Warner Bros. CEO Reveals Board Demands Bigger Takeover Offer — What's Next?

Warner Bros. Discovery pushes back on sale bids as board demands a premium valuation for its prized assets

Warner Bros. Discovery has confirmed it is open to a sale, but insiders say the board has rejected early takeover bids, insisting that none yet reflect the studio's full strategic value.

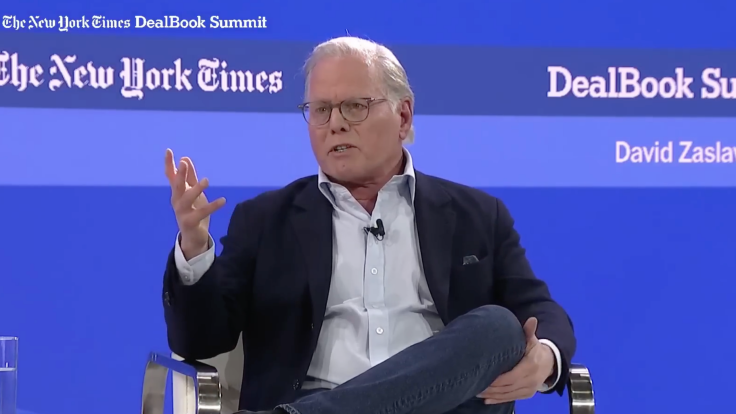

Chief Executive David Zaslav informed directors that the offers received so far undervalue key assets, such as HBO, CNN, and Warner Bros. Pictures, signalling that any potential buyer will need to pay significantly more to close the deal.

Board Rejects Initial Bids as Undervalued

According to reports from The Motley Fool, Warner Bros. Discovery has received unsolicited interest from several parties, including Paramount Global and Skydance Media.

However, the board has rejected these initial overtures, citing concerns that the offers do not reflect the full value of the company's assets and future growth potential.

The company's stock has surged by over 100% in recent weeks, buoyed by speculation surrounding a potential sale and investor optimism about a possible split of the business into two distinct entities—one focused on streaming and studios, and the other on global networks.

This strategic bifurcation, announced earlier this year, remains in motion and may impact how suitors value the business.

Key factors shaping the board's stance:

- Rapid share recovery driven by streaming and content growth.

- Ongoing split of the company into two entities — one for streaming and studios, another for international networks.

- Confidence that post-split valuations could attract larger, tech-backed bidders.

The board believes the company's long-term media portfolio is worth substantially more than current offers suggest.

CEO Signals Openness — But Not at Any Price

David Zaslav, speaking at the Allen & Co. Media and Technology Conference in Sun Valley, Idaho, reportedly told attendees that while Warner Bros.

Discovery is open to a sale, and the board is committed to securing a deal that reflects the company's long-term strategic value. The CEO is said to be wary of accepting a bid that undervalues key assets such as HBO, CNN, and the Warner Bros. film studio—all of which remain central to the company's brand and revenue streams.

Billionaire Bidders Circle the Deal

Several high-profile investors are reportedly exploring bids. Paramount'sDavid Ellison and Monumental Sports owner Ted Leonsis have both been linked to the talks. Analysts expect Apple, Amazon, and Comcast to monitor the proceedings closely.

The Allen & Co. event has long been the staging ground for major entertainment mergers, including past negotiations between Disney and NBCUniversal.

Potential suitors' goals:

- Gain access to Warner Bros. Discovery's premium IP catalogue.

- Expand global streaming dominance through HBO Max.

- Acquire valuable cable and news assets like CNN International.

With executives and investors gathered in one place, the pressure to strike a deal, or at least signal intent, is mounting.

What's Next for Warner Bros. Discovery?

While the company has not set a formal deadline for accepting offers, analysts expect the next few weeks to be critical. Any deal would likely require regulatory scrutiny, especially given the scale and influence of Warner Bros. Discovery's holdings across film, television, and streaming.

In the meantime, the company continues to pursue its split into two separate entities, a move that could make it more attractive to buyers seeking focused assets. The streaming and studios division, anchored by HBO Max and Warner Bros. Pictures, is expected to draw the most interest. At the same time, the global networks unit may appeal to buyers looking for international reach.

For shareholders and industry observers, the key question remains: will Warner Bros. Discovery secure a blockbuster deal, or will the board's demands stall negotiations?

With multiple billionaires circling, regulatory challenges ahead, and a board unwilling to settle for less, Warner Bros. Discovery's sale talks may shape the next phase of Hollywood consolidation.

The industry now waits to see who will meet the board's price, and what that price truly is.

© Copyright IBTimes 2025. All rights reserved.