Weak Chinese Trade Data Hits Stocks and Knocks Commodities

Global equities suffered and commodities including copper and crude dropped, as unexpectedly weak Chinese trade data upset investors already tense over the ongoing standoff in Ukraine.

The Stoxx Europe 600 was trading 0.22% lower against a backdrop of downbeat Chinese export numbers and general global uncertainty.

Merger activity in France spurred the CAC 40 but mining firms sensitive to China's demand for raw materials weighed on the UK's FTSE 100. Elsewhere, German firms' exposure to Russia saw the Dax underperform again.

Data from China showed that exports surprisingly dropped 18% year-on-year in February, swinging the trade balance into deficit, triggering fears of a slowdown in the world's second-largest economy. Market players in Asia exercised caution.

Copper and Crude

Chinese data pulled three-month copper on the London Metal Exchange down 1.7% to $6,663.75 a metric ton (7345.5 tons). It earlier slid to $6,608 a ton, its weakest since June 2013, when it stopped at $6,602, the lowest since July 2010, reported Reuters.

Chinese data also forced Brent and US crude down 84 cents and $1.25 to $108.15 and $101.31 a barrel respectively, ending two consecutive days of gains. Geopolitical tensions in Ukraine and Libya contained the falls.

Meanwhile, spot gold shed 0.4% to $1,334.50 an ounce at 10:35GMT, while US gold futures for delivery in April dropped $3.20 an ounce to $1,335.00.

"The Chinese export numbers are the main driver this morning - you can see that the Aussie and Canadian dollars are both under pressure," Alvin Tan, strategist with French bank Societe Generale in London told Reuters.

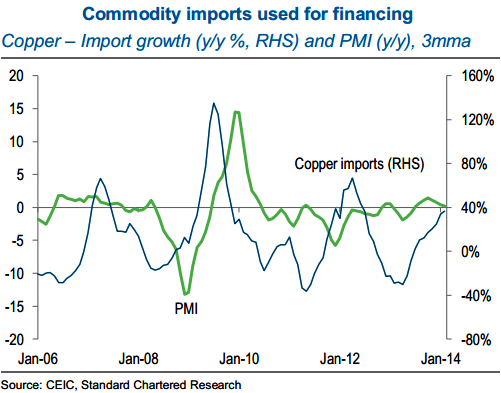

Standard Chartered said in a note to clients: "We believe China's official import data is partly inflated by commodity-financing activity. There is a sharp difference between strong imports of copper and China's moderating PMI over the past three months.

"This divergence is explained by trading companies importing copper (and some other commodities such as iron ore and coal) using letters of credit (LCs) issued by onshore banks."

"The commodities may then be sold in the domestic market (with the proceeds lent in the informal credit markets) or used as collateral to borrow more bank funding," Standard Chartered added.

Barclays Capital said in a note to clients: "We expect the China's trade balance to turn positive in the coming months although the monthly surplus will come down from the average of $30bn in Q4 2013 (Jan-Feb: 4.4bn, Q1 2013: 14bn), as 'hot money' inflows disguised in the trade flows being are squeezed out.

"Overall, we expect continued trade and current account surplus and net inflows under the capital account with the latter being controlled by the PBoC with its capital account opening measures. We believe this should support a modest appreciation of the CNY against the USD although at a slower pace than the 2.8% in 2013."

Standard Chartered said in a separate note: "We maintain our China's GDP growth forecast for 2014 unchanged at 7.4%. Q1 GDP is likely to come in at 7.6%. Premier Li has made it clear that some economic growth is necessary for carrying out reforms and that Beijing will support growth when needed, but mentioned that the trade data was not so bad as to trigger a shift in policy."

"The ongoing situation in Ukraine will put a high floor on oil prices and lead to more volatility," Victor Shum, vice president of energy consultancy IHS Energy Insight told the news agency.

In Asia

Earlier, MSCI's broadest index of Asia-Pacific shares outside Japan posted its biggest fall in over four weeks, losing 1.4%.

The Shenzhen Composite index lost 3.47% while the Shanghai Composite lost 2.86%. Hong Kong's Hang Seng finished 1.76% lower while Japan's Nikkei share average lost 1%, as downbeat Japanese GDP data added to investors' woes.

© Copyright IBTimes 2025. All rights reserved.