Euro and pound plummet sending US dollar index to 12-year high

Euro fell to a new nine-year low, while Sterling fell to a new multi-month low, helping the US Dollar index to a 12-year high.

The sharp slide in euro and pound has helped the dollar strengthen across the board, reflected by the 2.4% rally just within the first five days of 2015. The dollar index broke through the 92.43 mark to a 12-year high of 92.45.

EUR/USD fell to 1.1762 on Thursday as data showed producer price deflation worsened in November and consumer confidence fell for December.

A break below 1.1637, the October 2005 bottom which is just 125 pips away from the latest low, will take the pair to its lowest since November 2003.

The eurozone November PPI index fell 1.6% steeper than the 1.3% drop in the previous month. Consumer confidence indicator dropped to -12.0 from -11.5.

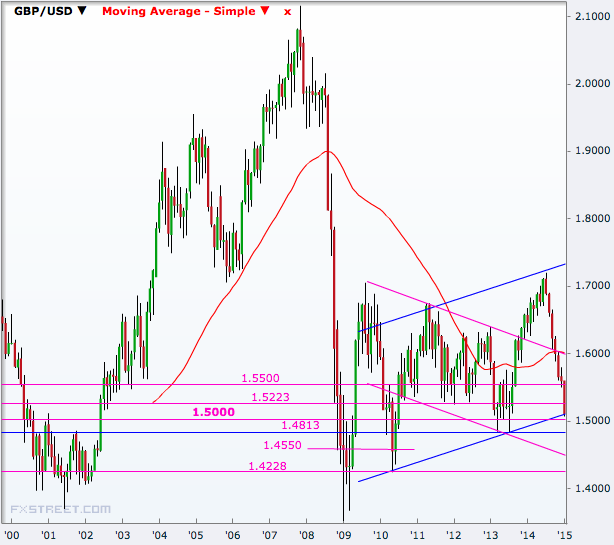

GBP/USD dropped to 1.5034, its lowest since July 2013, from 1.5072 where it was trading before Halifax said house prices in UK increased 7.8% year-on-year in December, lower than the November rate of 8.1% and trailing market expectations of 8%.

The 2013 low of 1.4813 is just 221 pips away, a break of which will weaken the UK currency to a four and a half-year low.

The UK central bank is unlikely to alter the benchmark rate of Bank Rate from 0.5% and the asset purchase target of £375bn at the review later in the day but the details like vote split in the decision will be keenly watched when the meeting minutes gets published two weeks later.

The market will be even more interested in Friday's US non-farm payrolls data.

Non-farm job additions may have fallen to 245,000 in December according to market consensus from 321,000 in November but the US unemployment rate is forecast to have fallen to 5.7% from 5.8%, adding to dollar positives.

© Copyright IBTimes 2025. All rights reserved.