Why User Experience is Vital for Neobank Adoption

In an interview with Dmytro Dubilet, the founder of Fintech Farm, we delved into the crucial role that user experience plays in adopting neobanks.

Dubilet, a seasoned professional in the fintech industry, sheds light on why a design-centric approach is pivotal for the success of neobanks.

Dubilet, a seasoned professional in the fintech industry, sheds light on why a design-centric approach is pivotal for the success of neobanks.

The Essence of Design in Neo Banking

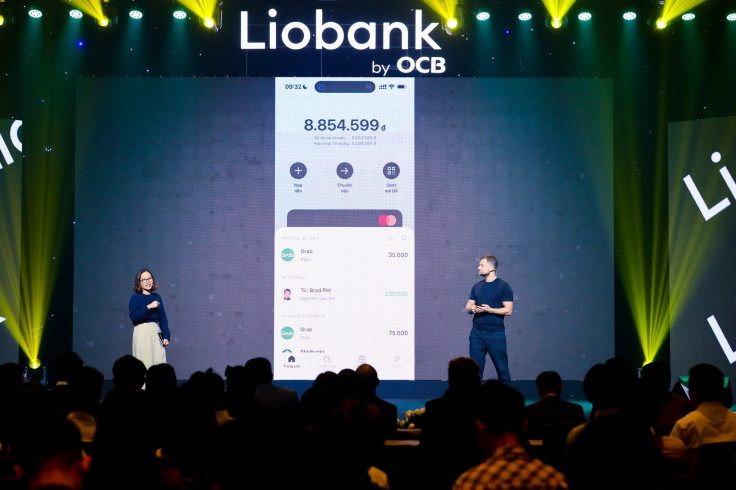

When discussing design as a competitive edge, Dubilet emphasizes the significance of a neobank's app design. In a narrow sense, it has become the primary means of communication for mobile-only banks.

With no physical branches, the app serves as the interface through which users interact with their financial institutions. Dubilet points out, "It's absolutely crucial for neo banks to design their app screens properly."

This underscores the fundamental importance of a seamless and user-friendly interface in capturing and retaining users.

The design philosophy varies among neobanks. While some opt for the trend of super apps, cramming multiple functions into a single interface, others, like Fintech Farm, take a different route.

With 98% of UK adults now owning smartphones, digital convenience has become a minimum requirement for any consumer-facing brand.

And, neobanks who prioritize user-centric design have an automatic edge in attracting seamless banking relationships.

Users drawn in by the design are more open to personalized insights, instant transfers, and modern budgeting tools unavailable from most banks.

Dubilet notes that they steer away from the super app concept, focusing on simplicity and transparency. "We want to make it sleek, simple, transparent, really easy to use," he states.

In a landscape where complexity can overwhelm users, the emphasis on simplicity becomes a distinguishing factor.

Focus on Core Banking Experiences

The super app trend, while popular, sometimes translates into enhanced user experience.

Dubilet cautions against the pitfalls of overloaded apps, highlighting neo banks' challenges in delivering great design amidst the pressure to conform to the super app model.

The struggle lies in creating an app that not only offers a multitude of features but also remains easy to navigate and use.

In pursuing innovation, neobanks must strike a delicate balance between functionality and user-friendly design.

Beyond Interface: The Broader Design Perspective

Moving beyond the narrow confines of app interface design, Dubilet emphasizes the need for a broader analysis of every touchpoint with customers. In this sense, design encompasses every interaction between the neobank and its users.

"It's absolutely crucial for any business to do a complete analysis of every touch point with your customer," Dubilet remarks. This holistic approach ensures that the entire customer journey, from onboarding to ongoing interactions, is optimized for a positive and seamless experience.

Traditional banks, often criticized for lacking user-friendliness, present an opportunity for neobanks to do better. Dubilet points out that the legacy banking system's inherent legopoly, with limited competition due to a scarcity of banking licenses, results in less inclination to prioritize legendary customer experiences.

This opens a strategic window for neobanks to differentiate themselves by offering unparalleled user-centric services.

Simplicity Could Lead to Growth

Some may assume the path to success involves packing apps full of new features.

However, Dubilet argues restraint and simplicity are smarter. "Neobanks could actually make their design to be sleek and only include essential functionality," he says. "That creates a transparent, easy-to-use experience customers really want."

So, rather than inflating complexity, neobanks should simplify banking to its core utilities. Eliminating clutter and confusion ultimately reduces friction for time-starved users, thereby driving growth.

Overcoming Legacy Challenges

Dubilet acknowledges the challenges neobanks face in an industry where user-friendly practices are different fromdifferent from the norm. Traditional banks, accustomed to a legopoly, may need to invest more in enhancing customer touchpoints.

This creates a niche for neobanks to thrive by prioritizing design and user experience. In doing so, neobanks can attract users who seek a departure from the cumbersome processes associated with legacy banking institutions.

In conclusion, Dmytro Dubilet's insights underline the imperative for neobanks to prioritize user experience, transcending mere interface design.

By adopting a design-centric approach that values simplicity, transparency, and holistic customer interaction analysis, neobanks can position themselves as leaders in a market hungry for innovation.

The future of banking lies in the hands of those who can seamlessly marry technological prowess with user-centric design, and neobanks are poised to be the torchbearers of this evolution.

The future of banking lies in the hands of those who can seamlessly marry technological prowess with user-centric design and neobanks are poised to be the torchbearers of this evolution.

© Copyright IBTimes 2025. All rights reserved.