Brexiteers are drunk on victory, Remainers are drowning their sorrows – both need to sober up

With the right policies we can overcome the shock of Brexit.

One of the easiest ways to figure out if someone supported or opposed Brexit is to ask them whether they think the fall in the pound is a good thing. Compared to the dollar it has fallen by 20% over the past year, making it one of the worst-performing currencies of the year – among large economies only the Argentine peso, the Venezuelan bolivar and the Nigerian naira have done worse.

Remainers are horrified; Leavers are more sanguine, saying it will boost exports. Both are partially correct, but for the most part the Remainers have it right. The pound's fall is important both for what it will do itself and for what it tells us about Britain's future.

To understand what the pound's fall means, we need to understand why it fell. A currency typically can fall relative to others for one of two reasons.

Inflation means that the purchasing power of a unit of currency in a given country will fall, relative to everything else. So if markets expect inflation to be higher in the UK, typically because the central bank has cut rates or done quantitative easing, the pound will weaken. This is known as devaluation.

The other reason is that the expected return from the average investment in a country has fallen. Think of a pound as a tiny fraction of every possible investment that could take place in Britain in the future: how profitable those investments are depends on 'real' factors like the innovative strength, productivity and profitability of the economy. If the expected return of the economy as a whole falls compared to other countries, the pound will be less attractive to hold than other currencies. This is known as depreciation.

What's happened after Brexit is probably a combination of these two effects. The Bank of England loosened monetary policy after Brexit to offset the possibility of consumers and firms holding more cash than usual because they were uncertain about the future. Since growth immediately after the Brexit vote has been pretty strong, the Bank has been criticised for easing policy too much.

This is confusing to me: there's every reason to think that the strong post-vote growth was at least partially attributable to the Bank taking swift action to quash uncertainty. And the downside of overly tight policy – deflation – is much more risky than the downside of overly loose policy, which is inflation.

But it also seems likely that much of the pound's fall was because markets fear that Britain will be less productive after Brexit. Most forecasts worth listening to (based on empirically-supported models and plausible ideas about how trade drives growth) predict a permanent hit to British GDP after Brexit.

The pound falling is like a giant pay cut for British firms.

If it's true that exports will be 25% lower – or anything like that – after Brexit, even with a free trade deal with the EU, then we should expect a lower level of GDP than we would have had otherwise, and thus the fall in the pound should not be surprising. Productive British firms that relied on international supply chains – whether selling or buying goods and services from abroad – will have to shut down if it becomes more difficult to do business abroad.

I am not sure which of these two effects is responsible for a larger part of the drop in sterling, but I suspect it is the latter effect that dominates. As the pound dropped after Brexit, inflation expectations did not rise as quickly, which makes me think that mostly the drop was down to pessimism about the future of the UK economy.

So what does this mean? The main point made by many is that this is good for exporters. A lower pound means that they can collect the same income in sterling terms for a lower price in dollar or euro terms, giving them an edge internationally.

That's true, but there is a commensurate rise in costs for importers too. Importers are consumers, as well as firms that import raw materials to turn them into more valuable products. It's not just Macbooks that have become more expensive – imports across the board have risen in price, and obviously any Britons travelling abroad will get less currency for their pounds sterling.

Overall, there is at best a transfer from importers to exporters going on here. If we think in terms of goods and services going in and out of Britain, when the pound weakens we're getting less imports for a given amount of stuff we send abroad. It's difficult to see this as a net positive for the country, even if exporters are getting more business.

Here's another way of looking at it: If I take a pay cut, if I'm willing to work for less, I'll be more attractive to other employers. But it's difficult to say that I'm better off. The pound falling is like a giant pay cut for British firms.

Some people say that the country's trade deficit is proof that the pound had to fall, and Brexit was just the straw that broke the camel's back. This is a little silly – if people knew the pound would fall, why didn't they act on that knowledge? It's hard to take seriously the prognostications of armchair investors who predict ten out of the last two currency falls.

But the reason for their prediction, I think, is because of a common misconception about the data.

A trade deficit occurs when we're buying more from abroad than we're selling. But unless foreign firms are giving us stuff for free, and effectively burning the money we send them, this can't actually happen. Instead, the money we send abroad is being spent on things that don't clearly show up in the data as exports.

Those are, generally, assets: houses, government debt, stakes in British firms, investment in Britain-based start-ups. The UK really has been 'exporting' things in exchange for imports for a long time – but they're things that don't leave the country when foreigners buy them.

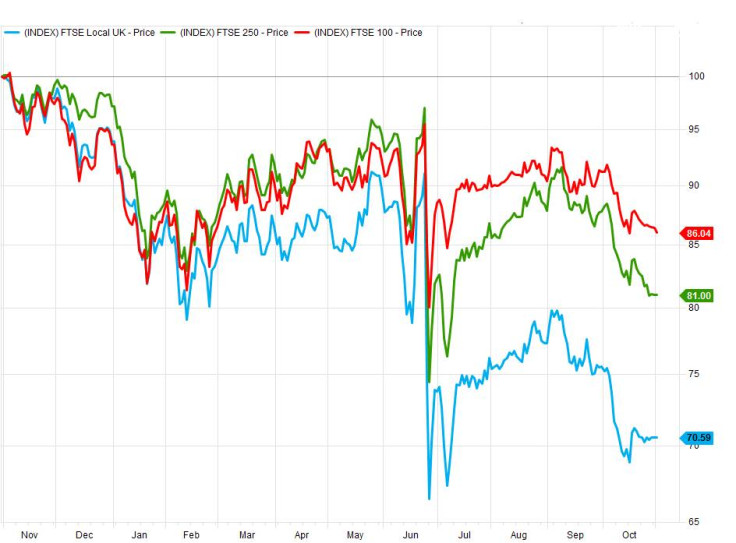

Now we may begin to understand why the FTSE rose after Brexit while the pound fell. British assets – which the FTSE represents – have become relatively cheaper to foreigners too. In dollar-denominated terms, the FTSE has fallen and not recovered since Brexit, including relative to other stock indices. (The chart below shows various FTSE indices based to where they were at the start of last November in dollar terms.)

I think with all this in mind it's fair to say that Brexiteers have been a little over-triumphalist about the pound falling. The fact that some of them have taken a single quarter of provisional GDP data as proof that nothing can possibly go wrong with Brexit is evidence of this. But pro-market Remainers have been too fatalistic as well.

Much of the weakness of the pound reflects market expectations: the market's best guess about what will happen in British politics, and in terms of Britain's trading relationship with Europe. We shouldn't dismiss the market's judgements as irrational – if we thought it was, we could make a lot of money by investing rationally and waiting – but we shouldn't take its judgements as holy writ, either.

A lot is up in the air. If we get a close, Single Market-like trade deal with the EU the pound will strengthen. If we get deep, comprehensive free trade deals with the United States, Mercosur in South America, the Commonwealth states and China it will do the same.

The biggest rewards might be at home, in areas not directly related to the EU: if we can use the shock of Brexit as a chance to cut through entrenched interests and reform our labour regulation, tax, and land-use planning systems, markets may judge that the future of investment in Britain is even better than it was while we were inside the EU.

Both sides are letting their emotions cloud their judgement. Leavers are drunk on victory, and Remainers are still drinking away their sorrows. Eventually both will need to sober up. That means understanding what the fall in the pound really means: a bad prognosis for Brexit, but one that with the right policies we can overcome.

Sam Bowman is Executive Director of the Adam Smith Institute, a libertarian think tank.

© Copyright IBTimes 2025. All rights reserved.