Mis-Selling Derivatives Scandal: 'IRSA Is a Noose, Not a Collared Product"

- MPs question independent consumer watchdogs and expert witnesses

- Consumer watchdogs hit back at bank fees, lack of transparency

- Panelists raise concerns over the banks involvement in market restructuring

1707 BST: This blog has now ended.

Thank you for joining us.

1705 BST:

Sachdev: "Confirmations of these products are so complicated that the businesses would find it too difficult to understand a 40 page ISDA agreement."

1703 BST: Policy recommendations .....

Sachdev: "I think the banks, independent assessors have to have created pressure put on them to really assess whether these banks were mis-sold and the correct and real redress where appropriate. The second element about going forward, I think it is a wrong answer to blanket ban hedging products but there has to be greater and tighter compliance of these products and appropriateness of what types of products it sells to these businesses."

1702 BST:

Sachdev: "This doesn't just relate to small businesses, this also includes businesses of all sizes. In the UK, the banks have a very small amount. The amounts that the banks will have to pay in the end are going to be massively more than they have set aside."

1659 BST:

Sachdev: "Every case has to be assessed one by one. Some of the early redress options are quite concerning. Part of the FSA redress scheme, if you have been sold a structured collar, then you can replace this with a fixed rate product. however, because that loan or swap that is at a rate from 2006, it will still leave the customer with the same breakcosts and penalties."

1658 BST:

Sachdev: "These sales people get paid investment banking salaries because they profit is immediately booked by the bank, the day the deal gets signed."

1657 BST:

Sachdev: "It all goes back to the FSA rules. Many banks have missed many steps of the FSA rules to explain the details of the products or the downside scenarios."

1655 BST:

Sachdev: "Businesses should have a hedging strategy but it is all about what is appropriate for the business, which has not been in many cases."

1652 BST:

Sachdev: "Banks were not interested in them having a separate fund to help businesses, to help bridge payments when it swap payments were high. They weren't interested."

1649 BST:

Sachdev: "Firstly, in terms of linking the two things together, is that banks will say that why they make it mandatory condition to have hedging with the loan is that they would not be happy with the risks to the health of the business. My opinion, no one forces a business to take it but if they make conditions of sanction, they do it on a blanket basis at a very early stage, without individual business analysis basis, which is very inappropriate."

1646 BST:

Sachdev: "The biggest tool that they have in the banks' arsenal is to not grant a loan unless you take a hedging product."

1643 BST:

Sachdev: "Interest rate hedging resulted in a huge economic profit of the bank. There is a carrot and a stick approach. The relationship managers would have significant bonuses for introducing the small businesses. If the relationship manager had 10 products to offer, interest rate hedging products would be the most profitable for himself and the bank."

1641 BST:

Sachdev: "Many businesses have felt they were being advised by the banks or forced to take up this product. Of course, the banks would have a number of documents to say that the businesses sought independent advice - even though it was hard to get that advice from an independent body."

1639 BST:

Sachdev highlights that one of the techniques banks would use to deliver these complex products to small businesses would be that they would only lend the money to businesses if they had 'some kind of hedging product' attached to it.

1637 BST:

Sachdev: "Swap products that are longer than the actual loan can be sold for a valid reason. However, when businesses are not aware of the full scale of what this would mean to their business models in all scenarios, then that is a very different case."

"The FSA has a number of rules of how the banks should nurse the suitability of the products and the businesses. Typically for a small business, they usually go to their solicitors or accountants. However, both are neither FSA authorised or qualified to give advice on these products. At the same time, the banks would plaster their literature with 'we do not give you advice', however if there was no one in the market for the businesses to turn to, how would it is feasible or possible to make an informed decision?"

1632 BST:

Sachdev: "There is no perfect hedging product, unless you look back in hindsight. One of the most important notes to make is that some of these 'simple products' that the FSA or banks try to push instead of the products [that are now banned] could be just as detrimental."

1630 BST:

Sachdev: "Many business owners did not know about these break costs at the outset. In 2004 and 2005, very small and unsophisticated businesses were being sold these very complex products. These products are completely separate to the loan."

1628 BST:

Sachdev: "The term of fixed rate loan is very deceptive as sometimes they were marketed like a fixed rate mortgage. However, it is very different because if these businesses try to get out of these fixed rate loans, it could be result in businesses paying 40% of the original loan amount to get out of the swap."

