Volex Group Aims for Transformation; Added to Brokers' Buy List

Volex Group says its trading will be in line with current market expectations for the twelve months to April 1, 2012 despite increased global economic uncertainty, which resulted slow growth in Q3 FY 2012.

The board is confident that it will see continued revenue growth and margin progression in FY2013, aided by the investments made in the most recent quarter.

The optical interconnect solutions provider is scheduled to report its trading update on April 9, 2012 and has set a path to transform the company in the years ahead.

Volex is positioned to achieve higher quality single digit percentage revenue growth in FY2012 and improved gross margins, with the latter expected to exit next year at around 20 percent. Across the business it has been a challenging but rewarding and successful year, delivering sales growth while building profitability.

Trading in the third quarter of FY2012 remained robust against a backdrop of volatile and uncertain macro-economic conditions, with revenue in line with the same period last year. Year-to-date revenue for the 9 months to December was 9 percent ahead of the previous year.

Volex recognises the need to maintain its focus on continually improving the core performance of its business, in selling highly valued connection solutions, in building greater engineering expertise and in striving for excellence in its manufacturing and supply chain, all underpinned by an ongoing programme of internal improvements to people, systems and processes.

'The board recognises that further challenges lie ahead, not least as a result of the increasingly uncertain economic environment. The group has a clear strategy to improve the core performance of the business and consolidate the gains made in the last eighteen months. Despite current market turbulence, the board is confident that the progress made in generating a platform for sustained profitable growth will deliver trading for the twelve months ending 1 April 2012 in line with current market expectations," said Chairman Mike McTighe.

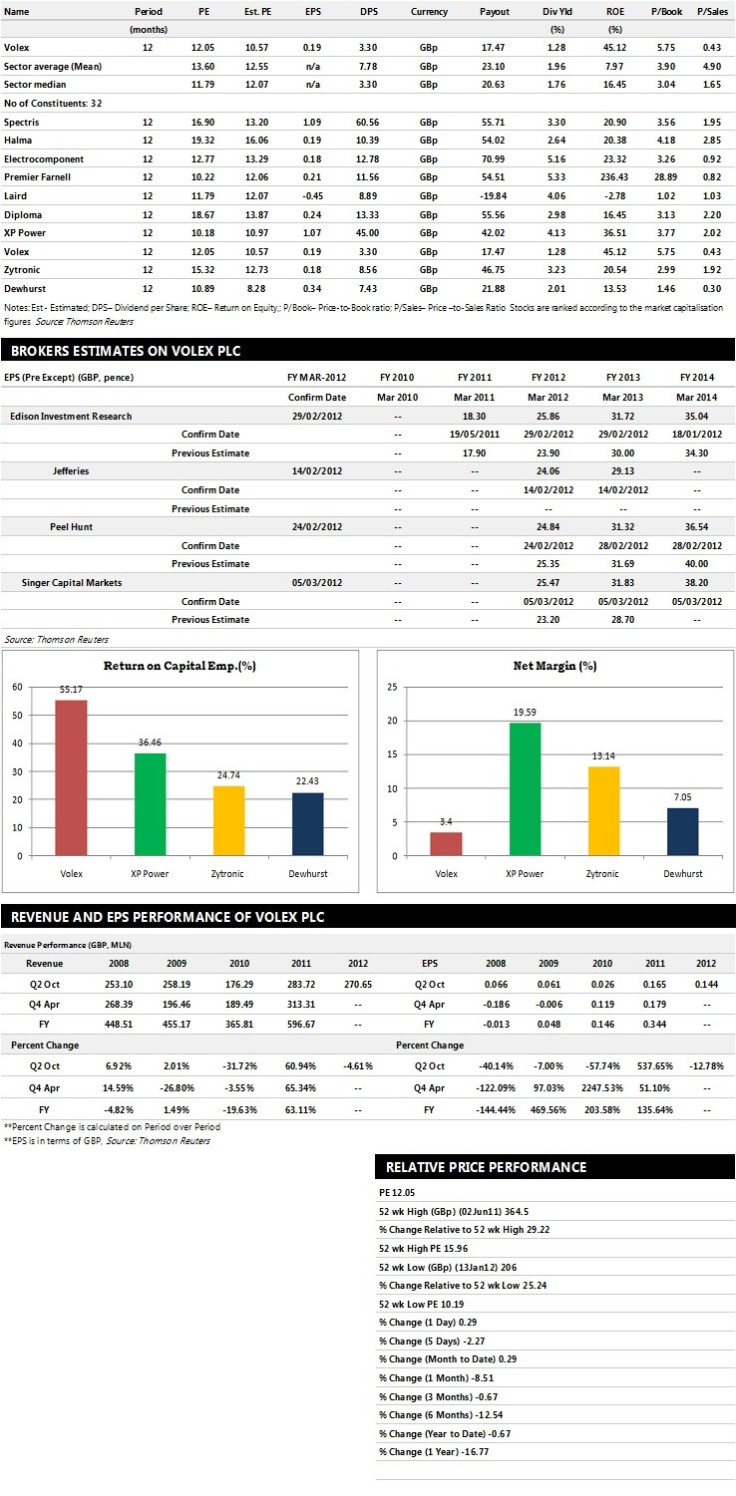

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

Brokers' Views:

- Singer Capital Markets recommends 'Buy' rating on the stock with a target price of 340 pence per share

- Peel Hunt recommends 'Buy' rating with a target price of 320 pence per share

- Charles Stanley assigns 'Buy' rating with a target price of 285 pence per share

- Investec Bank assigns 'Out Perform' rating with a target price of 315 pence per share

Earnings Outlook:

- Singer Capital Markets estimates the company to report revenues of £345.17 million and £356.90 million for the FY 2012 and FY 2013 respectively with pre-tax profits (pre-except) of £17.19 million and £21.49 million. Earnings per share are projected at 25.47 pence for FY 2012 and 31.83 pence for FY 2013.

- Edison Investment Research projects the company to record revenues of £339.96 million for the FY 2012 and £348.04 million for the FY 2013 with pre-tax profits (pre-except) of £17.47 million and £21.69 million respectively. Profit per share is estimated at 25.86 pence and 31.72 pence for the same periods.

- Peel Hunt expects Volex Group to earn revenues of £344.48 million for the FY 2012 and £368.62 million for the FY 2013 with pre-tax profits of £18.06 million and £22.83 million respectively. EPS is projected at 24.84 pence for FY 2012 and 31.32 pence for FY 2013.

© Copyright IBTimes 2025. All rights reserved.