ECB hikes rates again, maybe for last time

The European Central Bank hiked a key interest rate to a record high Thursday as it battles stubbornly high inflation but indicated that its historic hiking cycle may be at an end.

The European Central Bank hiked a key interest rate to a record high Thursday as it battles stubbornly high inflation but indicated that its historic hiking cycle may be at an end.

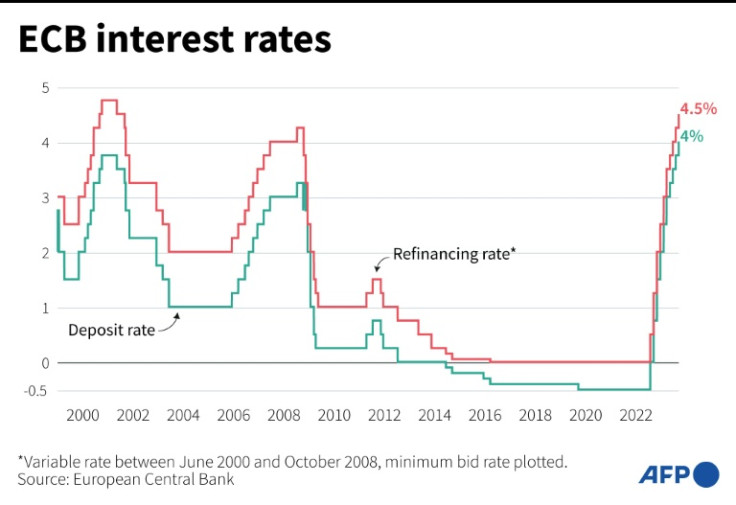

Policymakers raised borrowing costs by another quarter point, taking the closely-watched deposit rate to 4.00 percent -- its highest level since the introduction of the euro in 1999.

It marked the 10th straight increase since the central bank launched the most aggressive hiking cycle in its history in July last year after energy and food costs surged following Russia's invasion of Ukraine.

The bank pushed ahead with another hike despite growing signs of a rapidly deteriorating economic outlook in the 20 countries that use the euro.

But, while the ECB reiterated inflation was still "expected to remain too high for too long", it also said borrowing costs had reached levels that would help bring price rises back to the two-percent target in a timely manner.

Speaking after the rate decision was announced, ECB president Christine Lagarde stressed that rates had now reached levels that would make a "substantial contribution" to taming fast-rising prices.

She held back from making a firm commitment to no more increases, insisting that officials "can't say" yet that rates had peaked and future decisions would depend on incoming data.

But analysts nevertheless believed the language indicated the current run of interest rate increases was ending.

"The ECB's communication is clear: today was the last hike in the current cycle," said ING economist Carsten Brzeski.

Berenberg Bank economist Holger Schmieding agreed it was the final increase for now, and that the central bank had "signalled that it expects to be on hold from now onwards for a significant period of time".

Observers had been divided ahead of the meeting about whether the ECB would pause or hike, and Lagarde conceded some on the 26-member governing council had wanted to stay their hand.

But she insisted a "solid majority" ultimately backed a hike and the discussion was neither "antagonistic" nor "adversarial".

Highlighting the continued difficulties in bringing consumer prices under control, the ECB raised its forecast for inflation this year and next.

They lowered it slightly for 2025 to 2.1 percent, close to the ECB target.

But it also slashed its forecasts for eurozone growth over the next three years, and Lagarde acknowledged the picture was worsening.

"The economy is likely to remain subdued in the coming months," she said. "The risks to economic growth are tilted to the downside."

Recent data showed second-quarter growth reached just 0.1 percent, lower than previously estimated, and the EU on Monday also slashed its 2023 and 2024 GDP forecasts for the single currency area -- pointing in particular to weakness in Germany.

Europe's top economy is struggling to get back on its feet after sliding into recession around the turn of the year, hit by an industrial slowdown, high energy costs, and slowing exports to key partners such as China.

The weak data had fuelled calls for the ECB to pause it's hiking cycle for fear it could deepen a downturn.

Politicians in more indebted eurozone economies, including Italy and Portugal, have been urging the central bank to take its foot off the gas.

But despite the rapid increase in borrowing costs since last year, inflation has proved remarkably stubborn, coming in unchanged at 5.3 percent in August.

Price rises have slowed since peaks seen last year, in particular due to falling energy costs, but officials are now worried that other factors are keeping the pressure up -- particularly wage increases in a tight labour market.

The Federal Reserve -- which did pause its rate hikes in June, but then lifted borrowing costs again in July -- and the Bank of England are due to hold their own meetings next week.

© Copyright AFP 2025. All rights reserved.