1627 BST:

Sachdev: "If a business had a five year loan and five year fixed rate loan, the net effect would be the same."

1623 BST:

Garnier: "How did these products morph down to small business owners?"

Sachdev: "These products have been around for many years but only over the last few years, from 2004-2005 onwards they started marketing and selling it to SMEs. As we heard in a previous session, these situations usually result from profitability."

Garnier: "The motivation for banks selling these is key to understanding the situation. However, moving on can you describe the products around 2006 onwards."

Sachdev: "The simplest product is the swap, where there is a fixed rate of payment that results ifrom the movements in interest rate levels. The risk is that if the interest rates fall, there are significantly large payment to get out of the deal."

1620 BST: Garnier asks Sachdev to explain what IRSAs actually are and to distinguish between the structured collared and swaps.

Sachdev highlights the sheer complexity of the type of products sold to SMEs, which emphasises the unique situation for each and every business.

1611 BST: Up Next ...

Abhishek Sachdev, Vedanta Hedging on interest rate swap agreement mis-selling

1609 BST:

Davis: "We want two irreconcilable things. We want a safer financial system but with better access to credit."

1606 BST:

Fell: "Most of the change to the banking culture, would only happen if there was corporate governance reforms, better risk controls and greater individual accountability."

1558 BST:

Davis: "I like competitive markets and shadow banking does provide this. Of course they have their downfalls but it has provided terms of trade evolution, better connection with customers and flexbility."

1556 BST:

Davis: "Shadow banking is very small and some people are scared of it as it isn't as regulated as much as they should, some people perceive it to be. But what's interesting is what is on offer in shadow banking. People don't want to wait for 3 months to get a no and if they are in need of the cash, they'll get an answer in a few days."

1552 BST: Mark Garnier MP brings the questioning back to competition

1548 BST:

Panelists all agree that the lack of feedback from the banks to customers is worst parts of customer relations.

1547 BST:

Cherry highlights the number of overturned appeals from customer complaints and how poorly trained the staff are in handling these.

1545 BST:

Cherry: " Project Merlin has failed. Funding to Lending is more about cost rather than access to credit."

1536 BST:

Thurso says that when he went to a big bank yesterday and that they told him how they have had the highest level of deposits from SMEs in years. He then, however, highlights how different this attitude is compared with what the panelists are saying.

Davis: "Yes, there could be a high level of deposits from SMEs because there has been a switch from high level of debt, to a high level of equity. However, the banks should be lending more prudently. Across business from mid 1990s to mid 2000s is that this change in equity and debt was made. Banks had cheap and plentiful credit."

1533 BST:

Fell: "Regulatory reforms will make it much more unattractive for banks to lend money to SMEs."

1530 BST:

Davis: "I don't think there is a shortage of money in the system [to lend], I just think there is a shortage of appetite to take risks."

1524 BST: Thurso asks whether banks are pushing products onto businesses that they either don't want or need.

Thurso: "Why are the banks insisting on IRSAs and why do businesses agree to them?"

Mike Spicer: "The IRSA scandal: "lack of transparency, for example break costs, how the different interest rate levels will effect payments."

Mike Cherry: "It's more profitable for the bank to offer these to SMEs because it makes them more money. I think the reasons that businesses agree to them, is more because the banks, which we have seen time and time again, that they will package it up in other products."

1520 BST:

Mike Spicer: "Companies that are looking to export ... for a new exporter to embark on this venture will mean they will currently find difficulty on getting finance. We have raised awareness over UK export finance and this needs to be addressed. For younger businesses ..... in our SME finance monitor, these companies that will need a kick to boost the economy will mean they usually need bridging loans."

1517 BST:

Cherry highlights the importance of mis-selling IRSAs, after Andrew Love says that IRSAs only effect "a small number of business owners."

1516 BST:

Cherry:"Mis-selling of swaps and manipulation of Libor has destroyed confidence and trust in the banks."

