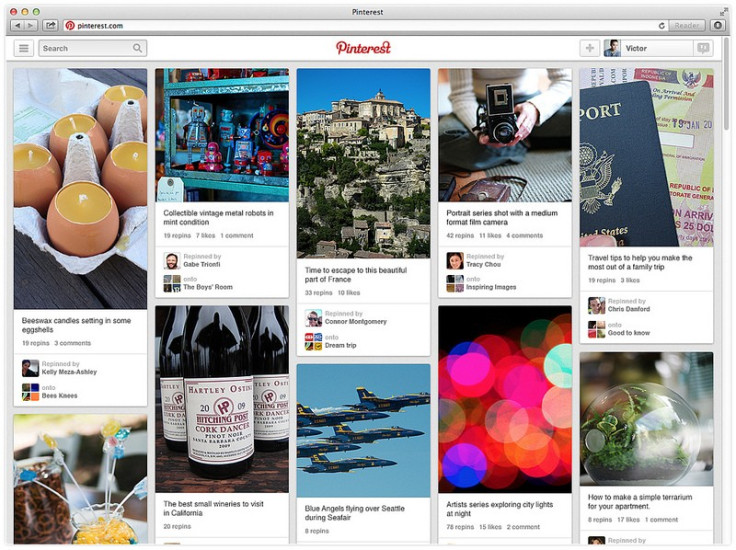

Pinterest Plans International Expansion as Valuation Boosted to $3.8bn

Virtual scrapbooking website Pinterest has received a hefty amount in its latest fund raising, which has increased its market valuation by more than 50%, making it one of the most valued, privately held internet firms.

The company said it received $225m (£139m, €163m) in its latest round of fund raising from investors led by Fidelity Investments. The three-year old company is currently valued at about $3.8bn, up more than 50% from its previous valuation of $2.5bn.

The California-based company, which employs more than 140 people, raised $200m earlier in 2013. It secured its first round of venture capital financing in May 2011.

Despite leading the fresh investment, Fidelity will not be part of the company's board, a person familiar with the deal told Reuters. Companies such as Bessemer Venture Partners, Firstmark Capital, Valiant Capital Management and Andreessen Horowitz, who invested in the company previously, have participated in the latest round as well.

Expansion Plans

The website which is used as a tool for collecting and organising people's interest on the internet was co-founded by Ben Silbermann, Evan Sharp and Paul Sciarra in March 2010.

At present, the firm operates a web platform and exclusive apps for Android and iOS devices.

With the new funding, the firm intends to expand internationally and bolster its mobile services.

"We hope to be a service that everyone uses to inspire their future, whether that's dinner tomorrow night, a vacation next summer, or a dream house someday," CEO Silbermann said in a statement.

"This new investment enables us to pursue that goal even more aggressively."

The company will use the capital for global expansion, after achieving a 125% international growth since the beginning of 2013, the company said in an e-mailed statement to IB Times UK.

Pinterest recently launched its UK, French and Italian websites and is planning to launch services in 10 more countries before the end of 2013.

The company also looks to invest in key mobile services, which have grown 50% since the beginning of 2013 and represented more than three quarters of all usage.

Besides, it will scout for ways to monetise its services as the company is yet to generate revenues.

In addition, Pinterest plans "capital investments in technical infrastructure to make the service faster, more reliable and more efficient" and "strategic acquisitions of both talent and technology".

© Copyright IBTimes 2025. All rights reserved.