Autumn Statement as it happened: Key points from Philip Hammond's first fiscal plan

The chancellor abandons plans to run budget surplus by 2020 and says Britain's economy will grow 2.1% this year.

UK Chancellor Philip Hammond has ditched his predecessor George Osborne's commitment to return government finances to a surplus by 2020.

In the government's first major economic announcement since the Brexit vote, Hammond also unveiled lower economic growth forecasts in his first Autumn Statement as Chancellor on Wednesday (23 November).

Here are the key points of Hammond's speech:

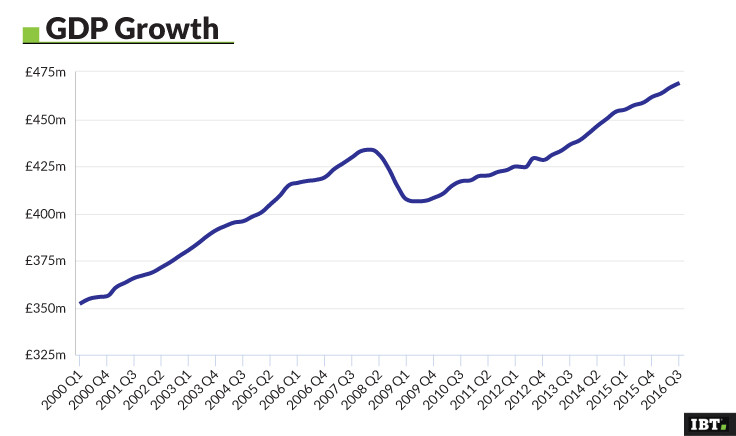

- Britain's economy is forecast to grow 2.1% for 2016 and 1.4% in 2017.

- The National Minimum Wage will raise to £7.50 an hour from April 2017.

- The government has abandoned plans to run a budget surplus by 2020 and will instead borrow £59bn next year, £46.5bn in 2018/19 and £21.9bn in 2020.

- Agency letting fees will be scrapped.

- The Autumn Statement will be abolished, while the budget will be moved to the autumn from March.

That concludes our live coverage of the Autumn Statement for today. Thanks very much for following and remember you can more in-depth analysis of today's events by visiting our dedicated Autumn Statement page.

In the lead-up to the Autumn Statement, much was made of the impact Hammond's speech would have on the so-called JAMs, families that are "Just About Managing." However, Liberal Democrats leader Tim Farron has claimed it is the government that is just about managing.

"The official figures have revealed a £220bn Brexit black hole - hundreds of billions taken out our economy when we need it most," he said.

"Given how bad the outlook is, it's no wonder the Chancellor doesn't want to have to do another Autumn Statement."

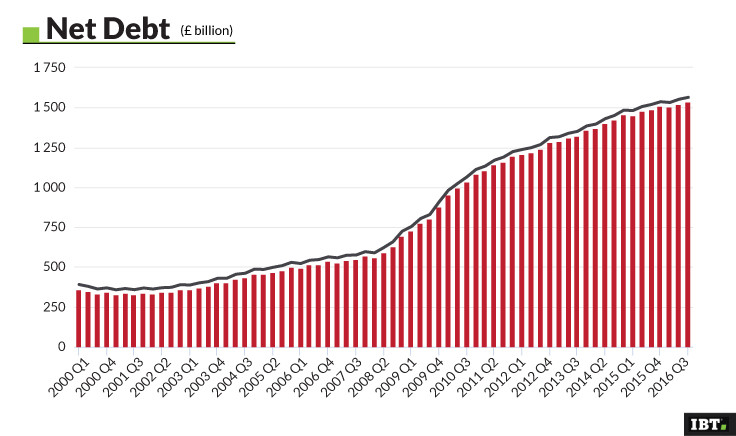

The £220bn figure is the projected increase in national debt by the end of parliament, which would bring the total to £1.9trn.

"We are seeing a drop in tax receipts of £8.2bn over the next two years alone," Farron added.

"That's enough to fund over 330,000 nurses. Sadly now patients will pay the price. There is also nothing for public sector workers, our doctors, teachers and armed forces, who deserve a proper pay rise."