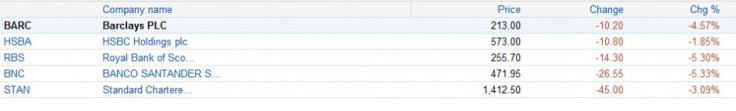

1513 BST: Bank Shares ...

1510 BST: Rebuilding trust?

Mike Spicer: "BCC conducted a large scale poll last week. Only 49% said they trusted banks somewhat. It has not grown over the last year and something needs to be done

1507 BST: Expectation gap as a result of credit crunch?

Mike Cherry: "it is a phenomenon that has grown over a number of years. In our banking survey in 2007, the communication on what the bank expect banks and vice versa, is that there is a big mis-match. The banks do not communicate well when they turn people down or alternative routes of finance"

1504 BST:

Andrew Love MP: "There's an expecation gap between what they expect from banks and what they actually provide. What's made this more acute in present time?"

Fell: "The big thing that stands out from business user perspective is that they don't perceive diversity or innovation in the products on offer and that's the sort of expectation gap. They want more diversity in the market."

1501 BST: NEXT SESSION TO BEGIN

On the panel until 1600 BST:

Matthew Fell, Director of Competitive Markets, CBI

Mike Cherry, Policy Chairman, FSB

Mike Spicer, Senior Policy Advisor, BCC

Andy Davis, Finance and business writer

1459 BST:

Vicary-Smith: "If there were three things for changes, I'd say end to sales focused culture and remuneration on selling, introduce independent professional standards and then hold individuals personally responsible in order to conduct proper accountability."

1453 BST: McFadden on mortgages: "We have moved from lending feast to a lending famine"

1453 BST:

Dailly: "Frontline staff are not trained and while it's not their fault, it's because the people from the top have not ensured they are trained."

1451 BST:

Dailly: "We understand there will be cost implications to putting in minimum qualification standards in place"

1449 BST: John Thurso MP asks the panel to what extent and how many people in the banking chain should have "set qualifications" that the panel are proposing.

1445 BST:

Farnish: "Regulators need to follow the money and see areas where the banks make money and see how this affect consumers."

Farnish also asks why there isn't a 'Consumer Advocate' at banks and risk directors should be accountable to no one, for example shareholders or executives at the bank and should report directly to the highest person.

1443 BST:

Dailly: "Things like PPI and other mis-selling scandals for interest only mortgages that will be a chicken coming home to roost, having a professional body will resolve a lot of these concerns. With criminal prosecutions, the FSA find it very difficult to find a single person or people responsible."

Vicary-Smith: "If long-term we get a better system in our country, something enshrined in legislation such as minimum qualifications, control, monitoring, redress, This cannot be done by the industry. We tried to let sort it out themselves and we've had Libor fixing, PPI and many other issues."

1440 BST: Banker accountability

Dailly: "At the moment, all we've got is the Chartered Banker Institute which is voluntary, there's no mandatory qualification but every other profession has a industry standards body. If there was something similar then it would rule out confusion over civil or criminal penalities when things go wrong."

1431 BST: Andrew Love MP asks panelists about the OFT inquiry

Vicary-Smith: "There is only one body that can change market structure is the competition commission. So it's better for them to just go straight into this. We are worse in terms of competition from years ago and the competition commission are the only people that can change this."

Dailly: "It would be a shame if another investigation would kick the problem into the long grass again [on OFT investigation], What we need to do is making competition better and we need to challenge the banks and make it easier for new people to come into the markets."

Farnish: "It seems to me that there should be more transparent in terms of fee structure, how does it all work, how much does it actually cost for each action from the banks (in current accounts). At the moment it is almost impossible to have a proper policy debate without this information."

1423 BST:

Dailly and Vicary-Smith are looking to promote a "Duty of Care," through possibly regulation with the Financial Conduct Authority - in the same vein of EU's MiFID.

However Farnish believes that by bringing in new legislation could mean that banks will make it even more difficult for grieved consumers by dragging it through the regulatory bodies and the courts.

1417 BST:

Dailly: "Banks always challenge the FSA on definitions on products, everything from power of attorney to financial products. The banks are always challenging the FSA on these and we think this is wrong. We have been lobbying for the FCA to promote a duty of care for the customers. We have it in EU MiFID, so we should too.

1415 BST:

Vicary-Smith highlights that for a HSBC packaged account, a consumer would have to read through over 160 pages of documents and that as long as banks use tactics like these to confuse customers, mis-selling will continue to happen.

1414 BST: PPI

Farnish: "Normal behaviour would mean that consumers went to banks for a loan. However, usually, especially when they are desperate to get this loan, the salesperson would tack on insurance onto the end (PPI)."

