No Improvement in Bank Loans for 90% of Small Businesses

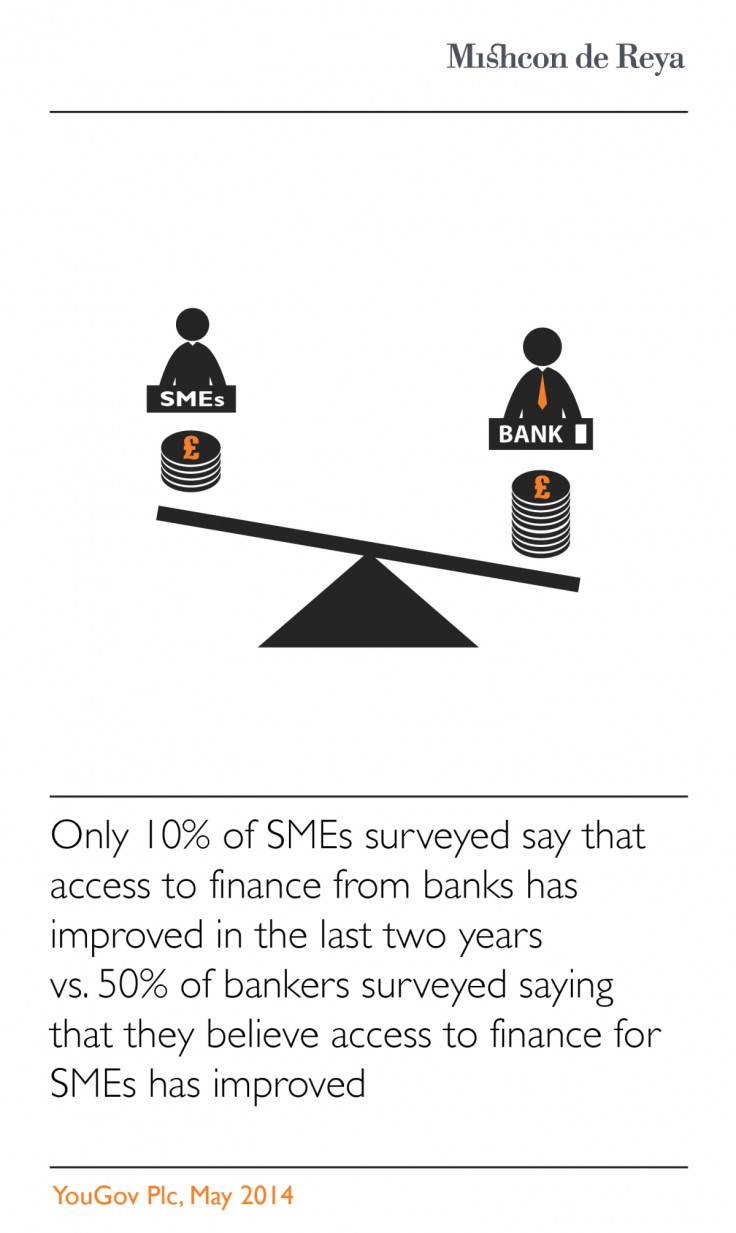

Only 10% of small and medium sized enterprises said getting loans from banks has become easier following the establishment of the Parliamentary Commission on Banking Standards two years ago, according to a survey.

However 50% of bankers surveyed by law firm Mishcon de Reya said they believed access to loans for SMEs had improved.

One of the parameters of the commission was to make it easier for small businesses to get loans, but only 8% said that the way banks handle the lending needs of SMEs had improved in the last year.

With these figures in mind, it is unsurprising to see that 67% of SMEs say that they have not received a loan from their bank in the last year.

Despite the fact that SMEs feel that they are treated poorly by their bank, the majority (58%) have not bothered to find an alternative lender.

Diametrically opposing these revelations, exactly half of bankers surveyed by law firm Mishcon de Reya said they thought that SMEs now have it much easier when they're looking for loans. And 38% said that the way banks handle the lending needs of small businesses has improved.

Masoud Zabeti, head of banking and finance at Mishcon de Reya, said: "What is most worrying about the latest findings is that the majority of small businesses we spoke to have not even attempted to secure finance from their bank, and have given up on any attempt to negotiate with them.

"Despite high profile attempts to encourage a change of culture amongst the banking industry, these latest findings suggest that change has not gone far enough. There still appears to be an ongoing lack of awareness amongst businesses of their rights, or of the legal obligations of the banks," said Zabeti.

© Copyright IBTimes 2025. All rights reserved.