Buy-to-let investors urged to look beyond London property for bigger returns and cheaper stamp duty

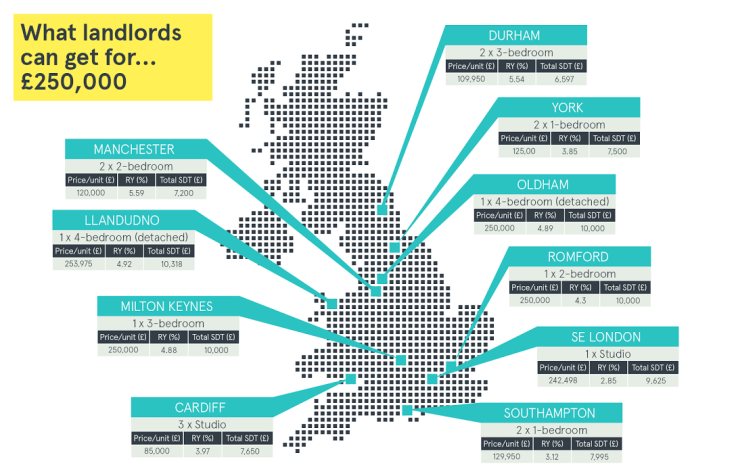

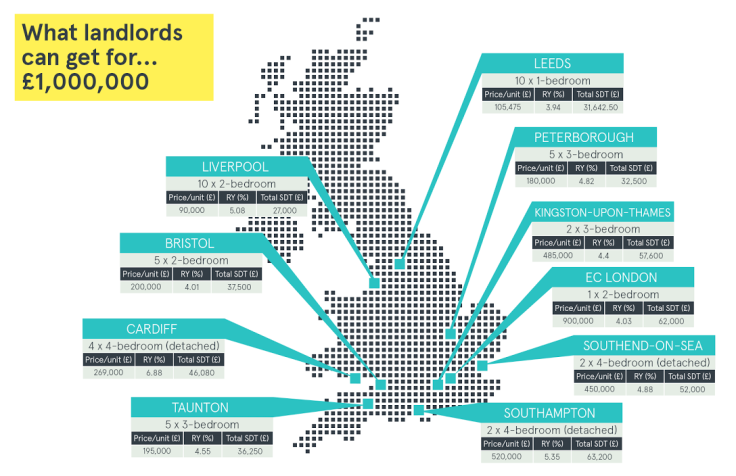

Property investors should look beyond London for the best returns when considering buy-to-let, according to research by LendInvest. Buying more properties outside of London can provide a higher rental yield with a lower stamp duty bill across all price brackets, stated the firm, an online marketplace for property investment.

"London rentals have long been seen as a market within a market, and the results of this study emphasise that fact," said Christian Faes, chief executive and co-founder of LendInvest. "It's no surprise that you can get as many as 10 similarly-sized properties in some cities for the same price as a single property in London. But it is surprising that those non-capital properties offer a far more impressive rental yield, and a smaller total stamp duty bill to boot."

For example, a £250,000 investment will only buy a single studio flat in London. But the same amount could secure two three-bedroom properties in Durham, which will generate a 200% higher rental yield and a 30% lower stamp duty bill.

At the top-end of the market, landlords with £1m to invest can buy ten two-bedroom flats in Liverpool or one of the same in central London. But the Liverpool option would see a 20% higher rental yield with half the stamp duty costs.

Chancellor George Osborne hiked stamp duty on 1 April for buy-to-let investors. All purchases of additional property, which is not intended to be the buyer's main residence, will also be subject to an extra 3% levy on top of the basic rates of stamp duty.

Moreover, rents have risen sharply in London over the past decade, pushing affordability to its absolute limits for hard-pressed tenants, meaning landlords will be able to squeeze less out of them in the future and denting potential rental yields.

"The current market is creating a huge opportunity for 'cross-country landlords' — professional landlords who live in one city, but rent out houses in other cities across the UK," Faes said. "Cities like Brighton and Southampton are becoming more popular with commuters thanks to the transport links into London, and developments like HS2 will prove an additional boost to areas in the Midlands and beyond."

© Copyright IBTimes 2025. All rights reserved.