Scottish Independence: Treasury to Make UK Debt Pledge

The UK Treasury will guarantee all UK government debt issued up to the date of the referendum on Scottish independence, to remove fears of any debt-sharing dispute between Scotland and the rest of the UK.

In a memorandum being sent to members of the financial community this morning, the Treasury will guarantee all of the UK's £1.2 trillion in debt, whether or not the Scottish people vote for independence this September.

Treasury officials have been worried about the cost of borrowing increasing if Scotland becomes independent.

There have also been concerns about the UK defaulting on its debt obligations if politicians on both sides of the argument cannot agree on how Scotland and the rest of the UK should split up the debt pile.

Analysts have warned that any breakup of the union could involve complex and messy negotiations between politicians in Westminster and Edinburgh over how the UK's debt pile should be carved up.

One outstanding question would be how the Royal Bank of Scotland, headquartered in Edinburgh but 81% owned by the UK government, would be resolved in the event Scotland left the union.

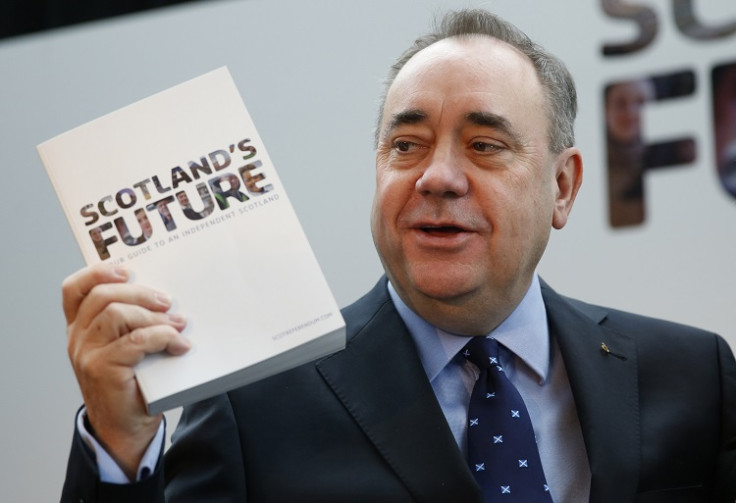

First Minister Alex Salmond has made it clear that Scotland would be responsible with its finances but likes of chancellor George Osborne and chief Treasury secretary Danny Alexander have made pointed attacks on the Scottish National Party's claims.

Scotland's share of debt, calculated according to its shared contribution to public finances since 1980, would mean it had £100bn (€120.6bn, $164.9bn) to pay from the total £1.6tn worth of net UK public debt in 2016-2017, according to a recent SNP white paper, entitled Scotland's Future

Another approach would be to make the calculation based on Scotland's population relative to the rest of the UK.

This would mean that Scotland would take on £130bn in debt as Scots make up 8% of the British population.

The final way of calculating the debt level is to apportion a slice of debt based on the size of Scotland's economy including the North Sea oil industry. This could potentially leave Scotland with much more debt than the previous two options, the white paper said.

© Copyright IBTimes 2025. All rights reserved.