My colleague Roger Baird has rounded-up what the Autumn Statement will mean for British businesses and the long-term implications of Hammond's fiscal plan.

"Chancellor Philip Hammond moved to calm the nerves of business leaders by insisting that the UK would remain a low-tax economy despite the country's Brexit vote.

He confirmed in the Autumn Statement that corporation tax will fall to 17% from 20% by 2020 as planned, which the government said would be the lowest overall rate of corporate tax among the G20 nations."

Carolyn Fairbairn, the director general of the Confederation of British Industry said the chancellor has prioritised a pragmatic down payment on future productivity growth.

"His emphasis on R&D, housing and local infrastructure will help businesses in all corners of the UK to invest with greater confidence for the long-term, during turbulent times," she said, adding the plans will be warmly welcomed.

"These measures must now be translated into action. That means tarmac, tracks and telecoms being laid, and clear, deliverable timetables for major projects – only then will they act as a catalyst for investment, jobs and growth.

"Reducing the frequency of fiscal events along with the commitment to stick with the tax roadmap will provide stability for businesses. Importantly, the new fiscal rules provide the Government with welcome flexibility, while remaining prudent, in uncertain times.

"The Government is right to accept the independent Low Pay Commission recommendations, as firms want to see affordable rises in the minimum wage that protects the low paid and avoids damaging job prospects.

"The Chancellor should keep a watching brief on the challenges created by higher inflation and uncertainty weighing on near-term business investment."

Here is some more political reaction on the Autumn Statement by our colleague Ian Silvera.

"Philip Hammond set a no-frills tone as he made a swift exit from Number 11 and jumped into his ministerial car before he unveiled the Autumn Statement on Wednesday. It was a sign of things to come as the Chancellor abandoned the pomp and circumstance of photo-friendly George Osborne, who sat by Ken Clarke as Hammond took to the dispatch box."

This graphic from the Office for Budget Responsibility offers a quite handy recap of what has unfolded today.

November 2016 forecast: at a glance #AutumnStatementhttps://t.co/Bf0hSKksyU pic.twitter.com/onnF8SnQPr

— OBR (@OBR_UK) November 23, 2016

AXA UK's chief executive, Amanda Blanc has criticised the government's proposals to increase insurance premium tax from 10% to 12%.

"This hike – the third in the space of 18 months – represents an unwarranted attack on millions of people simply looking to protect themselves, their families and their key assets.

"This is a classic case of the Government giving with one hand, in the form of whiplash reforms, and taking with another. The country is already underinsured and ever rising insurance taxation could have the unintended consequence of making this situation even worse."

Tom Stevenson, investment director for personal investing at Fidelity International, says that while we are not looking at a 1930s style building boom, there were significant sums committed in the Autumn Statement to support the construction of new homes and improve infrastructure.

"Housebuilders could gain, although the reaction from shares in the sector has been mixed, if not slightly negative," he adds.

"Things look better for companies supporting and exploiting construction in various ways – tool-makers, engineers, repair providers.

"Infrastructure investment companies could win if they can access the projects receiving a state boost while commitments to expanding internet coverage should help companies providing internet connections and network maintenance.

"Losers included estate agencies, who were told the admin fees they charge tenants are about to be regulated, while insurers suffered an increase in Insurance Premium Tax that makes their products more expensive. Employers of large, low-paid workforces will have to pay staff more than planned following the rise in the National Living Wage."

The Office for Budget Responsibility has also estimated the impact of borrowing directly related to Brexit, as explained by Resolution Foundation head of research Duncan Weldon.

VERY IMPORTANT OBR assumptions pic.twitter.com/0t7AHV36x2

— Duncan Weldon (@DuncanWeldon) November 23, 2016

Also important. OBR have done this... pic.twitter.com/shawsMd0GG

— Duncan Weldon (@DuncanWeldon) November 23, 2016

OBR put direct Brexit-related additional borrowing at £58.7bn over 6 years. Or, if you prefer, "£188mn a week".

