Trump Says US Would Be 'Screwed' if Court Blocks Tariffs — What It Means for Taxpayers

President Trump signals dire economic fallout for government finances and taxpayers if top court rules against his emergency tariff policies.

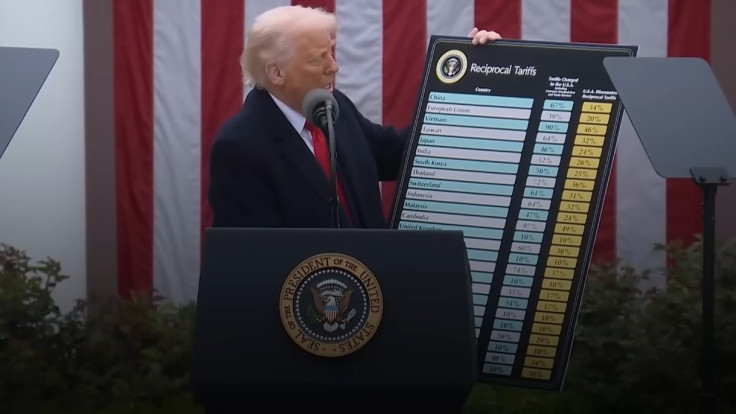

President Donald Trump has warned that the United States would be 'screwed' if the Supreme Court strikes down his emergency tariff regime, arguing that a defeat would force the government into massive, chaotic repayments that ultimately hit taxpayers. The warning lands just days before the high court is expected to rule on whether his use of emergency powers to levy tariffs passes constitutional muster, turning a complex legal battle into a pocketbook issue for households and investors.

In a post on Truth Social, Trump claimed that a loss at the Supreme Court could obligate Washington to return 'many Hundreds of Billions of Dollars' in tariffs collected under the International Emergency Economic Powers Act (IEEPA), and suggested that follow-on 'payback' demands from companies and countries could push the total into the trillions. He argued that such a bill would be 'almost impossible' for the federal government to absorb, warning of what he called a 'complete mess' for public finances if the court rules against him.

A Legal Fight With Real Money on the Line

At issue is whether Trump's broad tariff actions, imposed on imports from more than 100 countries under a 1977 emergency powers law, exceed presidential authority and effectively function as taxes that should require congressional sign‑off. If the justices decide the White House overreached, duties on about £98.42 billion ($133 billion) of goods could be in jeopardy, and the government might have to refund payments importers have already made.

Treasury Secretary Scott Bessent has tried to calm nerves, saying the department holds roughly £574.8 billion ($774 billion) in cash and could phase any refunds over several weeks or months, rather than dumping them on the system at once. That reassurance has not fully silenced critics, who warn that even staggered repayments on that scale could strain the public purse, complicate budget planning, and unsettle investors who track America's fiscal capacity and borrowing needs.

Why Taxpayers Should Care

For taxpayers, the risk is that huge tariff refunds would squeeze the same pot of money that funds daily government operations. If Washington has to send back hundreds of billions of dollars—or more—it leaves less room in the short term for spending on infrastructure, education, and social programmes without either cutting elsewhere or borrowing more.

There is also a market angle. Economists also warn that the uncertainty surrounding refunds might destabilise financial markets, as investors reassess the outlook for U.S. government bonds and corporate profit margins.

A ruling against the tariffs could force firms to change their cost base again, affecting consumer prices and hiring decisions.

Power Struggle Between President and Congress

Behind the money sits a constitutional fight over who controls trade tools that behave like taxes. Critics argue that Congress holds tax and tariff authority, and that leaning on emergency statutes to rewrite trade conditions sidelines elected lawmakers.

Supporters counter that emergency tariff powers give Washington leverage in negotiations and a quick way to shield domestic industries from what they see as unfair foreign practices.

What Happens Next

The Supreme Court has not yet set a public date for its decision, but legal watchers expect a ruling soon. If a majority backs Trump's reading of IEEPA, the current tariff structure stays in place and any immediate threat of refunds recedes, though Congress could still move to rewrite the law.

If the court sides against him, officials will need to design a mechanism to unwind years of collections, decide which importers qualify for repayments, and manage the fiscal and market fallout.

Either way, the decision will reach beyond the courtroom. It will shape the next phase of US trade policy.

© Copyright IBTimes 2025. All rights reserved.