Is Gold the Best Bet in the Long Term? A Look at the Future of Gold Investment Beyond QE3

Gold prices ease after ECB announcement on bond-buying

The unlimited bond buying programme announced by the European Central Bank (ECB) has eased gold prices in the international market, dashing hopes of speculators that gold will go all the way up for quite some time.

Reacting to the announcement by ECB President Mario Draghi, spot gold fell 0.3 percent to $1695.89 an ounce at 00: 37 GMT down from $1,712.91, the highest level since March. US gold lost 0.4 percent to $1698.60, shows Reuters data.

What doused the extremely bullish sentiments is that the ECB agreed to launch a new bond buying programme called Outright Monetary Transactions (OMT), which is unlimited though tied to strict conditions, to lower the borrowing costs of the struggling eurozone nations.

The yellow metal had jumped the most in August, 4.5 percent, on expectation of another round of economic stimulus by the US Federal Reserve and speculations of monetary loosening in China to boost the slowing domestic economy.

The metal is widely expected to cross $1800/oz by the end of 2012. Continued loss of faith in currencies, especially in dollar, is stoking inflationary fears, which is leading to ultra-low interest rates in many developed economies, forcing investors to opt for gold as a safe investment option that can yield reasonable returns.

"The price of gold is likely to challenge $1,800/oz before year-end," noted Thomson Reuters GFMS in its mid-year update to its April 2012 Gold Survey.

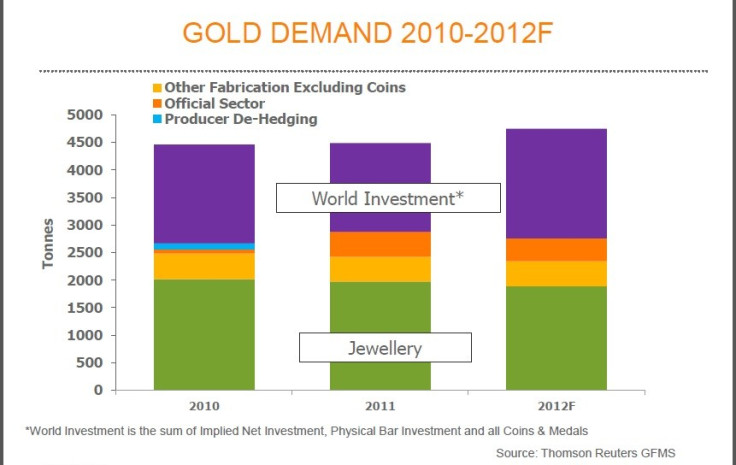

GFMS's bullish outlook is attributed to rising investment demand in gold and the chances of further monetary easing in Europe and the US. It also points to the possibility of higher buying by the official sector, pulling the demand up and thereby leading the price rally.

Philip Klapwijk, global head of metals analytics at GFMS, notes: "I think we're on pretty safe ground saying that we've already seen the lows for the year and that firmer price, particularly towards year-end, are on the cards.

"We've recently seen how gold can react sharply to any prospect of more QE in the United States and we're fairly confident that some form of easing is more likely than not in the end."

The Fed could unveil further economic stimulus at its next meeting, though it depends on the US job report expected by weekend.

Many industry watchers agree that the precious metal is rallying in anticipation of the next round of stimulus by the Fed. "It is not surprising that gold is rallying in response to expectations of the launch of a third round of quantitative easing in the US later this month," John Higgins of Capital Economics, told the Wall Street Journal.

The last two rounds of QEs have fuelled prices of the yellow metal and, in fact, helped double the price in four years. The Fed is expected to come out with a more convincing third round of quantitative easing, which might see outright purchases of US government debt, quite similar to the one announced by the ECB.

Capital Economics is forecasting a $2,000/oz price target by the year-end, though not basing this price rally entirely on QE3.

"Rather, it is mainly based on an expectation that a break-up of the eurozone will boost the demand for gold as a safe haven," said Higgins.

Spot gold average monthly returns from 2000 till 2011, data compiled by Bloomberg demonstrates, that September and November are historically the best months to make money in gold.

Traditionally, there will be seasonal weakness during summer months, which is used by investors to accumulate the commodity and later exit in the months of September and November when the prices peak. Bloomberg data further shows that in the last eight years gold has yielded an average return of 14 percent in six months after hitting the bottom in summer months.

Investors who missed the opportunity in the summer months have a chance in October, when traditionally the yellow metal takes a dip before peaking in November.

Notwithstanding the positive outlook, industry watchers are cautious about the capability of the commodity to weather the unpredictability of the global economy.

Jesper Dannesboe, senior commodity strategist at Societe Generale, says in his note to clients "I'm not a super bull on gold because there's not enough ETF (exchange-traded funds) buying to call for a new high, but there's enough reason to believe that in the short term speculators will buy gold given the context of quantitative easing."

Jesper's view has to be taken seriously looking at the physical demand. There has been a gradual slowdown in physical gold, despite the start of the festive season, in India, a major consumer of the precious metal.

Trends from China are also not overwhelming. With falling demand from the two largest gold consuming countries, there is no reason to anticipate for a long-term bull run in the metal, warn analysts.

Recent data from the US Commodities Futures Trading Commission points out that the speculative positions in gold are at the highest levels since March, 2012. These could have been built in anticipation of QE3 by the Fed in August. The expectation is that these commercial positions will be liquidated as soon an opportunity is seen, thereby crashing prices.

The question is, when will this happen? Will it happen soon after the Fed's QE3 announcement or only at the next opportunity?

Caution

Though proven, the monthly strength of gold in September and November is not guaranteed and price falls in these months are also possible.

A core position in gold is always advisable, in order to guard against the risk of currency devaluation or a systemic event.

© Copyright IBTimes 2025. All rights reserved.