UK housing market banishes post-Brexit blues

Estate agents and property listing sites are set to benefit from the recovery of house prices after the EU referendum in June.

Is Middle England's dinner party conversation revolving around property prices once again? Prices look to be on the march higher once again, after a post-Brexit dip.

This is the main message contained in the latest missives from property sale specialists Rightmove (Chart 1) and the Royal Institute of Chartered Surveyors (RICS): UK house prices are rising, well at least outside of central London.

So it looks like the housing market has banished the Brexit blues from its thoughts, with the fundamental lack of housing stock particularly around London (the South-East, Surrey, Essex, Hertfordshire) benefiting.

But the biggest pickup in house buying interest over the last month has come in the North of England, the West Midlands and Northern Ireland (Chart 2).

There seems to be relatively little in the way of available houses to buy, judging by the RICS "average stocks per surveyor" measure; clearly this scarcity of housing supply is what is driving up prices once again (Chart 3).

Remember, UK housing is a lot cheaper for overseas investors now

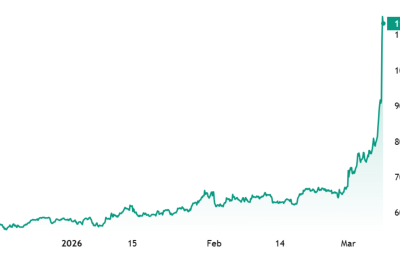

Of course, one factor that should not be ignored is currency: with the pound falling against both the US dollar and euro by 17-18% since the 23 June EU Referendum vote. (Chart 4) So for overseas investors, UK property suddenly looks a lot cheaper when judged in those currencies rather than good old sterling.

And borrowing money is becoming cheaper too

Money is also cheaper to borrow – HSBC is offering a three-year fixed-rate mortgage for 1.74% (with no fees, conditional on a 40% deposit) and a five-year fixed rate mortgage at 1.99% (no fees, 40% deposit again). For a really long-term fixed-rate, HSBC again offer a 10-year fixed rate at the same terms as the three and five-year fixed rate offers, but at 2.49%.

If you are after a variable-rate mortgage, the Coventry Building Society is offering a tracker mortgage with a current interest rate as low as 1.65% (if you are prepared to pay a £999 arrangement fee). The average lifetime tracker mortgage rate has fallen to as low as 2.38%, according to the Bank of England (Chart 5).

The value investor could look at estate agent companies

If this house price resurgence endures, then estate agents could finally be in for better times. Over 2016, listed estate agent shares have been frankly a terrible investment, with companies like Foxtons (UK code: FOXT) seeing share prices fall by up to 50% since January.

However, Foxtons would not be my favourite pick among listed estate agents, given its heavy emphasis on London. After all, it is rather the regions which are seeing a return of buying interest rather than the capital. So I would rather look to other estate agent chains with conveyancing and other additional property services to offer.

LSL Property Services (code LSL), the parent company for estate agent chains Reed & Rains and Your Move, is currently languishing some 90p below its 2016 price highs of 320p. LSL benefits from offering a wide range of property services including the management of lettings.

This is a market that has seen rapid growth in recent years off the back of the buy-to-let boom. LSL is valued very cheaply at only sevenx P/E and offers a solid income from dividends of 5.5%.

Countrywide (code: CWD) is another property services company similar to LSL that has seen its share price lose one-third from March 2016 highs, and today offers an even more juicy 7.9% income yield from dividends.

Thirdly, Winkworth (code WINK) is a smaller listed estate agent company that operates a franchise model, reducing the financial risk to the investor. This low-capital business model results in very high levels of profitability, a 31% operating margin and also a 31% return on equity. Winkworth also holds net cash rather than debt on its balance sheet, according to stockopedia.com data. And there is a 6.3% dividend yield for income-focused investors too...

Growth in property listing websites

Property listing websites are another potential beneficiary of a housing market pick-up. Rightmove (code RMV) and Zoopla (code ZPLA) remain the two dominant players in the UK. An amazing 47% of the UK population have used a property search website in the past 12 months, and some 2.6 million people admit to browsing Rightmove or Zoopla at least once per day!

Neither stock is particularly cheap, but this is only to be expected given their dominant market shares, their resulting high profitability and double-digit growth rates. These companies are then better-suited to growth rather than value-oriented investors.

© Copyright IBTimes 2025. All rights reserved.