Britons Hear Mark Carney's Forward Guidance as Fewer Expect Rates Rise

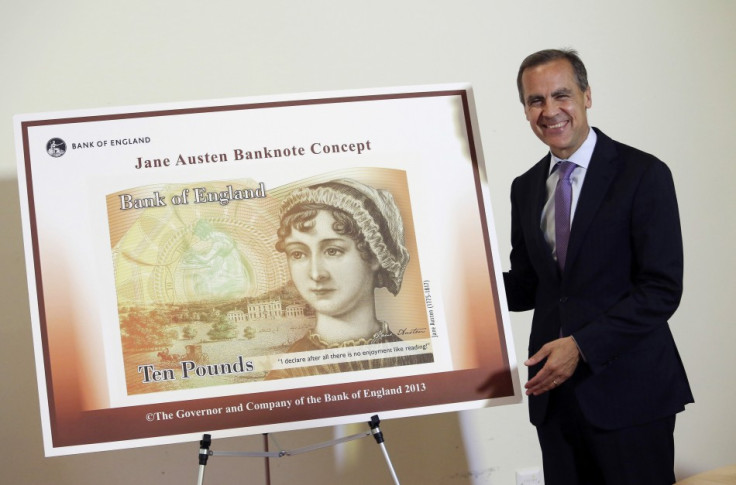

Bank of England Governor Mark Carney has achieved a coup with the finding that the lowest number of Britons since November 2008 expect interest rates to rise over the next 12 months, suggesting his forward guidance policy has permeated the public's conscience.

Of those polled in the BoE's inflation attitudes survey, conducted by pollster GfK NOP, only 29% expect rates to increase, compared with 34% in May 2013.

It is only the fourth time when fewer respondents expected rates to rise since the survey began in 1999.

When asked the question about what would be best for the economy - higher interest rates, lower rates or no change - 15% thought that rates should go up against 16% in May.

A total of 41% thought that interest rates should stay where they are compared to 35% in May, again reinforcing Carney's point that markets have misunderstood his forward guidance policy by being far too bearish.

Market scepticism of forward guidance has appreciated sterling and pushed up gilt yields.

Meanwhile 19% of respondents thought that the interest rates should go down compared to 20% in May.

Best Rate for Me?

Interestingly, when asked what would be "best for you personally", there was no clear cut response.

There were 22% of respondents who though rates should go up, the same as in May, and 26% of said it would be better for them if the interest rates were to go down, slightly down on the 27% reading in May

Responses towards the what is best for you personally question may be defined by whether the person is a spender or saver.

Carney has made it clear that his forward guidance is meant to support growth, with low interest rates related to some flexibility on the inflation target and acceptance of higher inflation.

His dovish strategy penalises pensioners with a policy that some have argued is far too soft on fears of high inflation.

Public Attitudes vs Market Expectations

It seems that public attitudes towards the path of future interest rates and market expectations are in conflict with each other.

Carney hopes that his forward guidance will persuade everyone that low interest rates are here to stay, but it remains to be seen if he can pull off this great gamble.

For now, this survey conducted from the 8-13 August has probably brought him a little smile.

© Copyright IBTimes 2025. All rights reserved.