Beyond Bitcoin: Trading cryptocurrency today

FBG Capital has developed and implemented a systematic framework for evaluating altcoins and tokens.

Traditional financial markets have historically focused on the crown jewel of cryptocurrency: bitcoin. However, the record number of Initial Coin Offerings (ICO) launched in 2017 has spurred a skyrocketing secondary market, which has a total trading volume that overshadows even that of bitcoin by 88 percent. In the advent of this thriving market, the sheer volume of blockchain projects poses challenges to traders to understand the dynamics of different altcoins/tokens and their prices. At the forefront of this new era of crypto trading, FBG Capital has extensively researched multiple projects to develop and implement a novel, systematic framework for analyzing and trading altcoins/tokens with the objective of long-term price appreciation and volatility minimization.

Today, the entire world intently follows bitcoin trading, cheering at the peaks and weeping at the dips of price volatility, but few traditional financial market practitioners have realized that altcoin and token trading (tokens that are utilized by individual blockchain projects) is a much larger market, with innovation and new price dynamics emerging every day. 2017 was an epic year for bitcoin price, with growth fueled by the introduction of futures in the world's largest and most heavily regulated derivatives exchanges, CME and CBOE. As explained by leading CME economists, bitcoin exhibits intrinsically mixed features of an equity, currency, and commodity. For traditional financial markets that are only just starting to acknowledge bitcoin as a legitimate asset class, understanding, trading, and meeting the demand for bitcoin exposure from enthusiastic but uneducated investors is a daunting task.

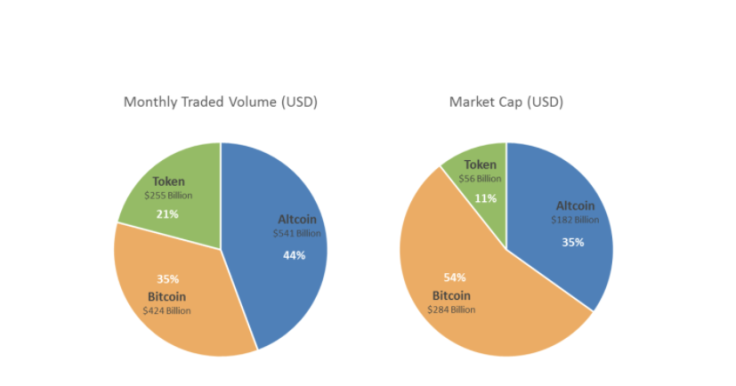

Unfortunately, merely surviving is not enough in this new era of cryptocurrency trading. For the first time ever, Wall Street is late in the game. There exists today a $182 billion USD altcoin market and a $284 billion token market financed by a few visionary crypto funds and buoyed by a large and growing community of blockchain embracers. As shown in Figure 1, altcoins and tokens are traded more actively than bitcoin, contributing to 65 percent of daily trading volume and comprising 46 percent of total market capitalization.

Figure 1: Cryptocurrency Traded Volume and Market Cap.

Knowledge Gap

While project teams are passionate, working on changing the world, and backed by a community firm in their belief of each innovative idea, the reality is that few stakeholders truly understand trading dynamics and the critical link between altcoin/token valuation and the success of each blockchain project.

The new breed of traders entering the crypto market come with a variety of backgrounds. Though they share the same underlying belief in the potential of blockchain technology, their methodology for research and trading differs considerably by individual and by team. Technologists tend to focus on the blockchain 'features' of each project for altcoin/token valuation including consensus protocol, transaction speed, code robustness, and development timeline. Retail investors often rely on unregulated media and social network channels to sense the sentiment of each altcoin/token. The list goes on.

As avid observers and participants in the introduction of hundreds of new altcoins and tokens, FBG Capital has developed and implemented a systematic framework for evaluating altcoins and tokens. Using the approach below, we offer advisory services to project teams, ranging from exchange listing strategies to managing volatility in order to support project community with healthy and long-term growth.

FBG Capital focuses its altcoin and token analyses on the following areas:

1) Blockchain relevance

First and foremost, it's important to consider if the project is truly a blockchain project. Currently, ICO projects can be broadly categorized into three categories:

A) Blockchain infrastructure projects that aim to advance the distributed ledger technology itself

Altcoins and tokens like this have tremendous upside and are typically difficult to put a price cap on. Unfortunately, they also exhibit greater volatility with a possibility of dropping significantly in value. Most altcoins fall into this category.

