Man Group Secures 'Buy' Rating, Expects Positive Performance For FY 2011

Man Group, the alternative investment management company is expected to deliver a positive performance as markets are normalised and trading opportunities are re-emerged.

The group is in the preferred stock 'Buy' list of top brokers like Credit Suisse, Societe Generale, Charles Stanley, Peel Hunt etc and is expected to release its preliminary results for FY2011 on March 1, 2012.

With a strong capital base and continued focus on efficiency and performance, Man is well placed to benefit when investor demand improves.The group expects that markets will remain volatile.

With strong suite of liquid investment strategies designed to capture value for investors across market cycles, it is well placed to continue to attract investors even in tough markets.

Strong investment performance across the board in calendar year 2010 has provided a healthy backdrop for sales. Although recent performance conditions having been challenging, it remains focused on building sales momentum.

Man Group expects the current high level of regulatory and policy change to continue, but at a slower pace, with the detailed implementation of regulation now becoming clear.

The company is well placed to address these new regulatory environments given its scale, relationships and brand. It continues to regard scale as a competitive advantage in this area.

Although its focus this year will be on organic growth, it remains prepared to use its financial strength to invest in its talent pool and develop new market opportunities as they arise.

Man now has a highly competitive suite of investment strategies, strong global distribution and significant scale advantages.

By executing well on a compelling strategy in a structurally favourable market, it can achieve substantial asset and profit growth over the years to come.

The UK-based manager of alternative assets became a signatory to the United Nations-backed Principles for Responsible Investment (PRI).

It is a framework designed to encourage sustainable investing by incorporating environmental, social and governance issues into investment decision-making and ownership practices.

This step is a signal of Man's continued commitment to responsible investing.

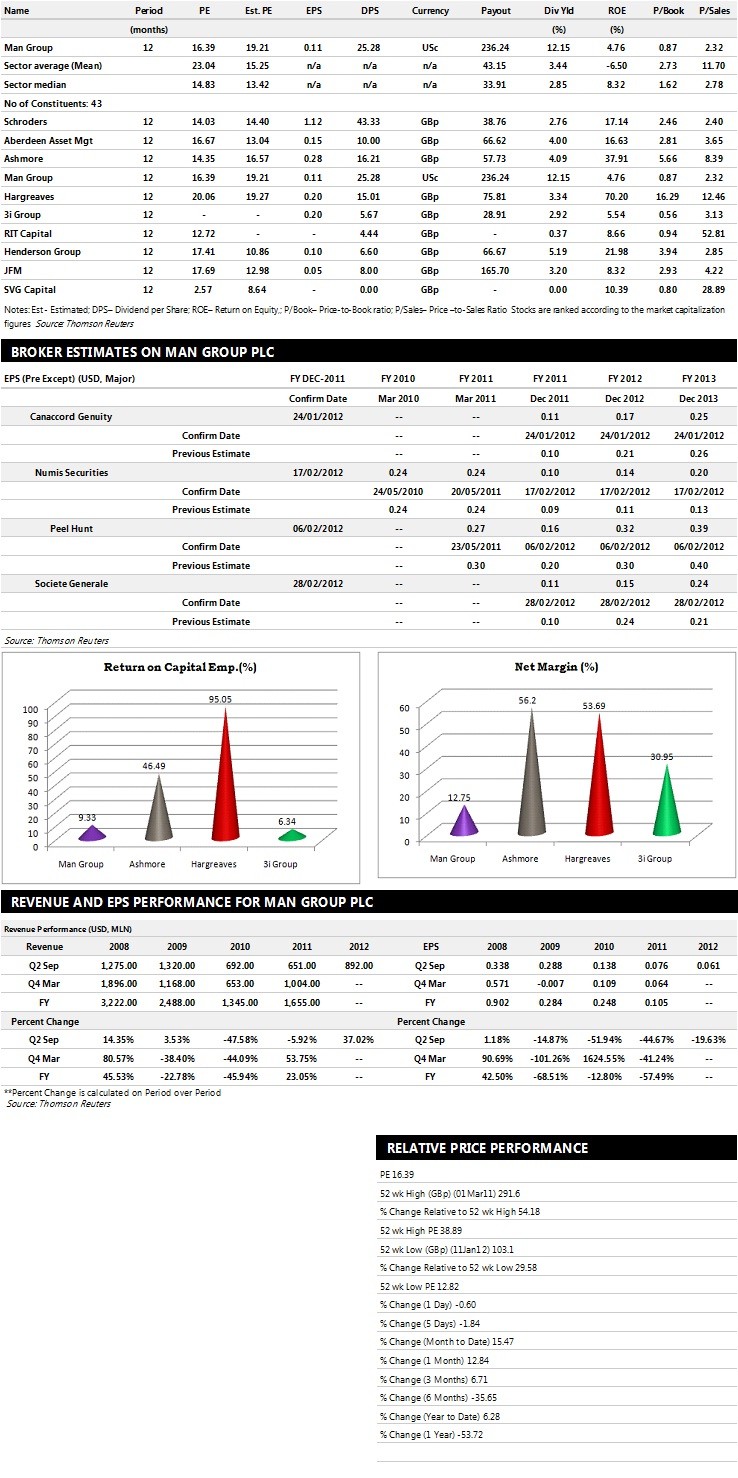

Brokers' Views:

- Credit Suisse assigns 'Out Perform' rating on the stock

- Societe Generale recommends 'Out Perform' rating on the stock

- Charles Stanley gives 'Buy' rating on the stock

- Peel Hunt recommends 'Buy' rating on the stock

- Numis Securities gives 'Buy' rating on the stock

Earnings Outlook:

- Numis Securities estimates the company to report revenues of $1,287.30 million and $1,496.10 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of $560 million and $340.90 million. EPS is estimated at 24 cents for FY 2011 and 14 cents for FY 2012.

- Peel Hunt expects the company to record revenues of $1,049.30 million and $1,887.30 million for the FY 2011 and FY 2012 respectively with pre-tax profits (pre-except) of $560.30 million and $735.10 million. EPS is estimated at 26 cents for FY 2011 and 32 cents for FY 2012.

- Singer Capital Markets projects the group to earn revenues of $1,601 million for the FY 2011 and $1,239 million for the FY 2012 respectively with pre-tax profits of $570 million and $257 million. Profit earnings per share is projected at 20 cents for the FY 2011 and 10 cents for the FY 2012.

Below is the summary of sector comparisons in terms of price earnings, earnings per share, dividend per share, dividend yields, return on equity and price-to-book ratio.

The table explains how the company is performing against its peers/competitors in the sector and represents ten companies based on market capitalisation.

© Copyright IBTimes 2025. All rights reserved.