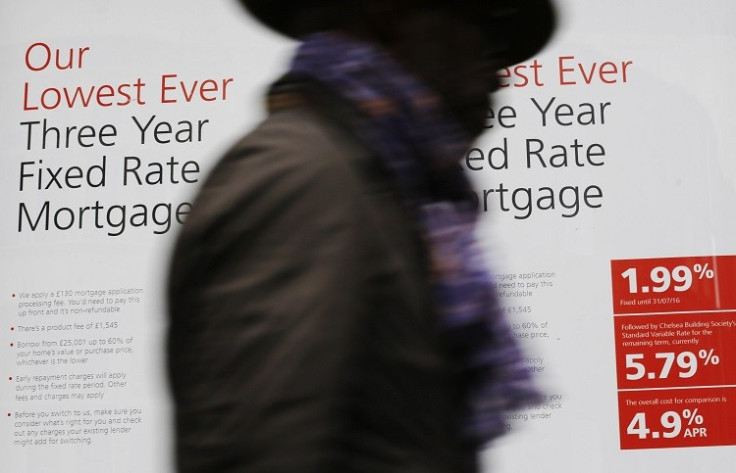

Mortgage Approvals Leap 31% Across Year - BBA

The spiralling number of mortgage approvals from UK banks stalled during July, but billions of pounds' worth of credit easing schemes have seen it leap 31% over the year.

Monthly figures compiled by the British Bankers Association (BBA) show a slight drop in the number of home loan approvals during July to 37,200, from June's 37,377. However, this is far ahead of July 2012's 28,400.

Both Help to Buy and Funding for Lending, two flagship schemes from the Treasury and Bank of England designed to loosen the grip on consumer credit, have lowered the barrier to entry for aspirant homeowners by bringing down interest rates and deposit requirements on residential mortgages.

"Mortgage activity has strengthened during 2013 with the help of government schemes, but high repayments and redemptions mean, however, that we are not seeing increases in net mortgage borrowing for the high street banks," said BBA Statistics Director David Dooks.

Help to Buy, which offers consumers an interest free equity loan worth up to 20% of a property's value as well as a government guarantee on mortgages for banks who pay a small fee, has been heavily criticised since it was unveiled by Chancellor George Osborne, with one City analyst calling it "moronic".

Osborne hopes Help to Buy will fuel enough demand in the mortgage market to catalyse a new wave of homebuilding by construction firms, but critics say there is little hope of this happening and the UK will instead inflate a new housing bubble.

There is a dearth in supply of new affordable homes. Current housing stock already falls well behind the needs of demand, so the rise in mortgage approvals is causing concern.

Fitch, the credit ratings agency, warned that banks and building firms will see their profits rise because of the increase in mortgages and higher house prices, but precious few new homes will likely be built.

Two of Britain's biggest housebuilders have reported soaring profits as Funding for Lending and Help to Buy push up house prices in London and the south east.

Persimmon reported a 38% rise in pre-tax profit during the sixth months to the end of June, while Bovis Homes said it saw a 50% jump in profit in its housing business in the same period.

© Copyright IBTimes 2025. All rights reserved.