Precious metals 2014: Stable gold and rewarding palladium

At the end of 2014, which saw a turbulent second half, gold managed to remain little changed and palladium staged a 12% rally on the year despite a 12% jump in the dollar index.

While silver dropped 18% and platinum fell more than 12%, the main crude oil futures dropped about 40%, the IBTimes UK analysis of year-end prices since 2007 showed.

For 2014, prices just ahead of the year-end thin markets have been taken, considering much volatility is unlikely in the remaining few days of the year.

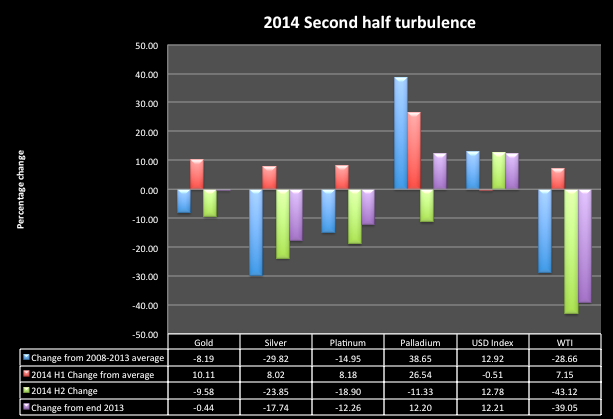

The chart above shows that much of the turbulence in precious metals, US dollar and oil occurred in the second half of the year.

In the first half, gold was up 10%, silver and platinum were 8% higher, while palladium made a 26% jump. In the second half, all the four did move southward - gold 10%, silver 24%, platinum 19% and palladium 11%.

So, the big first-half rally helped palladium end 2014 higher.

Another interesting point from the analysis of prices since 2007, when the great global financial crisis shook commodities and currencies across the globe, shows that the price changes at the end of 2014 from the average of year-end prices of the 2008-2013 period, is similar to the July-December changes.

This means that the last six months may have replaced a six-year trend by a new one, which could now continue.

Silver eyes $10 and the rest $1000 in 2015

Big picture technical charts project downward trends for all the precious metals but palladium, which is likely to hit new highs to $1000/ounce or above in 2015.

And despite the stability shown this year, the yellow metal is on track to hit $1000/ounce next year while silver could test the $10/ounce area.

Platinum too keeps the southward trend intact and can fall near the $1000-mark along with gold.

So, gold-platinum-palladium-silver seem headed towards an interesting value set of $1000-$1000-$1000-$10 next year. (See the charts below.)

Slowing global growth

Major rating agencies are predicting a tougher year ahead, with China's rebalancing and Russia's crisis severely affecting global GDP output.

Global economy is expected to be supported by the US, data and authorities' assessments over the past year showed, but support from the UK -- a major G10 contributor to the world economy -- has weakened towards the end of this year.

In the Brics group, India is the only one expected to see stronger growth momentum based on reforms and output optimism with the change in the government, while China is projected to see lower growth rates and Russia is headed for major financial and currency crisis.

Fitch said in its September Global Economic Outlook (GEO) report that world GDP will grow 2.6% in 2014, 3% in 2015 as compared to 2.7%, 3.1% predicted in the June GEO.

The rating agency said China's GDP growth will moderate at 7.2% in 2014, 6.8% in 2015 and 6.5% in 2016 on account of its gradual rebalancing.

In such a background, the need for inflation hedge is unlikely to be a supporting factor for precious metals while demand for the dollar could remain, given its safe haven identity and the trend of the US economy.

Supply and demand factors

At the same time, traditional demand from retail physical buyers in countries like India is likely to help gold, and supply factors could continue to help keep the palladium trend.

Industrial demand for palladium is always there, but supply factors are difficult to assess with Russia, -- the country that holds 50% of the world's palladium -- that keeps statistics of the metal a state secret for trade reasons.

South Africa is the second largest producer followed by the US and Canada. Both the African and North American mines are expected to increase investments in palladium mining in the years ahead, but these bits of information are not sufficient to predict the prices of palladium, which some investors call as the metal of the 21st century.

© Copyright IBTimes 2025. All rights reserved.