1412 BST:

Vicary-Smith:"Let's not think that the only way they make money is through pernicious charges, but in fact they have a lot of other ways, including Tesco clubcard details."

1410 BST:

Christine Farnish highlights how consumers are paying 'disproportionately' high fees at banks, which has only be exacerbated by lack of transparency in term of fee bundles."

1408 BST: Overdraft charges

Dailly: "Cost of someone looking through a file for the cost. Actually it's a cross-subsidisation. It's not ethical or sustainable because when you look back, the banks have increased and brought in late charges and overdraft fees to bring in more money for the banks.

1405 BST: Sales incentives and packaged bank accounts

Peter Vicary-Smith: "First of all that bear in mind that retail banking has always been profitable throughout a crisis. I think it is offensive and ludicrous that having a monthly fee/incentive will stop mis-selling. It's more a question of culture."

Mike Dailly: "Packaged bank accounts were innovative but now it has meant less transparent and has now left an unethical mess where people don't know what they are being charged for and where the fees are coming from."

1401 BST: McFadden opens the session

"The PBSC is asking to give evidence to this panel on experience but we are not looking for resolutions today."

1356 BST: First session to begin shortly ...

A reminder that:

Peter Vicary-Smith, Chief Executive, Which?

Mike Dailly, Financial Services Consumer Panel

Christine Farnish, Chair, Consumer Focus

will be giving evidence on the: Panel on the consumer and SME experience of banks

1350 BST: More sign up to Bully-Banks conference

You may have all read Paul Adcock's story by now, but it is worth noting as an example of businesses which are claiming to be mis-sold IRSAs.

"Despite UK interest rates being held at a record low of 0.5%, Adcock & Sons is paying an interest rate of 9% on a commercial mortgage, which is generating a bill of just under £80,000 a year. The joint owner of the business, Paul Adcock said that he did not know that the interest rate swap that came with the extra features would have triggered the deal swinging against him. He was sold, he says, a bet on the Bank of England's offered rate not falling below 4.7%.

Since rates have stood at 0.5% since May 2009, he, like many others, has been paying unsustainable amounts on a product that bears little resemblance to the loan he thought he had taken out in the first place. He has had to lay off staff and now says it is unlikely that the business will survive much longer. Adcock says that the Barclays Capital salesman who sold him the contracts had said that the protection would be "free"."

Adcock has since become a prominent member of the Bully-Banks group and was present at the UK Treasury talks recently.

He told IBTimes UK today that the group have had around 400 people sign up to its Birmingham conference this weekend, which will feature Guto Bebb as a speaker.

1325 BST: More MPs championing further debate into mis-selling derivatives

In addition to today's panel, it's worth noting some of the other MPs actions over helping resolution to the potential mass mis-selling of derivatives.

Of course, as we noted at IBTimes UK several times, without a deadline for investigations into redress for companies, it comes as to no surprise that no cases have been publicly announced of a resolution.

The only cases where a SME has found resolution with a bank over IRSAs have, so far, been in out of court settlements.

However, there are a number of MPs that have highlighted the complexity and size of businesses being affected, including Guto Bebb (Aberconwy) (Con) MP.

Catch his speech from 21 June, here.

Here is an exerpt, where Bebb recants trying to help out a constituent and following the possession of the banks transcript:

"My concern, which became apparent from the transcript, was that time and again-on four if not five occasions-during the telephone conversation that was the basis of the legal agreement the bank described the product as a fixed-rate one."

1310 BST: Is the FSA Agreement enough? MPs weighing in harder

It is important to note how quickly the situation has changed since the Financial Services Authority (FSA) findings on banks mis-selling derivatives were published on 29 June.

- It identified "seriously failings" in the way HSBC, Barclays, RBS and Lloyds sold IRSAs to customers.

- It subsequently banned them from selling these products again.

The swift turnaround of the report was commendable, however since then, there has been growing concern over whether the subsequent agreement between the FSA and the banks is "fair."

- Under an agreement with the FSA, the banks are now in charge of leading investigations into all the potentially affected customers with the aid of independent reviewers, who are overseen by the FSA.

- The FSA said that although not all businesses will be owed redress, for those that are, the exact redress will vary from customer to customer and could include a mixture of cancelling or replacing existing products, together with partial or full refunds.