— Duncan Weldon (@DuncanWeldon) November 23, 2016

Those thinking the government's forecast for borrowing were bad better brace themselves for the worst, as the latest economic and fiscal outlook from the Office for Budget Responsibility (OBR) makes for some grim reading.

The figures show Britain's national debt is expected to hit £1.945trn by 2019-20, the end of the current parliament, and continue climbing to £1.952 by 2021-22.

Wow. OBR forecasts £220bn increase in national debt by end of parliament to staggering £1.945 trillion. Huge Brexit impact

— Robert Peston (@Peston) November 23, 2016

"We expect further upward revisions to the borrowing forecasts in future as growth falls short of the OBR's expectations and as the Government backslides on the big consolidation planned for 2019/20, just before the next election," said Samuel Tombs, chief economist at Pantheon Macroeconomics.

Tina Hallett, government and public sector leader at PwC, said the Autumn Statement is a first step in the right direction, although she warned that there was still a long way to go to achieve Theresa May's aspirations of a "country that works for everyone".

"Though the Prime Minister and Chancellor have changed, the problems the country is facing have not," she said.

"For public finances to be repaired, including a higher stream of tax revenues, we also need real incomes to grow which ultimately requires higher productivity. But income growth is meaningless if the cost of living also grows and the people 'just about managing' or not managing at all feel no difference day-to-day.

"Today's announcement does recognise the need for people to feel investment, for example, a cash injection into small infrastructure schemes, like road repairs, quickly make a difference to the daily commute.

"While this type of investment produces a 'quick win' for the government, they still need to address the underlying issues which keep many families living in poverty, struggling to manage. The Poverty Premium - where the poorer you are, the more likely you are to pay higher costs for goods and services - is an example of a fundamental problem which we need to address to help prevent a deepening of the social mobility challenge in this country."

Here is the Office for Budget Responsibility's reaction to the Autumn Statement.

"The Chancellor has relaxed his fiscal targets to make space for a modest infrastructure spending giveaway over the next five years," it says.

"A weaker outlook for the economy and tax revenues – and these new spending commitments – mean that the budget is no longer expected to return to surplus in this Parliament, with a £21bn deficit remaining in 2020-21."

"Public sector net borrowing is now expected to fall more slowly than we forecast in March, primarily reflecting weak tax receipts so far this year and a more subdued outlook for economic growth as the UK negotiates a new relationship with the European Union.

#AutumnStatement OBR points out past fiscal rules breached, new ones focused on "structural deficit" so easier to meet than overall deficit pic.twitter.com/E8WOfiED7o

— Linda Yueh (@lindayueh) November 23, 2016

In case you have missed something, you can read the Autumn Statement in full here.

Quite surprisingly, Hammond says this is his first and his last autumn statement, as he is abolishing it and no other major economy makes hundreds of changes every year.

Next year's spring budget will be the final spring budget, with an autumn budget to follow thereafter ahead of the start of a new financial year.

Following that, there will be a spring statement to respond to the forecast from the Office for Budget Responsibility but there will be no major fiscal event.

Basically Philip Hammond has swapped the #AutumnStatement and Budget around

— Asa Bennett (@asabenn) November 23, 2016

Philip Hammond is axing the Autumn statement and replacing it with a Budget. The March Budget will be replaced with a statement. All clear?

— Christopher Hope (@christopherhope) November 23, 2016

UK chancellor Philip Hammond has ditched predecessor George Osborne's commitment to return government finances to a surplus by 2020.

In his first major economic announcement since the Brexit vote, Hammond also unveiled lower economic growth forecasts in his first Autumn Statement as Chancellor on Wednesday.

Personal allowance will rise to £11,500 in April 2017, Hammond says, adding 28m people have had their income tax cut over the last six years and 4m people have been taken out of income tax altogether over the same period.

The chancellor adds the government remains committed to taking the allowance up to £12,500 by the end of this parliament, while the 40p threshold will rise to £50,000 over the same period.

Tax threshold increases will remain in line with manifesto commitment - £12,500 and £50,000 by 2020. No acceleration #AutumnStatement

— Kamal Ahmed (@bbckamal) November 23, 2016

Hammond claims the current government has done more than any other to tackle tax avoidance and evasion, bringing Britain's tax gap among the lowest worldwide. A new penalty for people who use a tax avoidance scheme will be introduced, he says, adding the new tax avoidance measures will save £2bn over the forecast period.

