UK tops list for property tax burdens as campaigners call for stamp duty to be abolished

TaxPayers' Alliance highlights cost of business rates, council tax and stamp duty in OECD table.

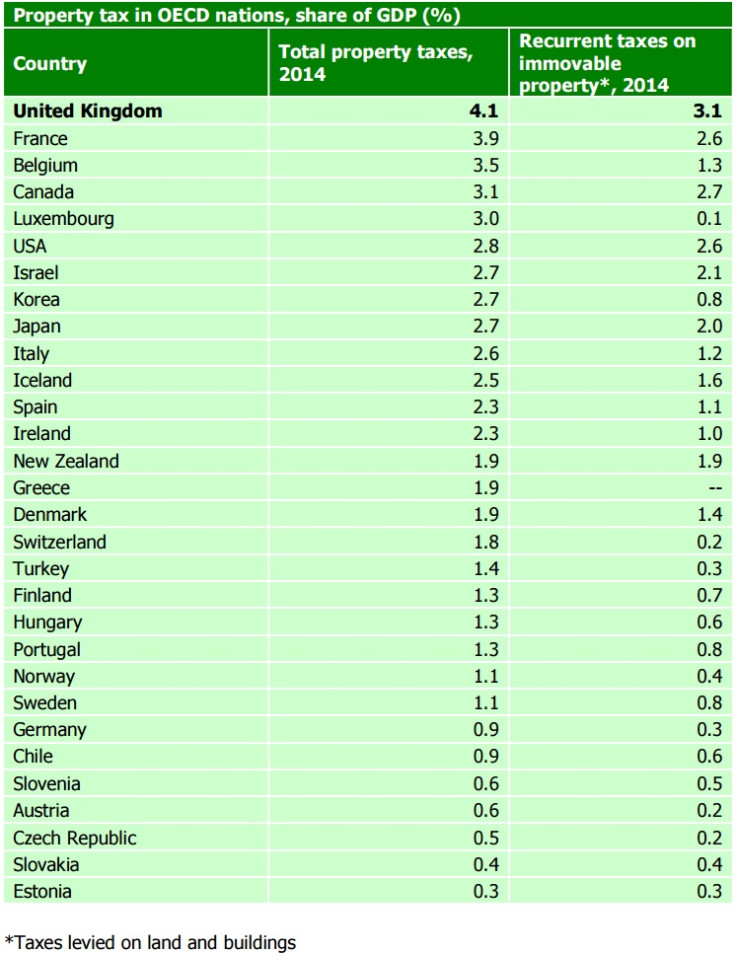

Britain has the highest property tax burden of all OECD countries, according to a report. The TaxPayers' Alliance, a campaign group for lower taxation, said the value of property taxes collected in 2014 was equivalent to 4.1% of GDP.

That placed it top of the list by the worldwide forum, the Organisation for Economic Co-operation and Development.

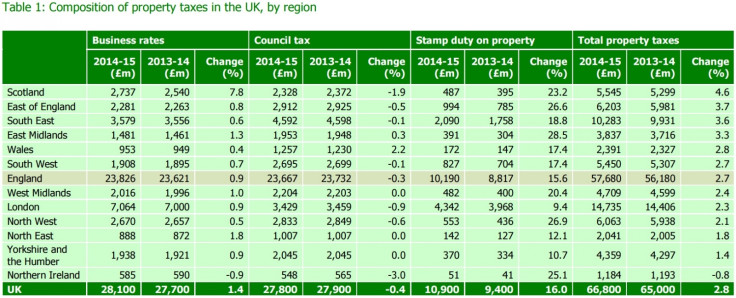

In the 2014-15 financial year, £66.8bn ($87bn) in property tax was collected, up 2.8% over the year.

In second place was France at 3.9% and third Belgium at 3.5%. Bottom was Estonia at 0.3%. The figure includes tax on property-linked shares and inheritance, as well as council tax, business rates and stamp duty. On a measure which only includes taxation on land and buildings, the UK also comes out on top of the OECD league at 3.1%. Canada is next place at 2.7%.

The Treasury has hiked some property taxes in recent years. At the end of 2014, it increased stamp duty on residential properties worth over £1.1m, though it slashed the tax for those below. It has since also increased stamp duty on more expensive commercial property.

But campaigners say high property taxes are barriers to homeownership — the rate of which has fallen in recent years — and business expansion. The TaxPayers' Alliance called for stamp duty to be slashed in half and eventually abolished. "We often hear about the impact of high property taxes on the overheated London housing market, but the truth is that they are a massive burden in every region of the UK," said Jonathan Isaby, chief executive of the TaxPayers' Alliance.

© Copyright IBTimes 2025. All rights reserved.