Should you invest in gold in 2017?

Gold investment demand tends to go up when the world economy is uncertain and volatile.

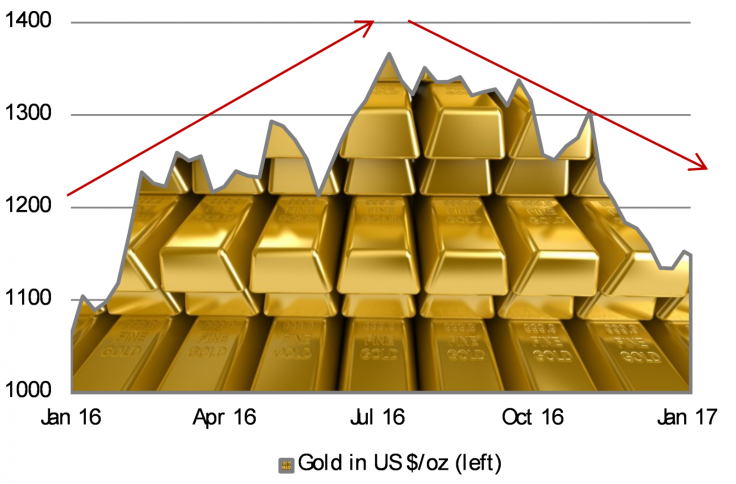

2016 was an archetypal game of two halves for gold investors.

From January up until early June, gold bugs could do no wrong, with the gold price surging from about $1,070 per ounce to a high of $1,364/ounce.

But then came gold's second act, with the shiny yellow metal falling sharply back to a December low of 1,130/ounce (see chart 1).

After such a rollercoaster ride last year, what might 2017 hold in store for gold and gold producers?

Demand for gold: Investment and jewellery

Gold is unusual as a commodity in that its primary sources of demand come not from any industrial or nutritional use, but from its appeal as a "safe investment" store of value and for its use in jewellery.

Focusing on its use as a safe investment, gold investment demand tends to go up when the world economy is uncertain and volatile. Basically put, the more worried people are about the world, the more gold they tend to buy as a "safe haven".

Drivers of the gold price: the US dollar, and interest rates

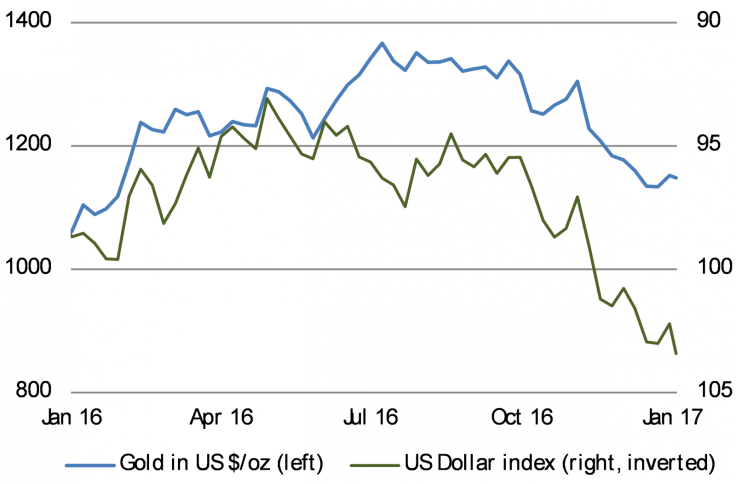

Historically, the gold price has been driven primarily by two key forces: the US dollar and interest rates.

Firstly, the US dollar. Generally, when the US dollar strengthens, this is bad news for the gold price as it is quoted in US dollars. Most importantly, a stronger US dollar tends to mean a stronger world economy, and thus less demand for gold as investors tend to be less worried when the world economy is on a solid footing.

Since the middle of 2016, the US dollar (shown in chart 2 as the green line; note the invested scale, so a falling line actually indicates a stronger Greenback) has been appreciating against other world currencies.

As a result, the gold price has fallen 16% since the beginning of July 2016.

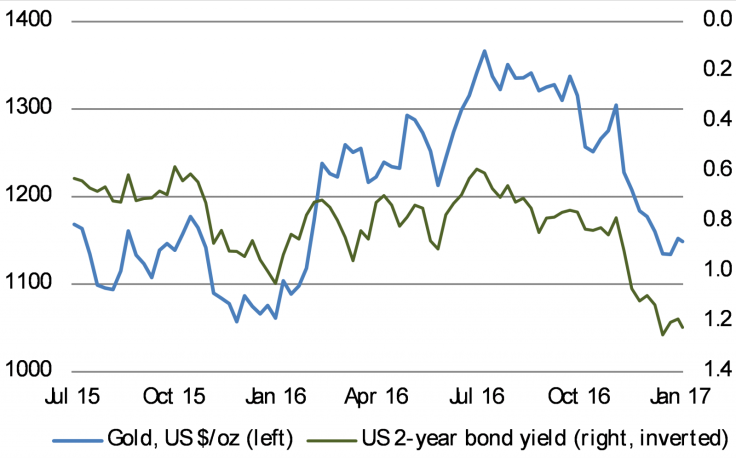

Secondly, gold tends to fall when interest rates are rising, principally when interest rates in the US are rising (as the US is the world's largest economy).

Again, the US 2-year bond yield (a measure of US interest rates) has been rising steadily since July 2016 (shown inverted on chart 3), driving the gold price lower as investors prefer other assets to gold.

Why might the gold price rise once again? Fear...