Insurance premium tax will rise from 10% to 12%, but the government will change the rules on whiplash compensation, which will save drivers £40 a year on average. Hammond adds from April next years, employers and employees who use benefits in kind schemes will pay the same tax as everyone else. However, there will be exceptions, including for childcare and cycling.

Bye-bye to to most salary sacrifice schemes...only raises c. £100m & likely to be unpopular with voters. #AutumnStatement

— Dharshini David (@DharshiniDavid) November 23, 2016

Aligning employer and employee National Insurance rates - so employers will pay more. #autumnstatement

— Helen Barnard (@Helen_Barnard) November 23, 2016

Public spending has a proportion of GDP has fallen to 40% in the six years since the Coalition government came to power, compared to 45% under the previous Labour government, Hammond says.

He adds the Conservative party has showed controlling spending and having world class services are not mutually exclusive and that departmental spending limits will remain in place, before rising along inflation in 2021-22.

New borrowing forecasts are a cumulative £122B higher over the next five years #AutumnStatement pic.twitter.com/e81xHZKaZH

— Samuel Tombs (@samueltombs) November 23, 2016

Hammond admits investment has been focused on London for far too long and points out no other major economy is burdened by such a gap between the productivity of its capital and its other cities.

As such, the government will work on address the disparity between London and the rest of the country, beginning with an evaluation that will allow the east Midlands rail hub to go ahead.

The chancellor adds the government remains committed to devolution and new city deal for Stirling is being negotiated.

As widely expected, Hammond stresses the need for the UK to be a world-leader in 5G technology and the government will commit over £1bn to be invested in digital infrastructure.

From April next year, business rates relief will be implemented on investment in new fibre technologies, while spending on economic infrastructure will rise to between 1% and 1.2% of GDP from 2020, compared to the current 0.8%.

“…injecting an additional £400 million into venture capital funds through the @BritishBBank” #AutumnStatement pic.twitter.com/yVKFz0nBut

— HM Treasury (@hmtreasury) November 23, 2016

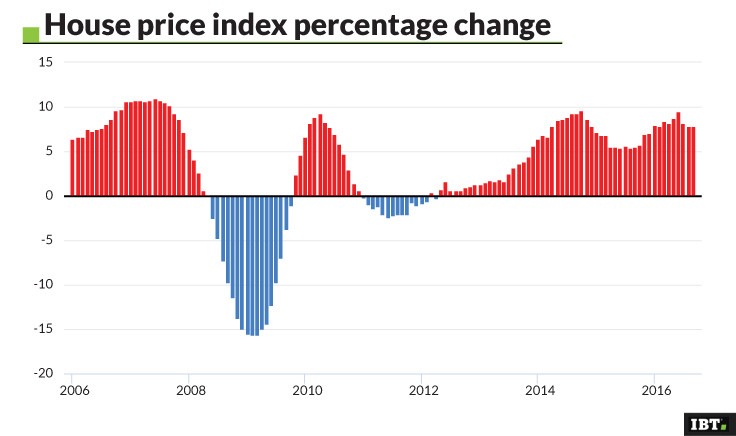

On the subject of home ownership, Hammond admits the goal of owning a property remains out of reach for a number of people living in Britain. Infrastructure spending will be focused where it can encourage new development and he adds the government will implement new funding for the housing sector.

New £2.3bn Housing Infrastructure Fund for infrastructure for up to 100,000 new homes in high demand areas #AutumnStatement pic.twitter.com/Bnp0LUYM5c

— HM Treasury (@hmtreasury) November 23, 2016

Hammond explains the government will form a new national productivity investment fund worth £23bn, which will focus on innovation and infrastructure and, as expected, investment in research and development will rise by £2bn a year by the end of the decade.

The chancellor adds that Britain lags behind the US and Germany in terms of productivity by about 30 points, which means longer working hours and lower wages for British workers.

A summary of the fiscal rules announced by the chancellor.

