-comparing their Robert Parker Score and Vintage quality score will identify wines that look undervalued. Then by looking at availability on the market, recommended drinking window (which will indicate when there is likely to be acceleration in the reduction of supply) and future potential for improvement in the quality of the wine.

Tom Gearing is director of Cult Wines, a fine wine investment firm.

© Copyright IBTimes 2025. All rights reserved.