Cyprus Cure Sets Tone for Future Eurozone Problems [BLOG]

EU fix of Cyprus bailout sacrificed ordinary savers and rich Russians to German elector sentiment

Cyprus' banks reopened amid continued uncertainty regarding the future of the small Mediterranean country. With people queuing for hours to get their hands on what little of their own money they had access to, those with more than €100,000 were told to expect as much as 60 percent of their deposits to be converted into bank shares in an effort to recapitalise the nation's banks.

How did it come to this?

In short, the crisis is the result of a poorly regulated and bloated banking sector heavily exposed to Greek debt. When Greece ran aground in 2010 the banks incurred massive losses and the government simply didn't have the funds to bail them out. With a dearth of private bondholders to take the hit, it is hoped that a one-off raid on wealthy depositors, in conjunction with a bailout from the EU and IMF, will be enough to restore the nation's finances and a semblance of normality to a thoroughly shaken country.

And the first step towards normality comes with the reopening of the country's banks. "Open" here is used in a fairly liberal sense, with strict controls governing how much money depositors can withdraw and measures to prevent people transferring funds abroad. Certainly this model of a bank is a far cry from what we are used to, and more pertinently is vastly removed from the idea Cypriots bought into when they originally trusted the banks with their savings.

We thus find ourselves in the midst of a hazardous psychological shift. Though those with less than €100,000 are no longer under threat - the damage has already been done. In a situation where a state could feasibly appropriate the assets of its citizens at any time, it necessarily sacrifices the principle of private ownership of assets. For if money can be seized from my bank account at any moment, and there are strict rules governing how I may use my own capital, in what sense is it really mine?

Worse, the sacrifice of this principle undermines the very confidence on which the whole economic system is based. Naturally, if your deposits are threatened your first instinct is to remove them. But without these deposits the banking system ceases to function. Importantly, it loses the capital required to lend effectively. And while the necessary capital controls have been put in place to prevent an otherwise unavoidable collapse, it will be many years before the Cypriots regain their faith in their banking system.

More ominously, a wider precedent has been set for the eurozone. For while the markets may have reacted calmly for now, we could see the pernicious effects of this bailout in the months the come. The next time Spain or Greece are in trouble this episode will be prominent in people's thoughts. As the US economist Paul Krugman remarked: "It's as if the Europeans are holding up a neon sign, written in Greek and Italian, saying 'Time to stage a run on your banks!'" When the chair of the eurozone's finance ministers suggests Cyprus could prove a template for future bailouts, any sign of trouble in Europe's other ailing members could result in a disastrous panic.

Make no mistake though, the Cypriot government have had little say in the matter. Though it rejected the first draft, a blanket levy on all deposits, reality has since sunk in. The simple equation it faces is a bailout or bankruptcy. Whether it eventually leaves the euro or not, a long and painful restructuring is unfortunately well overdue. And while retaining the euro will grant it access to some palliative financial support, crippling austerity is guaranteed to follow; there are no easy options when the money runs dry.

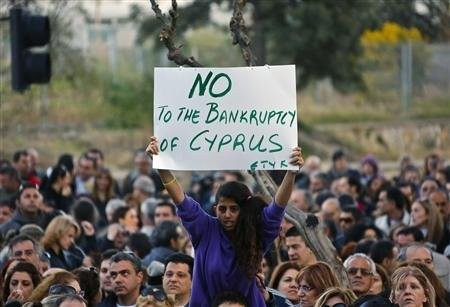

The culpability for the consequences of such an ill-conceived and ineptly executed arrangement therefore lies elsewhere. This was, after all, a deal imposed on an uncooperative populace despite vehement protest. Though allowing Cyprus to fail or leave the euro would be deeply destabilising for the rest of the eurozone, the effective hegemony enjoyed by Germany allows it to dictate the terms of any agreement. The impotence of the Cypriots in the face of such devastating and oppressive measures has understandably provoked much hostility towards Angelica Merkel's government.

And after the previous bailouts of Spain, Greece et al, it may seem strange for Germany to take a stand against a tiny country requiring a vastly smaller sum of money to keep it afloat. But Cyprus marks a turning point in German sentiment. Public opinion has increasingly shifted against the perceived fecklessness of the South, and your average German has little sympathy for the wealthy Russians whose dubious deposits comprise a large proportion of those under threat.

With a looming election in Germany this is critically important. Never mind the collateral damage to ordinary Cypriot businesses and citizens, the injustice of imposing such punishing measures on the ordinary people of a fellow European country. When your opposition can successfully equate any more reasonable alternative with bailing out Russian oligarchs, there is very little room to manoeuvre.

But a 60 percent haircut imposed on Russian depositors is understandably unpalatable for Moscow. While unwilling to bail out Cyprus itself, this particular solution has certainly soured relations between Russia and the rest of Europe. Putin himself described the bailout as "unfair, unprofessional, and dangerous," and when Putin describes an action as dangerous it becomes very dangerous indeed.

What we have then is a politically and economically parlous solution to what should have been one of the eurozone's lesser problems. Confidence in the banking system and belief in the ability of Europe's leaders to navigate the financial crisis have been the great casualties in a deal that has plunged the continent into ever greater uncertainty. And with larger challenges looming in the near future, this unedifying episode inspires little optimism for a speedy resolution to Europe's myriad woes.

James Pollock is a student writer at The Boar, the online student newspaper at Warwick University

© Copyright IBTimes 2025. All rights reserved.