Chancellor: Today I am publishing a new draft Charter for Budget Responsibility, with 3 new fiscal rules #AutumnStatement

— HM Treasury (@hmtreasury) November 23, 2016

Fiscal rule 1: borrowing should be below 2% by the end of this parliament #AutumnStatement

— HM Treasury (@hmtreasury) November 23, 2016

Fiscal rule 2: Public sector net debt as a share of GDP must be falling by the end of this parliament #AutumnStatement

— HM Treasury (@hmtreasury) November 23, 2016

Fiscal rule 3: Welfare spending must be within a cap, set by the government and monitored by OBR #AutumnStatement

— HM Treasury (@hmtreasury) November 23, 2016

Hammond adds the government will borrow approximately £68.2bn this year and £59bn in 2017. Thereafter, he forecast Britain will borrow £46bn and £21bn in 2018-19 and 2019-20 respectively, with the figure set to drop to £20.7bn in 2020-21 and to £17.2bn in 2021-22.

Government will still be borrowing £20.7bn in 2019-20 - goodbye to the surplus #AutumnStatement pic.twitter.com/9BsYLwZFZp

— Ben Chu (@BenChu_) November 23, 2016

As expected, Hammond has shelved his predecessor's plans to run a budget surplus by 2020. He adds the government is publishing a new set of rules and here the key points.

- Hammond says the government aims to get the budget in surplus in the next parliament, and to bring borrowing down to 2% by the end of this parliament.

- The government aims to get net debt to decline by the end of this parliament.

- Hammond adds the governmen is also committed to keep welfare spending below a limit.

The strength and resilience of the British economy have confounded observers since the Brexit vote, Hammond says.

He adds growth is forecast to be 2.1% this year, and 1.4% next year, due to lower investment and weaker demand, which have been triggered by higher inflation and increased uncertainty.

The economy is forecast to grow by 1.7% in 2018, and by 2.1% in the following two years, before then slowing to 2% in 2021.

Hammond says he is determined to build an economy that works for everyone, adding the Brexit vote has increased the need to address economy's weaknesses and the government is determined to confront the "challenges head on".

Hammond also pays tribute to former chancellor George Osborne, although he admits his style will be markedly different to that of his predecessor.

Hammond makes a rather good joke. Compares his talent for pulling rabbits out of hats to Boris's for taking balls from back of scrums

— Patrick Kidd (@patrick_kidd) November 23, 2016

Analysts have suggested the pound could rally should the Autumn Statement include plans to boost investment.

"Because of Brexit, [Philip] Hammond will unleash a spending spree to help support the economy," said Fawad Razaqzada, market analyst Forex.com

"This could very well support the pound, which is lower across the board at the time of this writing [12.17pm GMT]."

However, he warned the pound could take the opposite direction, should the chancellor refrain from announcing any major changes.

"The bigger surprise in my view would be if it contained no bold measures to boost the economy," he added.

"If so, the pound could come under further pressure."

Some have suggested Hammond's speech will be much shorter than George Osborne's and this tweet seems to point in the same direction. If confirmed, the news would be undoubtedly very welcome by journalists and analysts.

I'm told the #AutumnStatement document, ordinarily 100 pages, is just 64 pages long - half the length it was in 2013

— Faisal Islam (@faisalislam) November 23, 2016

Approximately 200 people are currently conducting a pro-Brexit demonstration outside Parliament. It is fair to say they have picked the right day in terms of media coverage.

Outside Parliament 200 protesters shout "What do we want? Brexit! When do we want it? Now!" #AutumnStatement pic.twitter.com/LVg5g5APK6

— Christopher Hope (@christopherhope) November 23, 2016

Prime Minister's Questions are about to get underway, followed by Hammond's big moment at approximately 12.30pm (George Obsorne kicked off his speech at 12.33pm last year).

Meanwhile, here is a reminder of just how much inflation expectations have changed over the last four months.

