Laird On Track to Deliver FY Earnings Not less Than 16% Per Share

Laird, the supplier of products and technology solutions, is confident of delivering underlying earnings of not less than 16 pence per share for the year as a whole. The group is expected to release its preliminary results on March 2, 2012 with its increase customer base and expanded technology portfolio.

The group has a strong breadth of capabilities across the markets it serves and continues to expect 2012 to be a year of good progress. While it is mindful of the effects of the current macro-economic uncertainty, it expects the underlying demand for its products in the medium to long-term to continue. It remains confident in its ability to meet its short and medium term targets announced in July, 2011.

Industry commentators are forecasting strong growth in all of the group's end-markets. With its current leading market positions, Laird is well-poised to benefit from this increasing demand both from existing and new emerging applications. Following the decision to exit the Handset Antennae business, which had masked the overall speed of its recovery from the financial crisis, it is able to focus on the organic strength of its underlying core businesses, and its targets reflect its confidence to deliver future growth.

The group has made good progress in 2011, notwithstanding losses in the "discontinued" businesses. Its underlying profit before tax from its core businesses was up 65% in the first half of 2011, driven by good organic growth, and strong performance from its Cattron and Kluver acquisitions. The products and technology solutions group's strategy has succeeded in allowing it to expand into growing markets where it has ensured that it has the right products in the right markets to drive profitable growth. Although it is not immune to the wider economic changes that could potentially affect its markets, it continues to expect further progress in 2012 and beyond.

The group's financial position remains healthy and it is focused on strong cash generation, with tight controls on working capital and capital expenditure again held below depreciation. Trading in the fourth quarter continued to follow the trends of the third quarter, as set out in its Interim Management Statement on 27 October 2011.

The year gone by was a year of progress for Laird, advancing its strategic objectives and focusing on delivering on its targets and commitments. The group's overall market position remains strong and it continues to benefit from operating within diverse end markets and with a broad customer base.

Commenting on the weaker macroeconomic outlook, Analyst Dominic Convey at Peel Hunt said: "A good trading update with organic constant currency revenues up 8 percent on tough comps, driven by strong sales of tablets, smartphones and telematic systems."

UBS also upgraded its rating for the electronics and technology group to "Buy" from "Neutral", citing the stock's healthy growth potential and its attractive valuation. "We believe the long term growth potential for most of Laird's end-markets remains healthy, particularly for smartphones, tablets, telematics and M2M (machine-to-machine technology)," UBS said in a note. "While we recognize the potential headwind from macro uncertainties in some of Laird's end markets, particularly PCs and consumer electronics, we believe the secular growth in smartphones/tablets is likely to offset this," the broker added. However, in an attempt to de-risk its numbers, UBS lowered its earnings forecasts for Laird by 3-17 percent for 2011/12.

Brokers' Views:

- Numis Securities gives 'Buy' rating on the stock with a target price of 230 pence per share

- Peel Hunt recommends 'Sell' rating on the stock

- Arden Partners gives 'Hold' rating

- Credit Suisse recommends 'Under Perform' rating on the stock

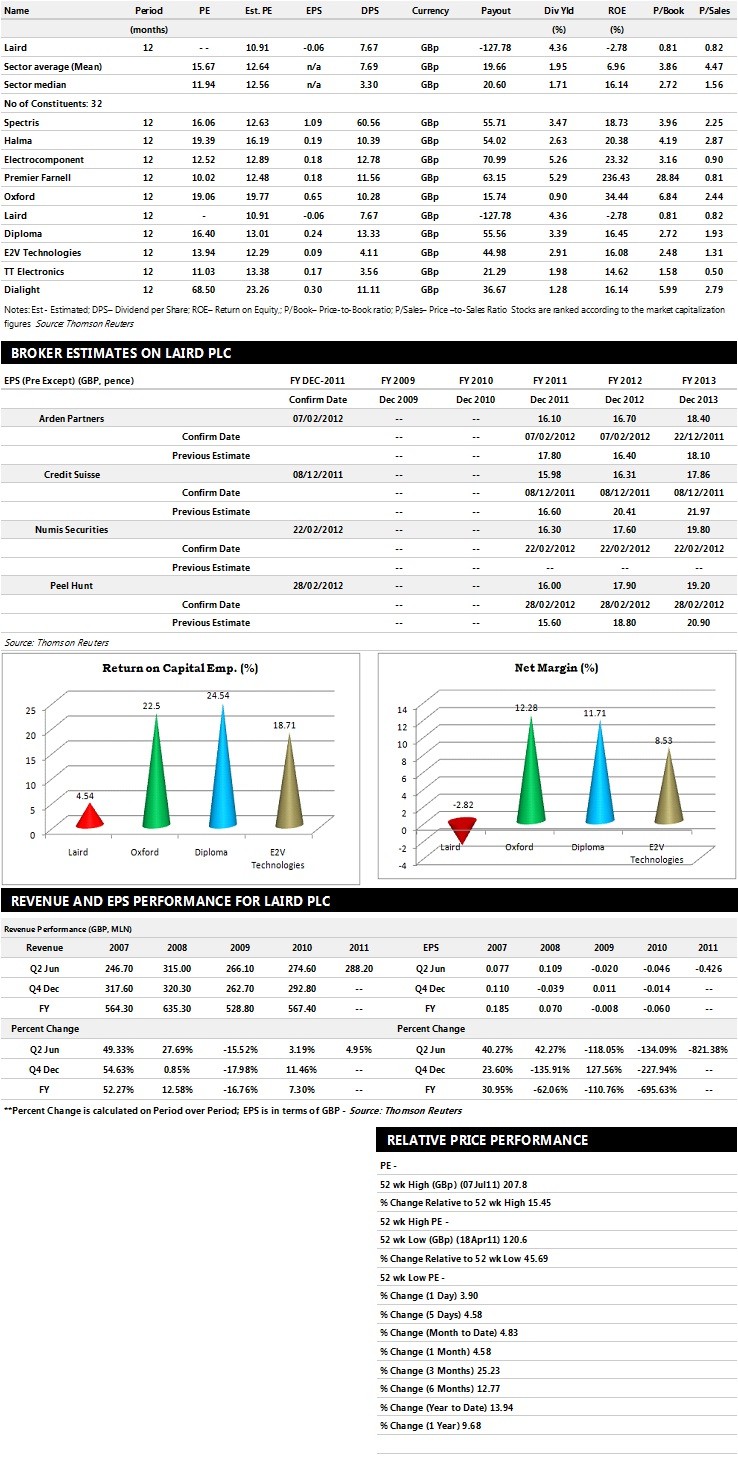

Earnings Estimates:

- Peel Hunt estimates the company to report revenues of £590.30 million and £570 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £52 million and £58 million. EPS is estimated at 16 pence for FY 2011 and 17.90 pence for FY 2012.

- Numis Securities projects the company to record revenues of £503 million and £537.20 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of £53 million and £57.50 million. Profit per share is estimated at 16.30 pence for FY 2011 and 17.60 pence for FY 2012.

- Arden Partners expects the company to earn revenues of £604 million for the FY 2011 and £526 million for the FY 2012 respectively with pre-tax profits of £53 million and £56 million. Profit earnings per share is projected at 16.10 pence for the FY 2011 and 16.70 pence for the FY 2012.

Below is a summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio. The table explains how the company is performing against its peers/competitors in the sector. The table below represents ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.