BBA Aviation FY Earnings Preview

BBA Aviation, the provider of global aviation support and aftermarket services, expects to deliver positive underlying progress achieving a full year result in line with the board's expectations. The group is scheduled to report its final results for the year ending on 31 December, 2011 on 2 March, 2012.

The group's Business and General Aviation (B&GA) activity has shown a modest development to date in the second half of the year, against a tough economic environment. As anticipated, the group is performing well in this ongoing uncertain economic environment. It has a well-built pipeline of investment and acquisition opportunities and continues to expect solid growth.

BBA Aviation has decided to change the company's presentation currency from sterling to US dollars, which will be effective from 2 March, 2012, with the preliminary results for the year ending 31 December, 2011.

Recently, the group's Signature Flight Support division acquired Azalea Aviation in Mobile, Alabama for an initial consideration of $22.0m with further payments of up to $5.30 million over a 5 year period. It has also acquired 95 per cent of Arrindell Aviation Services in St Maarten, Caribbean for a cash consideration of $7.80 million.

Signature agreed to acquire Avitat Boca Raton, a fixed base operation at Boca Raton Airport, Florida in July 2011, for a cash consideration of $21.00 million on a debt and cash-free basis. In addition, it has completed the acquisition of Tropical Aviation Corporation in San Juan for a cash consideration of $3.00 million. Signature has sold Spirit of St. Louis FBO to TAC Air and also sold its maintenance centre in Missouri for a cash consideration of $3.25m.

In the first half of the year, BBA Aviation has completed its acquisition of GE Aviation Systems' legacy fuel measurement business for a cash consideration of $62.5m on a cash and debt free basis, in addition to a further investment of approximately $7.0m in working capital and fixed assets.

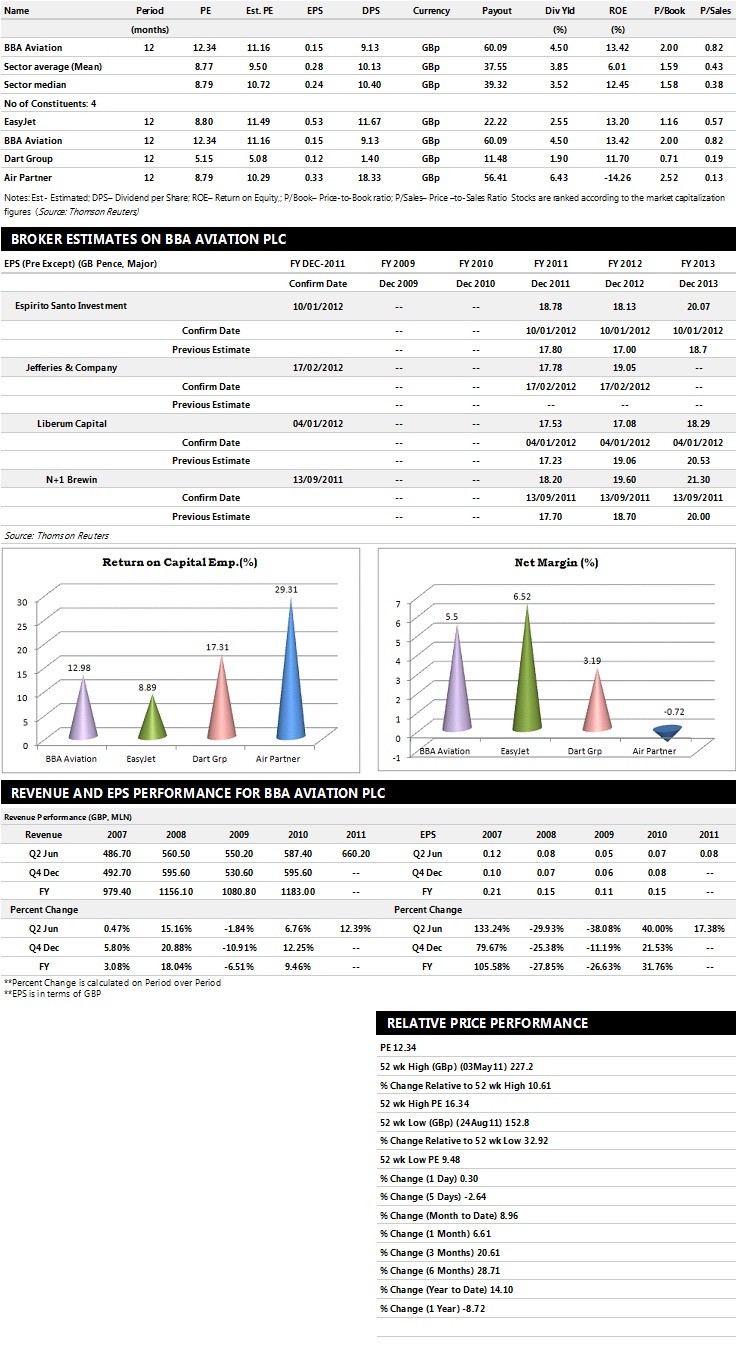

Brokers' Views:

- N+1 Brewin gives 'Hold' rating on the stock.

- Liberum Capital assigns 'Hold ' rating on the stock.

- Espirito Santo Investment Bank recommends 'Buy' rating on the stock with a target price of 230 pence.

- Jefferies & Co recommends 'Buy' rating on the stock with a target price of 250 pence per share.

Earnings Outlook:

- N+1 Brewin estimates the company to report revenues of £1,306.64 million and £1,333.34 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £108.14 million and £111.32 million. Profit per share is projected at 18.20 pence for FY 2011 and 19.60 Pence for FY 2012.

- Liberum Capital expects the group to post revenues of £1,362.96 million and £1,385.21 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £107.67 million and £109.52 million. EPS is estimated at 17.53 pence for FY 2011 and 17.07 pence for FY 2012.

- Espirito Santo Investment Bank projects that BBA to record revenues of £1,335.60 million for the FY 2011 and £1,395.88 million for the FY 2012 respectively with pre-tax profits of £110.06 million and £112.65 million for the same periods. Profit earnings per share is projected at 18.78 pence for the FY 2011 and 18.13 pence for the FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents top four companies based on market capitalisation:

© Copyright IBTimes 2025. All rights reserved.