Here's that inflation graphic that @bbckamal just used on our #AutumnStatement programme pic.twitter.com/PZHGx0XXNK

— DailySunday Politics (@daily_politics) November 23, 2016

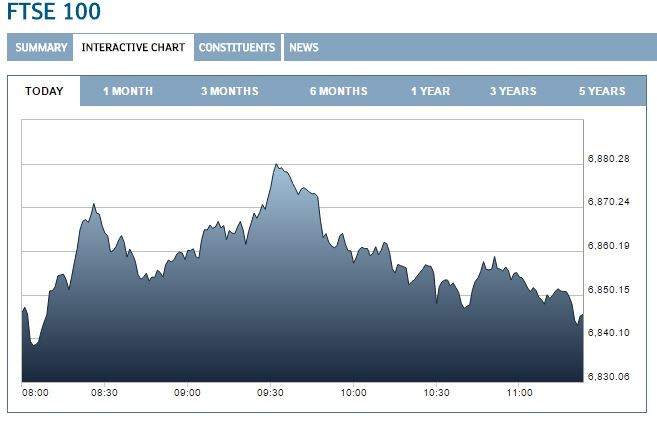

UK stocks have shown little signs of nervousness ahead of the Autumn Statement and analysts expect the trend to continue.

"Philip Hammond is not likely to announce any blockbuster measures this afternoon, with the chancellor keen to send a reassuring message to markets," said Chris Beuachamp, market analyst at IG.

"As a result, we will just have to sit through an afternoon of tinkering around the edges of the UK economy. Now, more than ever, the UK's fate rests far outside the control of either Nos 11 or 10 Downing Street."

Philip Hammond will deliver his speech in an hour. You can watch it live here.

The Chancellor will give his #AutumnStatement to the @HouseofCommons at 12:30pm - watch it here: https://t.co/ZuHw0bGE3j pic.twitter.com/nSoMQuwhg6

— HM Treasury (@hmtreasury) November 23, 2016

Prime Minister Theresa May has had this to say about the Autumn Statement.

.@theresa_may tells Cabinet "balanced & prudent" #AutumnStatement shows Govt "on side of ordinary working ppl struggling to make ends meet"

— Andrew Woodcock (@AndyWoodcock) November 23, 2016

The chancellor has just left Downing Street and, surprisingly, has not posed outside number 11 with the traditional red box.

Early tone setter from Hammond as he refuses to pose with red box outside Number 11 #AutumnStatement #AS2016

— Ian Silvera (@ianjsilvera) November 23, 2016

Philip Hammond has said the Autumn Statement will be focused on preparing and supporting the economy.

My #AutumnStatement today is focused on preparing & supporting the economy as we begin writing a new chapter in our country’s history

— Philip Hammond (@PHammondMP) November 23, 2016

Torsten Bell, director of the Resolution Foundation think-tank, has warned families on small income are likely to be the "big losers" over the next couple of years, despite the chancellor's pledge to help low earners.

That is down to the Treasury's decision to amend the taper rates to improve the impact of universal credit cuts.

Here's the family impacts - single parents still lose up to £2800 from work allowance cuts while some only gain up to £200 via 2% taper cut pic.twitter.com/HTkwT7uRPl

— Torsten Bell (@TorstenBell) November 22, 2016

This is the ongoing impact of tax and benefit plans being rolled out across the rest of this Parliament - not a pretty sight pic.twitter.com/8Un5M2AP5N

— Torsten Bell (@TorstenBell) November 22, 2016

Labour's Shadow Chancellor John McDonnell has delivered a scathing verdict ahead of the chancellor's speech.

"If this Autumn Statement is supposed to relaunch the Conservative party on the side of workers, then it has already failed," he says.

"Some working families, who will have lost as much as £2,500 a year, might only be getting back as little as £150 in this Statement. "It appears that Philip Hammond not only takes with one hand, he now pretends to give back with the other."

ICYMI: @johnmcdonnellMP sets out the three tests we’ve set the Tories for their #AutumnStatement today. RT if you're with us ↓ pic.twitter.com/JLe8v44w38

— The Labour Party (@UKLabour) November 23, 2016

Meanwhile, Labour leader Jeremy Corbyn has highlighted the overwhelming majority of savings pushed through in the last budget came at the expenses of women.

