New Zealand dollar at three-year low, as RBNZ to review policy amid falling inflation

With falling inflation rate and rising US currency, the New Zealand dollar seems headed for deeper lows in 2015, and the Reserve Bank of New Zealand's policy review next week will be watched in that background.

The consensus so far is for a hold decision, ie, the RBNZ is likely to keep the main rate at 3.5%, but a cut or stronger verbal indication in the dovish direction can't be ruled out, considering the latest global developments on the central banking and markets front.

The Kiwi dollar has already dropped more than 4.4% since the 20 January inflation data that showed the price rise rate in New Zealand has eased to its lowest in more than a year.

New Zealand's consumer price inflation was 0.8% in the fourth quarter of 2014, its lowest since the Q2-2013 reading which was 0.7%. The Q3-2014 rate was 1% and the Q2 rate was 1.6%, indicating the pace of disinflation.

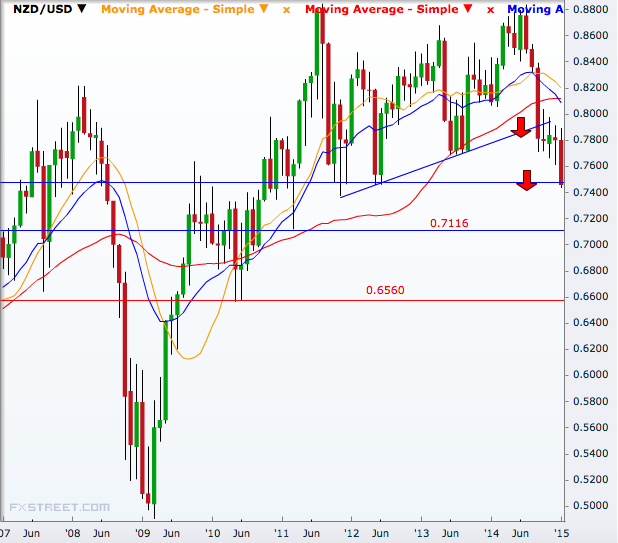

At Friday's low of 0.7431, the NZD/USD pair was down 4.7% on the year, the bulk of it has happened since the latest inflation data and it was the Kiwi currency's weakest exchange rate against the US dollar since November 2011.

The RBNZ was on a rate hike cycle in the first half of 2014 and NZ dollar had rallied 7.4% during that period to a multi-year high of 0.8838. The slide since July was supported by dovish remarks of authorities, finally helping the currency end the year 5.1% lower.

Early indications of the new year show that the pair has much big downside room left in the coming months and the market will be keen to watch what the central bank will do with the policy rate and currency remarks considering the recent developments.

Such a move will also be supported by the dovish surprises from elsewhere in G10 in the recent past. However, the sharp slide in the Kiwi dollar of late must be a consolation for the central bank as it will help exporters especially with falling commodity prices continuing to weigh on the economy.

New Zealand made four 25 bps hikes last year. The last hike was in July, and since then it has been kept steady citing easing inflation pressures and challenges to growth.

In the big picture, the kiwi dollar had been holding a sideways track against the greenback since September end but the negative surprise in the December inflation data pushed it down through the 0.7607 support, opening doors to deeper lows.

Technical analysis point to 0.7116 as the next major support, a break of which will materially reverse a four-year uptrend since mid-2010 and expose the 0.6560 support.

The fact that the greenback has rallied sharply across the board helped by the recent developments in Europe adds further weight to the NZ currency.

After European Central Bank's decision to expand its bond buying by 1.1bn euros last week, the US dollar index rallied to a new 12-year high of 95.50. The evolving Greek scenario is also euro-negative as Sunday's elections there is expected to bring anti-austerity parties into power.

Disinflation has strengthened dovish sides in Australia and UK as well. The Bank of England's latest policy review saw the two strong hawks shifting sides to support the hold decision there, adding to pound bearishness and dollar bullishness.

© Copyright IBTimes 2025. All rights reserved.