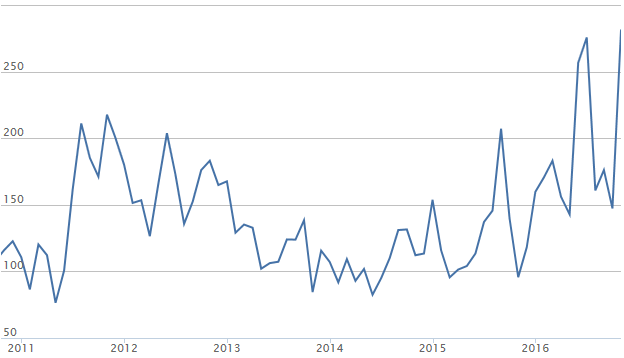

The key reason that one might expect the gold price to rise from the current $1,150 per ounce level is a resurgence of fear among investors, which could come from one or more of many sources.

Donald Trump may make some policy mistakes once he becomes US President later this month. Any one of the major parliamentary and presidential elections in Europe may spring an unexpected political surprise. Geopolitical fears surrounding Russia or the Middle East could flare up over the year. These uncertainties are captured in the multi-year high reading on the Global Economic Policy Uncertainty index (see chart 4).

We might also surmise that the sharp rise in US interest rates and the US dollar is already done, and might even see a small reversal in the opposite direction early in 2017. This could be good news for gold.

I should note that according to Bloomberg, the average gold analyst forecast for the gold price at the end of 2017 is $1,291 per ounce, 12% higher than the current level.

Easy ways to invest in gold

If you want to own gold in physical format, then you can always buy gold coins in the UK directly from The Royal Mint. The 22-carat Sovereign 2017, weighing 7.98 grams, is being sold by The Royal Mint for £430 each.

Otherwise, you can buy investments in either physical gold via exchange-traded notes or even in gold mining stocks.

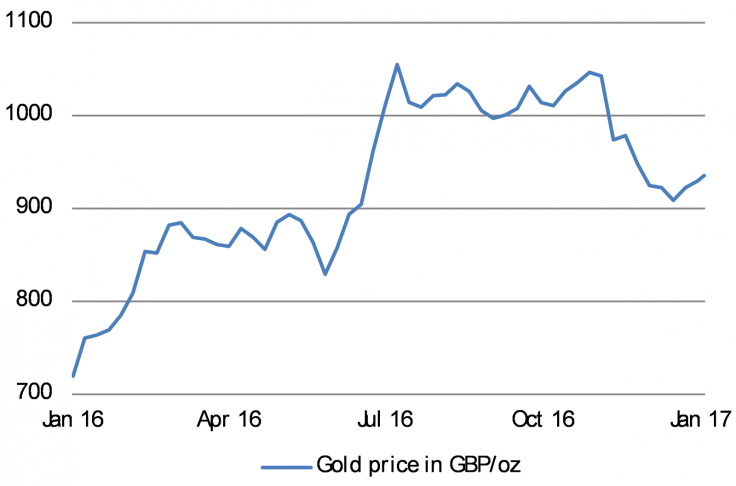

Even with its late-year dip, gold priced in pounds sterling has been a strong performer for UK investors, rising 30% over calendar 2016 thanks in part to the pound's weakness post June's Brexit vote (see chart 5).

One easy way to buy gold as an investment in pounds is to buy shares in the ETFS Physical Gold fund (UK code PHGP). For more information on this exchange-traded note, please look at the factsheet available on the ETF Securities website.

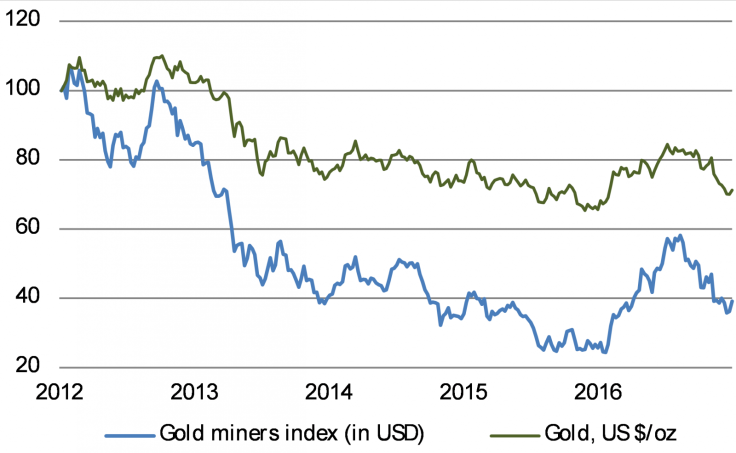

For the more adventurous investor, gold mining stocks are a more volatile but perhaps more lucrative choice. Risks are of course much higher than with physical gold, but could recover much more of the ground lost since 2012 (see chart 6).

UK investors could consider three choices of investment in gold mining, all of which must be judged to be highly speculative and thus not for the faint of heart:

- iShares Gold Producers ETF (UK code SPGP; current share price 725p). This contains gold miners principally located in Canada, the US and Australia.

- Centamin plc (code CEY; current share price 137p). This is a UK-listed gold mining company operating in Egypt, Ethiopia, the UK and Australia. Profitability is high, valuations are reasonable and the average analyst price target is 25% above current levels.

- Caledonia Mining (code CMCL; current share price 89p).A smaller UK-listed gold mining company with its principal gold mining assets in Zimbabwe, it has a low valuation, strong profitability and offers a 5%+ dividend yield for income. In addition, it is still a long off its 143p high reached back in late October 2016.

© Copyright IBTimes 2025. All rights reserved.