As of the last Budget, 86% of Tory savings through tax & benefit changes since 2010 came from women #AutumnStatement https://t.co/xiKoZLo90O

— Jeremy Corbyn MP (@jeremycorbyn) November 23, 2016

Away from the sticky topic of JAMs - see what we did there? - and onto the subject of wages.

TUC general secretary Frances O'Grady has urged the government to implement a fiscal plan that will boost workers' salaries.

"A raise to the national minimum wage for over-25s will help some low-paid workers," she said.

"But the government must also take the opportunity to boost the pay of hard-pressed nurses, teachers, firefighters and home helps, who face ten years of flatlining pay."

6 ways Philip Hammond could make today's #AutumnStatement work for everyone. More at https://t.co/BCY85L9nI8 pic.twitter.com/4l56X4dfUc

— TradesUnionCongress (@The_TUC) November 23, 2016

We might yet be proved dramatically wrong but, as yet, there is little doubt that the buzzword of the Autumn Statement will be "JAMs", the acronym that indicates families that are "Just About Managing".

However, with further cuts possibly on the way, could we see more gastronomically-related financial puns? Someone certainly seems to think so.

Next we have MARMALADE: Middle Aged, Rather More Affluent, Living A Dream Existence #AutumnStatement

— Jane Merrick (@janemerrick23) November 23, 2016

Then the PRESERVES: Pension-Rich, Everything Saved Early, Retirement Vacationers, Equity-Savvy. #AutumnStatement

— Jane Merrick (@janemerrick23) November 23, 2016

Approximately £50m has been wiped off the combined value of Foxtons and Countrywide in just under three hours of trading this morning. ETX Capital Neil Wilson said plans to ban letting agencies from charging fees to tenants is a "hammer blow to embattled estate agents"

"Passing on the cost to landlords could drive down fees by improving competition, although estate agents claim they make no money from fees," he said.

"Estate agents have suffered since the Brexit vote – shares in Foxtons are still trading down around 30% from their pre-referendum level amid falling client activity."

However, Alan Ward, chairman of the Residential Landlords Association, warned tenants could end up paying higher rental costs followng the reforfm.

"Agents' fees have to be paid by somebody. If any extra fees are passed on to landlords, tenants will end up paying them forever as market rents will increase," he says

Most are welcoming the government's plan to ban letting fees, but housing minister Gavin Barwell dismissed the prospect as a "bad idea" as little as two months ago.

.@KateAndrs is right: Hammond's letting fees ban attacks symptoms, not causes of the housing crisis #AutumnStatementhttps://t.co/eqO3Yo93s2

— IEA (@iealondon) November 23, 2016

Prime Minister Theresa May was not a fan of the idea either as she voted against it in 2014.

Possible changes to Britain's corporation tax have been one of the main points of speculation this week, after Theresa May announced the government plans to cut corporation tax. Speaking at the annual CBI conference on Monday (21 November), the Prime Minister outlined her support for free markets and confirmed the levy is set to fall from 20% to 17% by 2020.

However, with President-elect Donald Trump promising to slash the US rate from 40% to 15%, the UK could follow suit.

Hammond is unlikely to announce further cuts to the tax but Vince McLoughlin, partner at business, tax, and advisory firm, Russell New urged the chancellor to change his approach.

"Now more than ever the government needs to ensure UK remains an attractive proposition for investors," he said.

"We are in a vulnerable position, there's no doubting that. Competitive rates of tax should continue to help the UK be the destination of choice for international businesses.

"This would ensure Britain remains top of the league when it comes to attracting investment. Multinationals employ thousands of staff in the UK and further tax breaks such as this will only give them more room in which to expand and create more jobs and provide yet another boost to our economy."

City analyst David Buik has warned against expecting too much from Philip Hammond. In fact, he argued, the chancellor has very little room for movement.

"His hands are tied," Buik said.

"This country's overall debt stands at £1.64trn– the equivalent of £25,000 per person! With debt rising and the possibility of a £25bn back hole in the borrowing requirement next year and the press's obsession that it will be £100m over five years, if he insists on fiscal discipline, there will be rich pickings.