B) Industry-specific projects intended to disrupt existing industry market dynamics

Most existing ICOs fall into this category. They are relatively easier to evaluate but their adoption by current industry stakeholders will play a key role in their valuation.

C) Pseudo-blockchain projects claiming to utilize the 'blockchain' while only leveraging ICOs as a financing technique

Trading these tokens would naturally be challenging.

As we review each project, we define different macro-strategies for the first two categories and stay away from the scammers.

2) Fundamental Analysis

Evaluating the project team is critical, but extremely subjective. The project team's long-term plan, team member diversity, and even their personal goals have a substantial impact on altcoin/token circulation, as they are usually the larger holders in a distributed ecosystem. Some key facts we typically try to understand about the project team are:

- Development timeline and major milestones

- Future plan for the project team's personal token holdings

- Founder's view of the blockchain project and how it disrupts existing markets or creates new markets

- Trading and asset management expertise among the project team

3) Community activities and sentiment

For each project, and for successful projects in particular, an active community that shares the same beliefs and invests time and capital into the ecosystem plays a pivotal role in the price of each token. There are various social media channels each project team forms and cultivates, including Telegram, Facebook, Twitter, WhatsApp, Weibo, and WeChat.

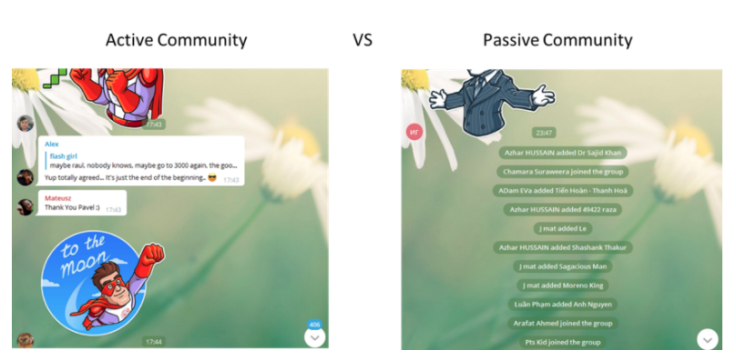

FBG Capital carefully analyzes the engagement and semantics of the chat logs, as well as responses to major announcements and price volatility in order to determine the current sentiment of each community. We found that the correlation is extremely high between positive sentiment in the community and a long-term (relative in crypto world) price appreciation. We also provide this analysis as part of our advisory services to the project team in order to manage expectations and foster a supportive community. Syntax analysis and natural language processing algorithms are applied to provide a rough estimate but certain discretion has to be allowed in our analysis using judgements. As illustrated in figure 2, active communities typically present high expectations for value growth and active discussions, while passive communities remain unresponsive.

Figure 2: Telegram Community Sentiment

4) Technical Analysis and AI-based trading engine

By the time we have completed the assessments outlined in the above three steps, the FBG Capital team usually has a nuanced understanding of the fair market value or long-term price target. We would then apply further technical analysis to validate the current overall market sentiment. The technical analysis methodology is not significantly different from other assets classes, but does have to be tailored to higher volatility and strong correlation to bitcoin and ether prices.

As we quantify the blockchain relevance, project team robustness, and real-time community activity into price signals, our Artificial Intelligence (AI) trading engine will interpret these signals for trading. Our goal aligns with the project team, which aims for long-term altcoin/token price appreciation while minimizing price volatility. The above signals equip our AI trading engine with leading indicators in preparation to manage volatility.

Very few traditional stock, currency, and commodity analysis techniques apply in this new market. But that doesn't mean that no methodology exists. As the leader in this market and disrupter to the traditional capital market trading, FBG Capital feels obligated to invalidate critiques that altcoin/token prices swing for "no reason". In fact, each altcoin/token is vastly different from each other, and each project comes with a set of metrics that can be assessed and used to support the progress of their associated ecosystems. As blockchain develops and becomes more established as a foundational feature in a growing number of industries, we hope that the above approach marks the beginning of the voyage toward trading this new altcoin/token market in a systematic way.

By Bo Dong, Partner, FBG Capital, and Ricky Li, Director of Trading, FBG Capital