Bank and Fintech collaboration – three drivers for growth in 2018

Simon Paris, Deputy CEO, Finastra, looks at open banking, digital transformation and robotization.

"I want it and I want it now" ... not the words of a petulant child, but rather the expectation of ever more demanding banking customers. Both retail and corporate banking clients have upped their demands in today's 24x7 digital world. But banks are often failing to deliver against expectations – to join the dots and provide the tailored, joined-up services customers want.

To meet such needs, we can expect to see greater levels of cooperation between banks and Fintechs than ever before. Indeed, PwC's Global Fintech Report 2017 states that some 82% of financial services incumbents plan to increase their collaboration with Fintech companies over the next three to five years.

I believe three key factors are driving increased collaboration between banks and Fintechs in 2018:

- Open banking – allowing customers to share their data and interact securely with approved third-party service providers

- Digital transformation – building a platform-based approach that supports agile development and increased cooperation and co-innovation

- Robotization – the rise of AI, machine learning and robotics, underpinning the 'fourth industrial revolution'

Open Banking

Opening up the bank to the outside world offers the potential to ignite innovation from an open ecosystem of Fintech and other players, including existing software providers – driving efforts to exceed customer and employee expectations. PSD2 doesn't just open up account and payment information, it creates opportunities to offer the customer a frictionless journey. Take mortgages, for example – in a world of open banking, the customer won't just be looking to apply for a mortgage but to be guided seamlessly along the entire house-buying journey.

In such a fast-moving landscape, it's unrealistic for banks to think they can continue doing it all themselves. Those that recognize the value in offering their customers integrated access to the very best new apps on the market (while still acting as the main customer touchpoint) will fare better than those that remain focused on developing their own proprietary offerings.

In its latest report on The Future of Fintech and Banking, Accenture asserts that open innovation is at the heart of the digital revolution. It defines this as engaging with external technology solutions, knowledge capital and resources, and often opening up the organization's own intellectual property, assets and expertise to outside innovators to help generate new ideas, change organizational culture, identify and attract new skills, and discover new areas for growth

Digital transformation

Of course, for many incumbent banks, adapting to a new world of open banking is made more difficult by their continued reliance on legacy systems and the need to deploy workarounds. Such obstacles are no longer insurmountable.

Adopting an open platform-based approach means that banks can continue to progress legacy and ecosystem transformation initiatives incrementally, embrace innovation, and evolve with the agility to meet ever changing customer demands.

The pace of change is such that any hopes of continually "ripping and replacing" technology to achieve revolutionary outcomes are founded on quicksand. Modern approaches and capabilities such as Agile, APIs and micro-services will allow for a more evolutionary approach to leveraging and deploying innovation.

By facilitating secure access to development platforms through open standards, banks can offer whole new capabilities. These include: enabling third-party Fintechs to develop apps on a secure platform; supporting corporate customers in developing their own apps; and encouraging the bank's own in-house IT staff to contribute development ideas and accelerate innovation.

Robotization

Artificial intelligence and robotics is the third key driver for change. It's an area that banks can't possibly ignore given its potential to fundamentally change the way the industry works. To capitalize on what is being dubbed the "fourth industrial revolution", banks will need to collaborate and bring in third-party expertise.

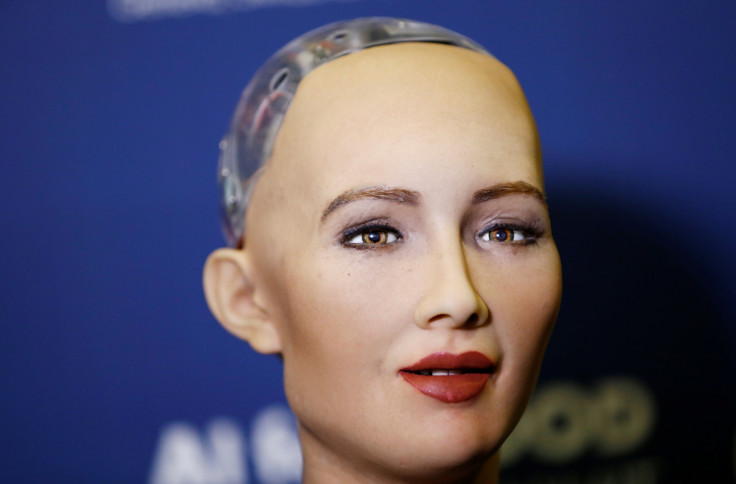

We are already seeing chatter around facial recognition technology, ever more natural language, written or verbal, interactions with 'bots', more biometric authentication and daily predictions around how AI and machine learning technologies will shape the banks of tomorrow (right, Alexa?). Robot bank clerks that exude empathy are already here, and it won't be long before customers have their own personal bank manager at home, who interacts directly with the bank via a chatbot or personal assistant. Banks must be ready to capitalize on these changes and work with Fintechs and specialist technology providers to incorporate the best technology in their customer offerings.

While in the past banks were perhaps skeptical of the long-term viability of Fintech firms, there's now a great deal of mutual respect – particularly as Fintechs increasingly partner with industry-specific global software houses. All sides of this "triangle" recognize that the other party has something valuable to offer and that they are better together. The Fintechs can deliver greater agility, innovation, simplicity and modern customer experience initiatives – while the banks bring experience, credibility, trust and an established customer base – and the existing software houses bring global distribution, support and technology expertise.

Open banking, digital transformation and artificial intelligence are all key drivers for change in ushering in a new era of increased collaboration and connectivity between banks and Fintechs this year. Combining their expertise, all parties can achieve mutual success – and at the same time start to transform the banking landscape with a renewed focus on delivering great banking experiences.