- The banks will be in charge of deciding the level of compensation for each customer individually, should it find that it mis-sold that customer the product.

- there is no deadline for these investigations and forms of redress to be completed.

Businesses, industry experts and MPs have all remarked that more needs to be done.

Recently, IBTimes UK spoke exclusively to Labour's Shadow Financial Secretary to the Treasury Chris Leslie:

"Timeliness is absolutely critical because of many of the small businesses financial health at the moment. I think a lot of these companies that are claiming mis-selling were initially greatly relieved over the FSA findings but now without a deadline in the FSA agreement, they feel let down.

We need to start rebuilding confidence for these companies and that they will be getting a fair redress.

The government can press the FSA to relook at the agreement and I am amazed ministers have not done this more strongly already.

More and more businesses are falling by the way side and I don't understand why these points can't be made more forcefully. This is critical matter that effects public policy, the economy and real people.

I would say, get on with it."

1253 BST: Business Case Studies: "SMEs are not poor losers"

Over the last year or so, IBTimes UK have spoken to a number of businesses that are claiming they have been mis-sold IRSAs.

In nearly every case that IBTimes UK has looked at, the business owners have said that they were:

- Told they were only allowed to obtain a loan with the bank IF they had this "interest rate insurance" package added onto it

- Were not told full explained in 'plain English' what the swap would entail and in some cases only the upside scenario should rates stay high

- Were not told of the 'break costs' should they not want the swap after they had signed

In many of the case scenarios that IBTimes UK has looked at, the swap has been longer than the actual original loan, which experts have said should be 'sure sign' of mis-selling.

In one Midlands business owner's case, he was sold two swaps with a 15 year maturity, however the tenure for his loan expires this year. This means he has to make thousands of pounds of payments to the bank each month, even though he doesn't have a loan "to protect from interest rate rises."

Like many small business owners, he said that he was not explained or shown this and was not told about the break costs until after he signed a thick document. The break cost ended up being nearly half a million pounds.

Another private business owner, who jointly owns the company with his wife, told IBTimes UK today that they have had to pay £7,500 each month on the swap. In total, they have had to pay around £500,000 to date on just swap payments:

"I have had to crash-sell all of my company and personal property portfolio (at loss as you can imagine) to survive last 5 years. The bank is still dragging its feet and apparently they actually have no plans for redress for "simple swaps."

"What beats me is that when the interest rate drops, it is only in times of recession. The rate drops to help the businesses to survive the difficult times when cash flow suffers from the effects of recession. To expect businesses to pay more during such difficult times is the fundamental flaw of the product. The FSA should not have allowed this in the first instance.

The argument that SMEs are being poor losers is wrong on that basis as well as the fact that the selling was forced."

1235 BST: NOT PPI - bit of background on mis-selling derivatives

Before the evidence sessions kick-off, it should be noted just how different PPI is compared with the 'mis-selling derivatives' debacle.

Payment Protection Insurance (PPI):

While banks are paying out compensation to customers over PPI, it should not be compared in terms of scope and scale to interest rate swap agreements.

The PPI product is essentially simple payment protection insurance, also known as credit insurance, credit protection insurance, or loan repayment insurance.

The product is an add-on to a loan, so it just means that you pay a sum each month and should the borrower become ill, disabled, dies, loses a job etc - then the product is designed to help bridge the gap of loss of earnings (if the claim is successful).

Interest rate swap agreements (IRSA):

I cannot stress how different IRSAs are to PPI and thus, resolution through the FSA, banks, Financial Ombudsman, courts require a completely different assessment when it comes to ISRA disputes.

Interest rate swap agreements (IRSA) are contracts between a bank and its customer where typically one side pays a floating, or variable, rate of interest and receives a fixed rate of interest payments in exchange. They are used to hedge against extreme movements in market interest rates over a given period.

Companies that have seen the value of these products move against them as rates fell during the recession now owe banks crippling sums in interest payments each year.

When IBTimes UK spoke to a number of SMEs who are claiming to be mis-sold these derivatives, it is clear that while there are similar themes and trends in terms of mis-selling, every case is completely different.

1220 BST: Where is Bully-Banks?

It does come as a surprise that Bully-Banks is not included in today's line-up.

For those who aren't aware of the organisation, it was set up by Jeremy Roe, who runs a chain of holiday cottages, after he said he fell victim to mis-selling.

