Bitcoin is not dead - it's making new highs

Bitcoin has been pronounced dead almost 100 times by news outlet after news outlet. Year after year, we find articles from notable news outlets such as The Washington Post, The Guardian, Forbes, and even a former bitcoin developer concluding that bitcoin is dead and that it is time to move on. Yet it's still here.

We, at XBT Provider, believe that the price of bitcoin is suppressed and that we are soon going to see an upward correction in the price that could break the previous highs of over $1,000 per bitcoin. We do not share the general view in mainstream media that bitcoin is soon forgotten, but instead, we believe that it will be an integral part of our financial lives, just like the internet is today.

Permissioned blockchains will not outcompete bitcoin

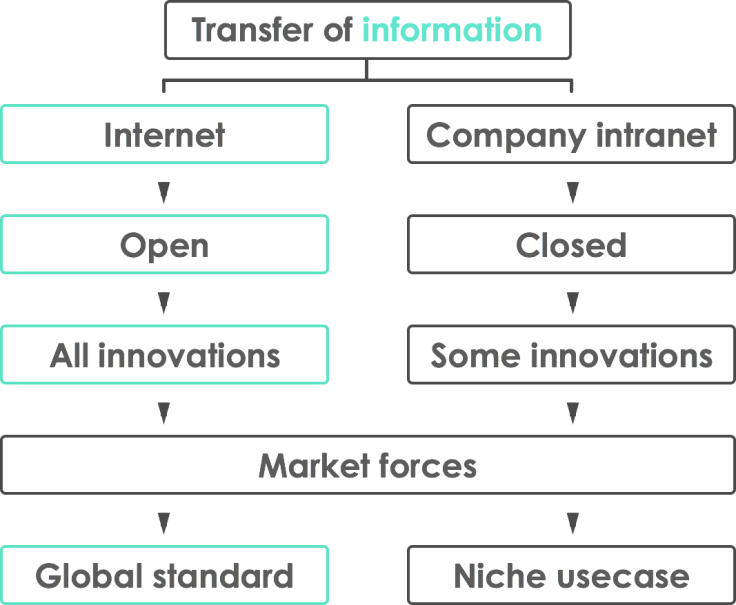

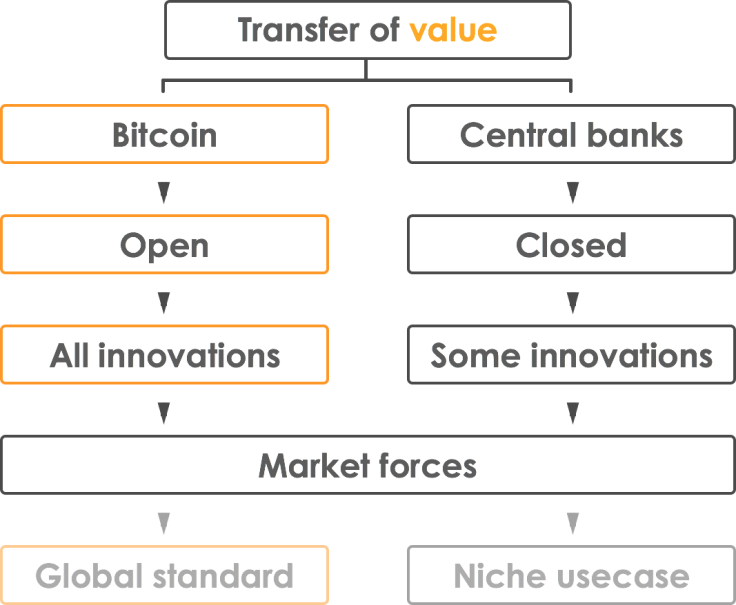

Open platforms, like bitcoin or the internet are all heavily dependent on network effects to gain traction. As an example, we can compare the development of the open internet in comparison to closed company versions of it.

While the internet was not the only protocol being developed for sending information, it won over similar centralized solutions because of its open characteristics which in the end led to faster innovation.

We believe that bitcoin is at a similar stage as the internet in the 1990s. We are seeing multiple centralized blockchain solutions being developed by companies, similar to what was promised about the internet. However, looking at the internet as a roadmap of what will come, we have a firm belief that bitcoin will become the dominating blockchain for the transfer of value in the not too distant future.

Bitcoin will remain the dominant cryptocurrency

The Bitcoin blockchain is not the only blockchain, and there are many blockchains in which people see potential. Hundreds of different blockchains have been developed, and hundreds have died due to lack of demand.

Some, like Ethereum, promises more bells and whistles than the Bitcoin blockchain, but to date, the Bitcoin blockchain has the highest number of users, the highest amount of investment in its ecosystem and the highest amount of resources securing its network by orders of magnitude.

