Philip Hammond sticks to script in his first Autumn Statement

Chancellor delivers expected increase in living wage, corporate tax cuts and ditches plans for budget surplus by 2020.

Philip Hammond stuck to the script when he delivered the first Autumn Statement of his career on Wednesday, cracking jokes but failing to deliver any meaningful surprise as he outlined his fiscal plan.

The biggest shock, in fact, came at the fag end of Hammond's hour-long speech as the former foreign secretary announced his first Autumn Statement would also be his last, with the event set to be replaced by a Spring Statement from 2018.

Prior to that, Hammond had ditched George Osborne's commitment to return government finances to a surplus by 2020, indicating the government will publish a draft charter for budget responsibility with three fiscal rules.

"First, the public finances should be returned to balance as early as possible in the next parliament, and in the interim cyclically adjusted borrowing should be below 2% by the end of this parliament," he said.

"Second, public sector net debt as a share of GDP must be falling by the end of this parliament, and third, that welfare spending must be within a cap set by the government and monitored by the Office for Budget Responsibility."

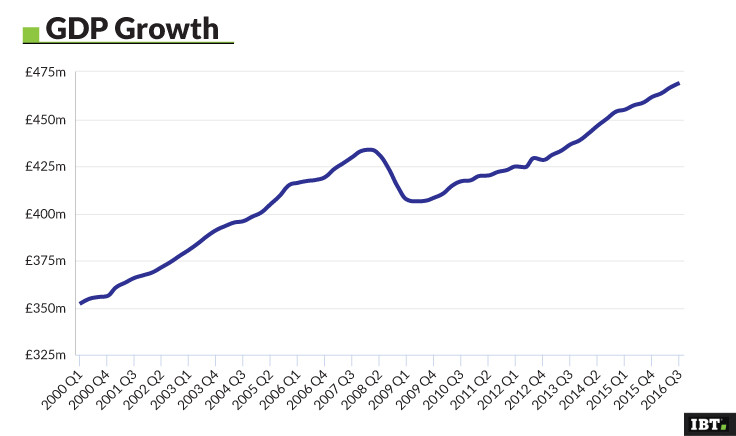

The chancellor added that debt will rise until 2018-19, after which it is expected to fall for the first time since 2002, and continue falling thereafter.

He added the Office for Budget Responsibility forecast economic growth of 2.1% for 2016 and 1.4% in 2017, down from an initial estimate of 2.2%. Meanwhile, the UK economy will expand 1.7% in 2018, rather than the expected 2.1% and by 2.1% and 2.0% in the following two years. The original forecast for 2019 and 2020 called for growth of 2.2% and 2.1% respectively.

"It's worth noting that there is a lot of guess work going on given Brexit, there are so many unknowns that these forecasts may need to be quite fluid," said Fiona Cincota, market analyst City Index.

"Post Brexit we don't even know what type of relationships will be formed, if we are looking at a hard or soft Brexit and therefore what immigration inflows will be and immigration inflows are data that make up part of these projections."

Away from growth forecast, Hammond reiterated the government will work to confront Brexit challenges head on and help the country become more productive. He highlighted Britain was severely behind the US and Germany in terms of productivity, which translated into British workers working longer hours for lower wages.

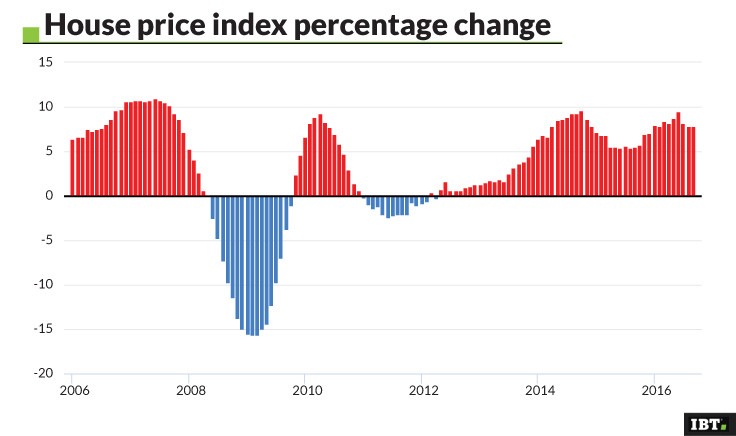

The chancellor also confirmed funding for 40,000 new homes and announced a large-scale pilot to give the right to buy to housing association tenants.

"We will focus government infrastructure investment to unlock land for housing with a new £2.3bn Housing Infrastructure Fund to deliver infrastructure for up to 100,000 new homes in areas of high demand," he said.

However, the biggest shake-up delivered to the housing market was his decision to abolish fees that letting agencies charge tenants.

"We've seen these fees spiral, despite attempts to regulate them, often to hundreds of pounds," Hammond told MPs in the House of Commons. "This is wrong. Landlords appoint letting agents so landlords should meet their fees."

Rebecca Wilkinson, corporate tax manager at accountancy firm Menzies LLP, warned that while the move would be welcome, it could also translate in higher rental costs being passed onto tenants.

"While reducing the burden of costs on tenants where possible is in everyone's best interests, 'letting fees' are designed to cover landlords' out-of-pocket expenses for checking tenant references and credit histories, as well as running immigration checks and the decision to ban fees could mean that corners are cut," she explained. "These costs will also become payable by landlords and rents could rise as a result."

Meanwhile, the chancellor moved to calm the nerves of business leaders by insisting that the UK would remain a low-tax economy despite the country's Brexit vote. He confirmed corporation tax will fall to 17% from 20% by 2020 as planned, which the government said would be the lowest overall rate of corporate tax among the G20 nations.

"My priority as Chancellor is to ensure that Britain remains the number one destination for business – creating the investment, the jobs and the prosperity to protect our long-term future, " he said.

He also said he would give small businesses in rural areas a tax break worth up to £2,900 per year by increasing the Rural Rate Relief, while the National Living Wage will increase from £7.20 per hour to £7.50 in April next year, which Hammond said is a pay rise of £500 a year to the average full-time worker.

"The latest increase will be felt by more employers and at a greater cost as more employees are now at the National Living Wage level,"John Harding, employment tax partner at PwC said.

"The actual cost will vary across industries, with retailers, facilities management, care homes and the hospitality industry especially impacted."

Overall, however, there were no major surprises from the chancellor and, perhaps, we ought not to expect any. After all, he began his speech by informing MPs he was nowhere near as adept at pulling rabbits from hats as his predecessor.

© Copyright IBTimes 2025. All rights reserved.