WPP Keen On Digital Revenues, Expects Improved Margins

WPP Preliminary Earnings Preview

Despite challenging economic environment, WPP, the communications services provider continues to focus on its long-term plans and strategic goals of improving operating profits by 10-15 percent per annum.

Numis Securities and ING FM have assigned a 'Buy' and 'Hold' ratings ahead of the preliminary results of the company on1 March 2012.

WPP expects to improve operating margins by half to one margin point per annum or more depending on revenue growth, improving staff cost to revenue or gross margin ratios by 0.6 margin points per annum or more depending on revenue or gross margin growth.

The Group has now increased its previous targets of one-third of revenues coming from Asia Pacific, Latin America, Africa and the Middle East and Central and Eastern Europe and services sectors to 35 to 40 percent of total revenues which is currently estimated at $16 billion.

Given these market trends, its strategic concentration is now centred, not only on strategic planning, creative execution and distribution, but on the application of technology and analysis of data, to the benefit of its clients and people. WPP expects its new strategy to place the Group in good stead in fast growing economic challenges.

Last month WPP's wholly-owned subsidiary, Shalmor Avnon Amichay Advertising, part of Y&R Advertising, acquired 75 percent stake in Union Media Israel, a leading media investment management agency in Israel.

The Group subsidiary JWT, has also acquired 51 percent of the shares in the capital of a newly incorporated Jordanian company which will acquire the assets of IDEA, a full service marketing communications company in Amman, Jordan, which has been JWT's affiliate for the past 7 years.

The Group has also agreed to buy 41?29! Media Internet, an independent digital communications agency based in Istanbul. This investment continues WPP's strategy of developing its services in fast-growing and important markets and sectors and strengthening its capabilities in digital media.

WPP's digital revenues are estimated at US$4.5 billion and almost 30 percent of its projected US$16 billion revenue. It has set a target of 35-40 percent of revenue derived from digital in the next five years.

Brokers' Views:

- Numis Securities gives 'Buy' rating on the stock with a target price of 901 pence per share

- ING FM assigns 'Hold ' rating on the stock with a target price of 825 pence per share

- Charles Stanley recommends 'Accumulate' rating on the stock with a target price of 858 pence per share

- CA Cheuvreux recommends 'Outperform' rating on the stock with a target price of 810 pence per share.

Earnings Outlook:

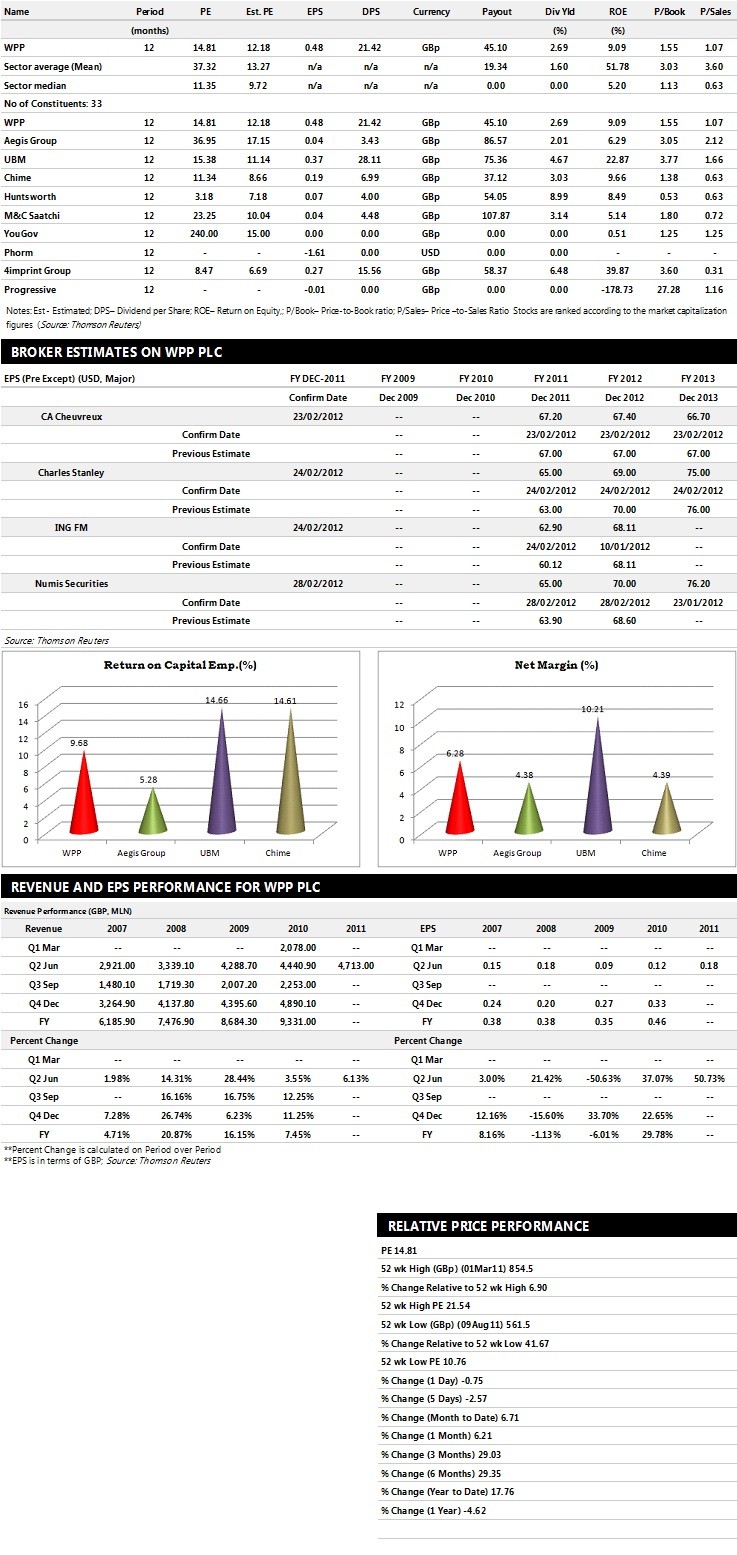

- Numis Securities estimates the company to report revenues of £10,002.00 million and £10,419.00 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £1,190.00 million and £1,290.00 million. Profit per share is projected at 65.00 pence for FY 2011 and 70.00 Pence for FY 2012.

- ING FM estimates the company to post revenues of £9,955.00 million and £10,171.00 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £1,098.00 million and £1,231.00 million. EPS is estimated at 62.90 pence for FY 2011 and 68.11 pence for FY 2012.

- Charles Stanley expects the company to earn revenues of £9,850.00 million for the FY 2011 and £10,200.00 million for the FY 2012 respectively with pre-tax profits of £1,160.00 million and £1,280.00 million for the same periods. Earnings per share is projected at 65.00 pence for the FY 2011 and 69.00 pence for the FY 2012.

Below is the summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector.The table below represents top ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.