Is the honeymoon between Donald Trump and the financial markets over?

Pointers from the financial market's performance in 2018

The long honeymoon between Donald Trump and the financial markets appears to be over or, has at least, landed in some trouble in the first part of 2018. It is too early to call the movement seen in the last few weeks an inversion but it is clear even to non-experts that something has changed. The US indices, after long months of rallies and new records, have stopped their bullish impulse. Since January, the Dow Jones and S&P 500 haven't marked any new records and now that we are in early May, the indices sit less than 10% below their previous peak, so consequences do remain limited.

The main story behind this is clearly about the Tycoon and his decision to announce new steel and aluminium tariffs with other import taxes on goods from China. Of course, Trump's movement generated a strong Chinese reaction with the Beijing government announcing tariffs on US items and initiating a real commercial war. The market's reaction was understandably sceptical and some nervous trading sessions followed. The overriding question now seems quite clear: is this the beginning of something bigger? There are growing chances this commercial war could involve other countries - with devastating results – which would of course generate what the market's want least: uncertainty.

As well as this, we need to consider the growing tension between the USA and Russia and the escalation of the Syrian conflict. So far, the stock markets have reacted as if they more like skirmishes or brushes, but the situation is delicate and subject to rapid change.

EUR/USD

EUR/USD has now broken 1.215 having fallen below 1.20 on the 1<sup>st of May and investors are again betting on the US currency. After more than three months in the lateral channel between 1.215 and 1.25, the EUR/USD pair did eventually breakdown. This happened after the speech of Mario Draghi but it is more closely related to the growing chances of seeing three more rate hikes in 2018 from the Fed and overall a total of four. Markets were expecting another hike in June and a third one in September but 45% of traders are now expecting a fourth rise before Christmas. The spread between eurozone interest rates and US rates is now 1.75 but will jump to 2.25% before the end of the year (or even to 2.50%). This of course represents a hidden cost of keeping euro.

Investors are closely monitoring the policies of the two-central banks: on the US side the majority of traders are still expecting just 3 rate hikes for 2018. If the Fed are able to do four, we could expect some further bullish movement of the US Dollar, even if the mandate of Mario Draghi slowly runs to its conclusion and his successor could decide to adopt some more hawkish monetary policies.

EUR/USD, daily chart. Source: ActivTrader Platform

Forex

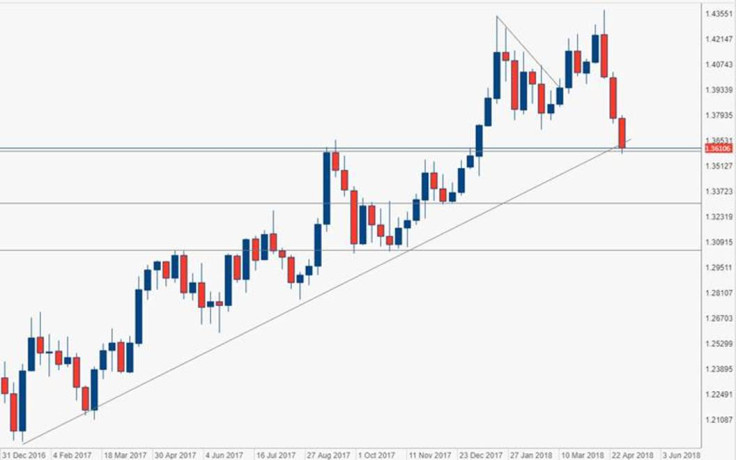

On the forex market attention remains high on the British pound, which achieved significant gains before slowing down after the inflation eased to 2.5% after the peak of 3.0% reached a few months ago. GBP/USD reached a post Brexit peak at 1.437, before correcting to 1.40 and then falling to 1.36, with an impressive -750 pips in just 2 weeks. The movement we have seen is mostly due to the strength of the US Dollar, combined with a change of view on future policy which is expected to be adopted by the Bank of England. Mark Carney was relatively dovish in his last comments and UK macro figures sit below expectations, but the Inflation rate has fallen to 2.5%, which means that there will be much less pressure on BoE coming from price growth.

GBP/USD, weekly chart. Source: ActivTrader Platform

Swiss franc

Another currency which has seen significant movements in the last few months is the Swiss Franc. The rate between the euro and the Helvetic currency jumped to a new 40 month high at 1.20. This was the PEG artificially decided by the Swiss National Bank between 2012 and 2014. It ended with a famous crash on the 15<sup>th January 2015, when EUR/CHF fell from 1.20 to 0.9 in fewer than 20 minutes. Afterwards, it started a slow recovery, which pushed the pair to 1.20 in the last few weeks. Of course, this could help swiss exports, which creates revenues in USD, Euro and other currencies. The devaluation of the national currency may also be positive in fighting deflation problems, so it is likely that the swiss central Bank is not too disappointed by this depreciation.

EUR CHF, monthly chart. Source: ActivTrader Platform

Metals

Gold has fallen to $1,305 per Ounce because investors are buying dollars and this is adding pressure to the yellow metal. From a technical point of view, we are again approaching the support area of $1,300/1,305, where we can expect the first reaction to come from the buyers. If gold price does fall below $1,300, it will lead to a negative signal but the current strength of the dollar might mitigate this signal. This will mean gold remains in the lateral trend between $1,300 and $1,350, which proved crucial in the last few months.

Gold daily chart. Source: ActivTrader Platform

As this happened, Silver had rebounded above $17 per Ounce and was showing a growing strength but after this rebound, silver lost almost all gains, going down to $16.5 again because of the growing strength of the US Dollar. The next few months could be crucial in demonstrating that the bearish phase which has lasted for more than 5 years, is now close to an end.

Carlo Alberto De Casa is chief analyst of ActivTrades, a company he joined in 2011. He provides regular commentary for UK outlets including the BBC, Telegraph, Independent & Reuters UK. He is also a weekly commentator for CNBC Italy, a columnist for La Stampa and has written a highly regarded book on the gold market entitled 'Secrets to invest in Gold' published in the UK in 2014.

© Copyright IBTimes 2025. All rights reserved.