Gold/silver ratio up to six-year high as palladium ratios tell new story

The gold/silver ratio has risen to a six-year high, once again proving the relative stability of the yellow metal during sharp price swings, but the extraordinary rise in the palladium/silver ratio and the steep fall in the gold/palladium ratio shift market focus to the Russia-controlled metal.

According to the prices just ahead of the illiquid year-end trading days, the ratio has been holding near 75, up from 61.97 at 2013 end and continuing the uptrend that started in 2010 when it was at 46.04.

In the four years from 2010 end, silver has fallen 48% while gold dropped just 15.5%, helping the ratio move upward.

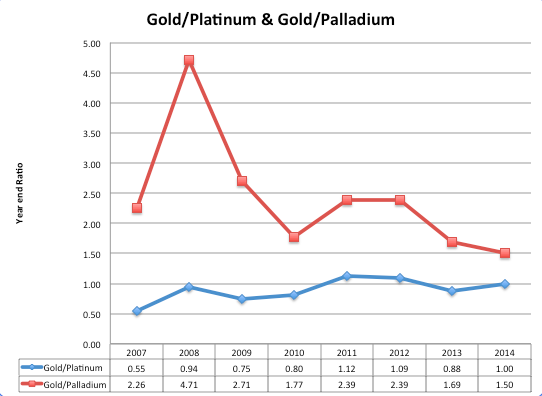

The gold/palladium ratio has fallen to a new low of 1.50 as of end 2014, down from 1.7 a year ago and 2.4 at end 2012.

The palladium/silver ratio has jumped to 50 as of this year-end, up from 36.7 one year ago and compared to 22 or so on average in the previous six years.

Gold over silver

Gold's relative advantage over other metals like silver and palladium has been aided by its status as a safer asset during uncertain times in financial markets.

While slow growth and weaker price pressures are long pending challenges for many developed economies, several large emerging markets still see higher inflation weakening their growth prospects, where some investors tend to seek the safety of the yellow metal.

Analysts say that the Swiss National Bank's decision to charge a fee for sight deposits will also support gold as the Swiss franc's safe haven demand will come down with the negative interest rate regime. An HSBC report also takes that stance.

Palladium over silver

The upside in the gold/silver ratio is bouncing back after a sharp two-year slide that started in 2008, but the steep rise in the palladium/silver ratio since 2012 has taken it to a new multi-year high, indicating the increasing strength of palladium as an asset.

In the first half of 2014, gold was up 10%, silver and platinum 8% higher each while palladium made a 26% jump. In the second half, all the four did move southward - gold 10%, silver 24%, platinum 19% and palladium 11%.

The overall result showed that the sharp first half jump has helped palladium buck the trend of others and end the year higher. More than half of the world palladium reserves are in Russia, which influences the prices globally.

Gold over platinum

Meanwhile, gold managed to keep its slight advantage over platinum, with the gold/platinum ratio rising to 1.0 from 0.88 at 2013 end.

It is still below the 1.1 level maintained in 2011 and 2012 but has kept the overall uptrend since 2007 when it was just 0.50.

© Copyright IBTimes 2025. All rights reserved.