"It will be all bout stimulating business and jobs. The drop in Corporation Tax to 17% next year is likely to be confirmed."

The ban on letting fees is expected to be one of the most eye-catching points of the Autumn Statement and has been met with a mixed response so far. Rebecca Wilkinson, corporate tax manager at accountancy firm Menzies has warned that the ban will be a sore point for landlords and how the ban could lead to rise in rent to cover costs.

"This is another body blow for buy-to-let landlords at a time when they are already reeling from other recent tax changes," she said.

"While reducing the burden of costs on tenants where possible is in everyone's best interests, 'letting fees' are designed to cover landlords' out-of-pocket expenses for checking tenant references and credit histories, as well as running immigration checks and the decision to ban fees could mean that corners are cut. These costs will also become payable by landlords and rents could rise as a result.

"The timing of the ban on letting fees is going to be a sore point for buy-to-let landlords, coming on top of other recent tax changes including increases in stamp duty, a restriction on interest rate relief and the removal of wear and tear allowance."

George Osborne delivered a few Autumn Statements in his career and while his plans to run a budget surplus by 2020 have long been scrapped by Philip Hammond, the former chancellor had a message for his successor.

Very best wishes to my friend @PHammondMP as he delivers his first Autumn Statement today & helps UK prepare for challenges ahead

— George Osborne (@George_Osborne) November 23, 2016

Philip Hammond is not due to speak until 12.30pm, but political reactions are already coming thick and fast. The chancellor will fail to give a clear plan for post-Brexit prosperity when he unveils, Labour has warned.

Shadow City minister Jonathan Reynolds told IBTimes UK that Hammond's proposals, including a change to the taper rate – how quickly benefits are withdrawn – for Universal Credit, is "very poor" on those who are "just about managing" (JAMs).

"The taper rate no way compensates for the reduction in work allowances in Universal Credit still going ahead," he said.

"And there is no big change on investment, which is where Labour and the Confederation for British Industry all agree. Fiscal rules must allow for serious investment, rather than gimmicks."

Housebuilders are set to receive a boost from the Autumn Statement, with plans to build 40,000 new affordable homes in England, the government says.

However, the picture for letting agencies promises to be far gloomier as tenants renting from private landlords will no longer have to pay upfront letting fees. The move has already hit the major rental agencies in Britain, with Foxtons shares plunging by 10% at the start of trading, with Countrywide and LSL Property down 5% and 6% respectively.

Foxtons shares down as much as 11 percent in London -- no more nickel-and-diming agency fees for them.

— Matthew Campbell (@MattCampbel) November 23, 2016

The pound has edged lower ahead of the Autumn Statement, and it is currently trading at $1.2381 and €1.1670.

FXTM research analyst Lukman Otunuga has warned that Philip Hammond's speech could trigger further volatility in the currency market.

"With the sensitive Brexit situation still a dominant theme in the markets, today's Autumn Statement could provide a unique touch," he says.

"If the economic forecasts for next year highlight the Brexit impacts and paint a gloomy picture, then sterling could be exposed to further downside risks.

"On the other hand, an aggressive outlook pointing to a stronger economic recovery may recreate another mystery move on sterling similar to Monday's sharp upsurge."

The chancellor is expected to announce an increase in the National Living Wage to £7.50 an hour from April next year. However, the news has been met with a somewhat lukewarm response so far.

"We welcome any pay rise for low-paid workers, especially now in these uncertain times with speculations about food and other prices set to rise," said Katherine Chapman, director of the Living Wage Foundation.

"The reality, however, is that a fifth of UK workers aren't paid enough to live on. There's still a gap between the Government minimum and our real Living Wage of £8.45 in the UK and £9.75 in London, which is based on what families need to earn to meet everyday costs."

Meanwhile, the FT's Jim Pickard has pointed out that while the increase is welcome, it is not going to be as significant as the Low Pay Commission expected.

Don't fall for living wage hype: rate will rise 4 per cent to £7.50 — lower than the £7.64 expected earlier this year. #AutumnStatement

— Jim Pickard (@PickardJE) November 23, 2016

© Copyright IBTimes 2025. All rights reserved.