It's time to seed a public wealth fund with $75 trillion of assets mismanaged by governments

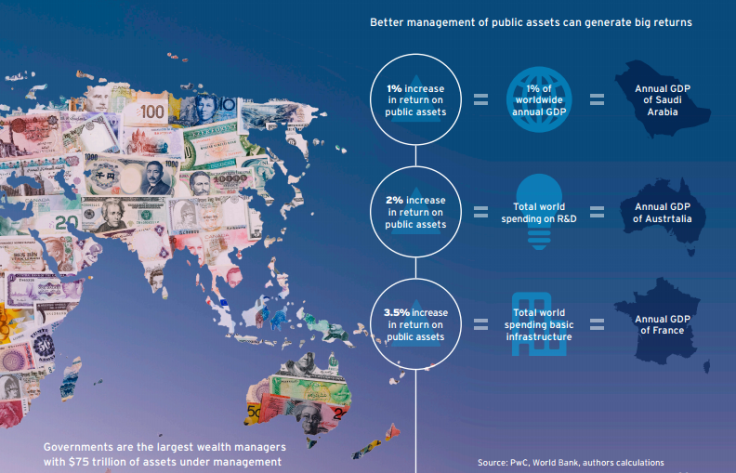

Governments around the world mismanage some $75 trillion-worth of public assets tied up in land, property and corporations, either out of political expediency or simply because they don't know how to value them.

These are public assets. The clue is in the name. Better management of this wealth could in a relatively painless way make us all better off, according to Dag Detter and Stefan Fölster, the authors of a new book entitled The Public Wealth of Nations.

The aims of the book were set out in the latest Citi research report in its GPS Series.

This could be done via a national wealth fund, which would be a consolidated single institution for holding public assets, with of course proper management. This fund could also be used for improving access or the cost of borrowing on the international capital markets for financing infrastructure projects or other commercial ventures or assets.

"Most governments have more wealth than they are aware of and if the quality of public asset governance were to increase, governments would likely be able to use the extra returns to offset debt burdens and increase revenues," said Detter and Fölster.

"The focus on public assets should be on yield, rather than ownership and calculate that improvements in public wealth management could yield returns greater than the world's combined investment in infrastructure."

Over the last few decades, policy makers have focused almost solely on managing debt while largely ignoring the question of public wealth.

In addition, a phoney war has raged between those in favour of public ownership and those who see privatisation as the only solution. This polarised debate is partly to blame for neglect of a more important issue -- the quality of public asset governance. This makes all the difference to how well public wealth delivers value to its owners, the public, said the authors.

An example of bad management of assets by a government is Greece. Most of its assets are poorly accounted for and some don't occur in any accounts. Even proper ownership registers are sometimes lacking: Greece still does not have an integrated national land registry or cadaster.

Compare this with Switzerland, which is geographically not far off and both countries are democracies. Yet Switzerland, with solid institutions, is one of Europe's richest countries, while Greece is one of the poorest, partly due to some of its institutions acting in a disorganised manner.

"The hidden public assets are the real commercial assets of the state, or perhaps more accurately the real commercial or real potentially commercial assets of the state. Many of these assets have not been managed effectively, let alone commercially — to the detriment of the citizens," said the authors.

"A large part of these assets is land and real estate, including ports, airports, canals, bridges and other infrastructure, but it also includes publicly-owned corporations. Although valuing these assets is often extremely difficult, the likelihood is high that in many countries a fair valuation would price them at more than 100% of annual GDP."

© Copyright IBTimes 2025. All rights reserved.