The group is independent and is aimed at publicising what has happened so that those small-to-medium enterprises (SMEs) who have been mis-sold interest rate swap agreements (IRSA) know that there are many others in the same situation.

The aim is to help prompt the exchange of information, coordinate a campaign to involve parliament, the FSA and the media and assist in the coordination of legal action.

The group is heavily active in trying to move forward resolutions over mis-selling disputes as the group and members feel they are either being "ignored" by the banks or the FSA agreement with the banks is not enough.

This month, Bully-Banks had met with the UK Treasury to discuss their concerns with MPs, so again, it is odd that a representative, such as Roe, is giving evidence and who would be not only well-versed in first hand experience, but also as a representative of its 700 members ...

EXCLUSIVE: Bully-Banks' New Firm Threatens 700 Lawsuits over Mis-Sold Derivatives

EXCLUSIVE: SME Consortium Meets UK Treasury on Banks' Mis-Selling Derivatives

1216 BST: MPs to question industry experts

Now we have the timetable, it's worth looking at who we have from parliament to grill the experts.

The membership of the panel on the consumer and SME experience of banks is as follows ...

Leader member is:

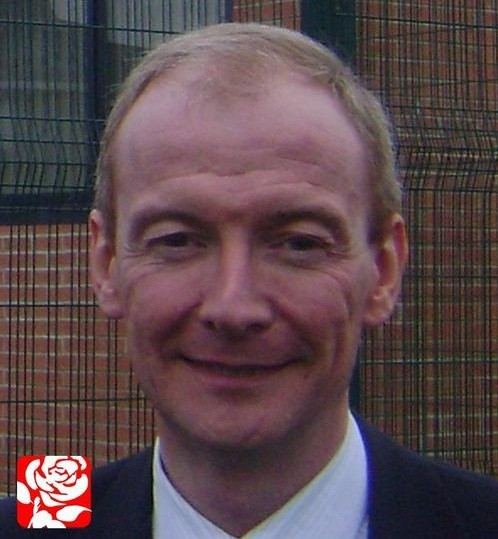

Rt Hon Pat McFadden MP

At first glance, it does seem the right choice for the Wolverhampton South East MP to be charged with the task of finding out the scope and scale of the fallout between the banks and SMEs - especially in light with the mis-selling derivatives scandal.

Unlike Treasury Select Committee hearings with Barclays, following the rigging of Libor, the evidence sessions fall mainly on independent consumer watchdogs, key industry groups such as the CBI and FSB, as well as, industry experts that have worked in banking themselves, such as Sachdev.

Only two days ago, McFadden travelled up to Birmingham to take part in a round table discussion event hosted by Birmingham Chamber of Commerce, attended by small and medium-sized businesses to hear, first hand how SMEs were being effected by the mis-selling derivatives.

He also wrote an article that is fully immersed in reclaiming the old way of highstreet banking:

The full article can be read here.

Also part of the panel:

Mark Garnier MP

Andrew Love MP

Rt Hon Lord McFall of Alcluith

John Thurso MP

1203 BST: Parliamentary Commission on Banking Standards to conduct evidence sessions

The newly constructed Parliamentary Commission on Banking Standards, in the wake of the Libor crisis, is to hear evidence from a number of independent experts and consumer watchdogs over the relationship between consumers and SMEs and the banks.

All of these evidence sessions are taking place in the Grimond Room in Portcullis House in Westminster.

Here is the timetable:

1400-1500 BST

Peter Vicary-Smith, Chief Executive, Which?

Mike Dailly, Financial Services Consumer Panel

Christine Farnish, Chair, Consumer Focus

1500-1600 BST

Matthew Fell, Director of Competitive Markets, CBI

Mike Cherry, Policy Chairman, FSB

Mike Spicer, Senior Policy Advisor, BCC

Andy Davis, Finance and business writer

1600-1630 BST

Abhishek Sachdev, Vedanta Hedging

1200 BST: Welcome to the Live Blog

Good afternoon and welcome to a special live Mis-selling Derivatives Scandal live blog.

Lianna Brinded, senior business reporter at IBTimes UK, will be blogging in the run-up and during the Parliamentary Commission on Banking Standards Joint Select Committee hearing that is set to commence at 1400 BST on the relationship between the banks and consumers, following the mis-selling derivatives scandal.

© Copyright IBTimes 2025. All rights reserved.