Network effects are hard to get but even harder to overcome by competitors once they are starting to take form. We believe that if adoption of blockchain technology happens further, it will mainly happen by the adoption of the bitcoin blockchain while other blockchains might become niche use-cases at best.

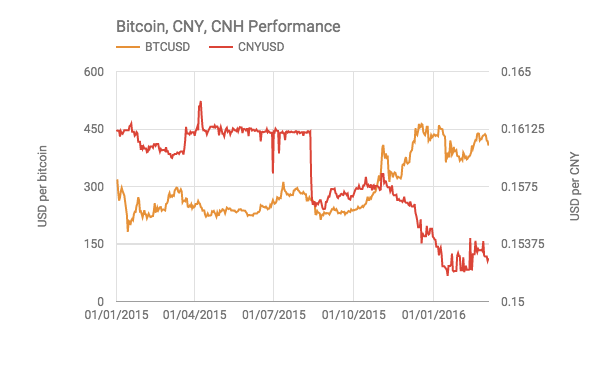

Chinese currency will devalue further

The Chinese Renminbi (also known as Yuan) have been devalued in the last months, as a consequence of inadequate performance from the Chinese economy. This has led to many investors taking bets against the Chinese Yuan expecting the People's Bank of China to be forced to devalue their currency against the USD further. If current trends continue, we expect to see a positive effect on the bitcoin price since bitcoin, and the Yuan is negatively correlated.

Capital controls

On top of this, China is seeing more and more capital fleeing China in anticipation of further Yuan devaluation. More and more Chinese investors are moving their assets out of the country as fast as they are allowed, and often in ways that are illegal, to make sure that they retain their wealth.

Since bitcoin's primary function is as a store of value and as a value transfer network that functions outside of any regulatory framework, we can anticipate a surge in their demand from Chinese investors if capital controls increase further.

Accessible for institutional investors

Since bitcoin is a new type of asset, and newer still within the regulated financial markets, we have not yet seen significant financial players taking a large position yet. This has mainly been due to the lack of bitcoin backed financial instruments and due to lack of regulatory clarity.

This is rapidly changing in the favour of more regulated bitcoin investments where we have seen US, EU and now Japan clarifying their stance on bitcoin and how it should be treated from the perspective of investors.

Additionally, regulated instruments tracking the price of bitcoin have been launched, enabling larger financial players a solution to get exposure to the new currency without having to leave their traditional channels of investing.

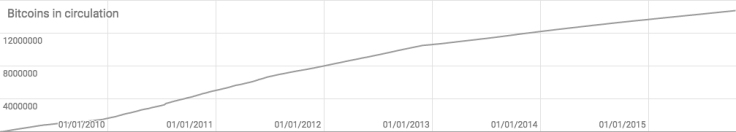

New supply will half in June

Bitcoin is often seen as a currency, but in some aspects, it behaves more like a commodity. This is because, just like a digital currency, it is simple and cheap to move. And just like a commodity, it has a finite supply. There will only ever be a total of about 21 million bitcoins, and the supply of new bitcoins will have a drastic reduction in June when the supply halves from 25 new bitcoins every 10 minutes or so to 12.5 new bitcoins.

Increased adoption

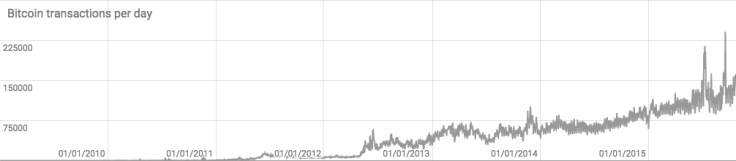

Bitcoin is seeing an increased adoption over time where the network facilitates more and more transfers of value. When the user base increases, so does demand for the currency, and since there is only a limited supply, this should mean an increase in the price of bitcoin.

New users and more transactions have led to that the current version of the bitcoin network is reaching its maximum capacity, which has led to a discussion within the bitcoin community on how to increase the network capacity to facilitate more transactions. Before this issue is solved, we are going to see a further suppression of the price. However, we believe that this matter will be settled within the next 12 months.

Conclusion

Our view at XBT Provider is that the price of bitcoin can reach new highs due to an increased global demand for the currency. With the supply of new bitcoins halving this year, China having to devalue its currency, even harsher capital controls potentially being introduced as an effect and bitcoin becoming more and more accessible to institutional investors, our opinion is that bitcoin currently is undervalued.

Additionally, while other blockchains, both open and closed versions, are being developed, we believe that bitcoin has reached a point where its network effects will keep it in place as the dominant cryptocurrency. We believe it will maintain its position as the currency with the most users, the highest market cap and the most development and investment being put into it.

Christoffer De Geer is working as marketing manager for XBT Provider, which provides bitcoin products on regulated exchanges

© Copyright IBTimes 2025. All rights reserved.